Updated on December 11th, 2023 by Bob Ciura

The Dividend Aristocrats are the ‘best of the best’ dividend growth stocks. The Dividend Aristocrats have a long history of outperforming the market.

Dividend Aristocrats are elite companies that satisfy the following:

- Are in the S&P 500 Index

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet with the full list of all 68 Dividend Aristocrats (with additional financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

All Dividend Aristocrats are high-quality businesses based on their long dividend histories. A company cannot pay rising dividends for 25+ years without having a strong and durable competitive advantage.

But not all Dividend Aristocrats make equally good investments today. Some Dividend Aristocrats are better than others, based on the sustainability of their dividends.

That’s why, in this article, we have analyzed the 10 safest Dividend Aristocrats from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The stocks below are all Dividend Aristocrats with Dividend Risk Scores of ‘A’, the top rating, and with the lowest payout ratios.

Table of Contents

- Why The Payout Ratio Matters

- Safest Dividend Aristocrats #10: Sherwin-Williams (SHW)

- Safest Dividend Aristocrats #9: Pentair plc (PNR)

- Safest Dividend Aristocrats #8: Dover Corporation (DOV)

- Safest Dividend Aristocrats #7: W.W. Grainger (GWW)

- Safest Dividend Aristocrats #6: Brown & Brown (BRO)

- Safest Dividend Aristocrats #5: Roper Technologies (ROP)

- Safest Dividend Aristocrats #4: Chubb Limited (CB)

- Safest Dividend Aristocrats #3: Nucor Corp. (NUE)

- Safest Dividend Aristocrats #2: West Pharmaceutical Services (WST)

- Safest Dividend Aristocrats #1: Albemarle Corp. (ALB)

Why The Payout Ratio Matters

The dividend payout ratio is simply a company’s annual per-share dividend, divided by the company’s annual earnings-per-share. It is a measure of the level of earnings a company distributes to its shareholders via dividends.

The payout ratio is a valuable investing metric because it differentiates companies with low payout ratios that have lots of room for dividend growth, from companies with high payout ratios whose dividends may not be sustainable.

Indeed, research has shown that companies with higher dividend growth have outperformed companies with lower dividend growth or no dividend growth.

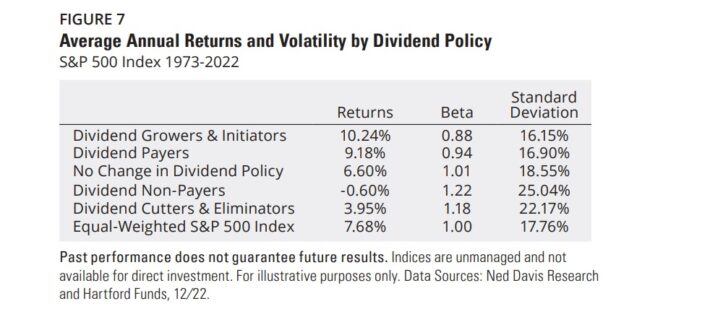

In research performed by Ned Davis and Hartford Funds, it was found that dividend growers and initiators delivered total returns of 10.24% per year from 1973 through 2022, better than the equal-weighted S&P 500’s performance of 7.68% per year.

Interestingly, the dividend growers and initiators analyzed in this study generated outperformance with less volatility – a rarity and a contradiction to what modern academic financial theory tells us.

A summary of this research can be found below.

Source: Hartford Funds – The Power Of Dividends

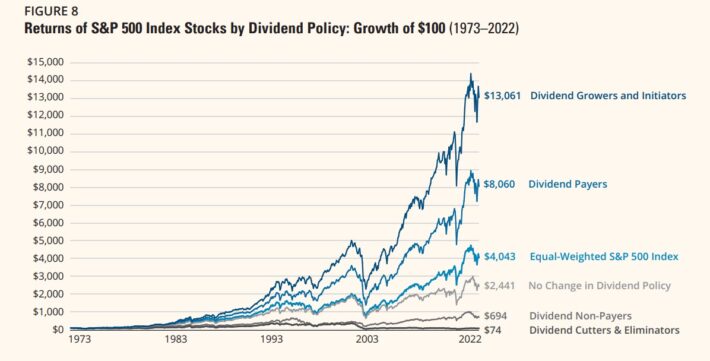

Outperformance of 2.56% annually might not seem like a game-changer, but it certainly is thanks to the wonder that is compound interest.

Using data from the same piece of research, investors who chose to invest exclusively in dividend growers and initiators were capable of turning $100 into $13,061. During the same time period, the S&P 500 index turned $100 into $4,043.

Source: Hartford Funds – The Power Of Dividends

Stocks that did not pay dividends could not match the performance of all types of dividend payers, turning $100 into $694 from 1973-2022. Dividend cutters and eliminators fared even worse, turning $100 into just $74–meaning these stocks actually lost money.

As a result, investors looking for stocks with better dividend growth (and long-term return potential) could consider the Dividend Aristocrats with the lowest payout ratios.

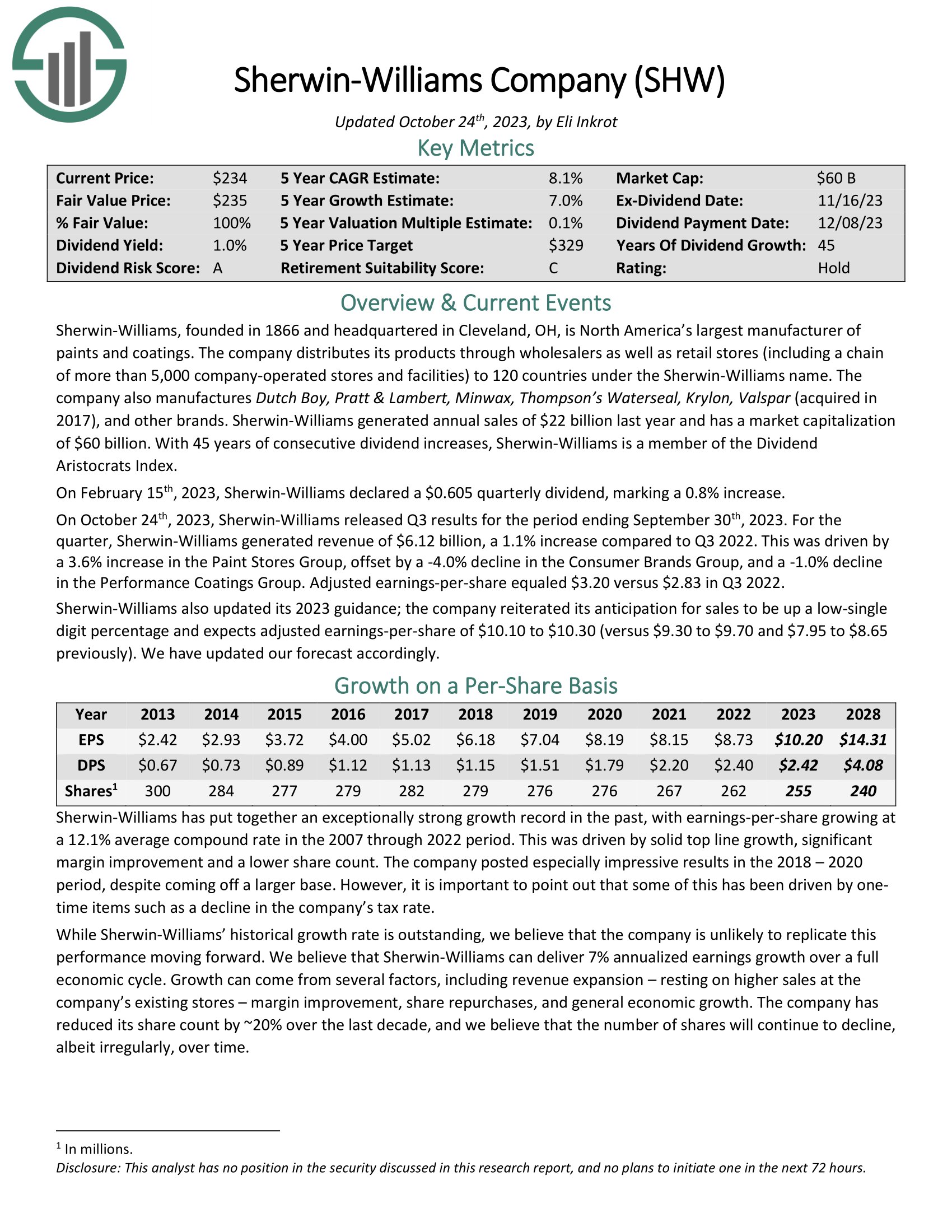

Safest Dividend Aristocrats #10: Sherwin-Williams (SHW)

- Payout ratio: 23.7%

Sherwin-Williams, founded in 1866, is North America’s largest manufacturer of paints and coatings.

The company distributes its products through wholesalers as well as retail stores (including a chain of more than 4,900 company-operated stores and facilities) to 120 countries under the Sherwin-Williams name.

The company also manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and other brands.

Source: Investor Presentation

On October 24th, 2023, Sherwin-Williams released Q3 results for the period ending September 30th, 2023. For the quarter, Sherwin-Williams generated revenue of $6.12 billion, a 1.1% increase compared to Q3 2022. This was driven by a 3.6% increase in the Paint Stores Group, offset by a -4.0% decline in the Consumer Brands Group, and a -1.0% decline in the Performance Coatings Group. Adjusted earnings-per-share equaled $3.20 versus $2.83 in Q3 2022.

Click here to download our most recent Sure Analysis report on SHW (preview of page 1 of 3 shown below):

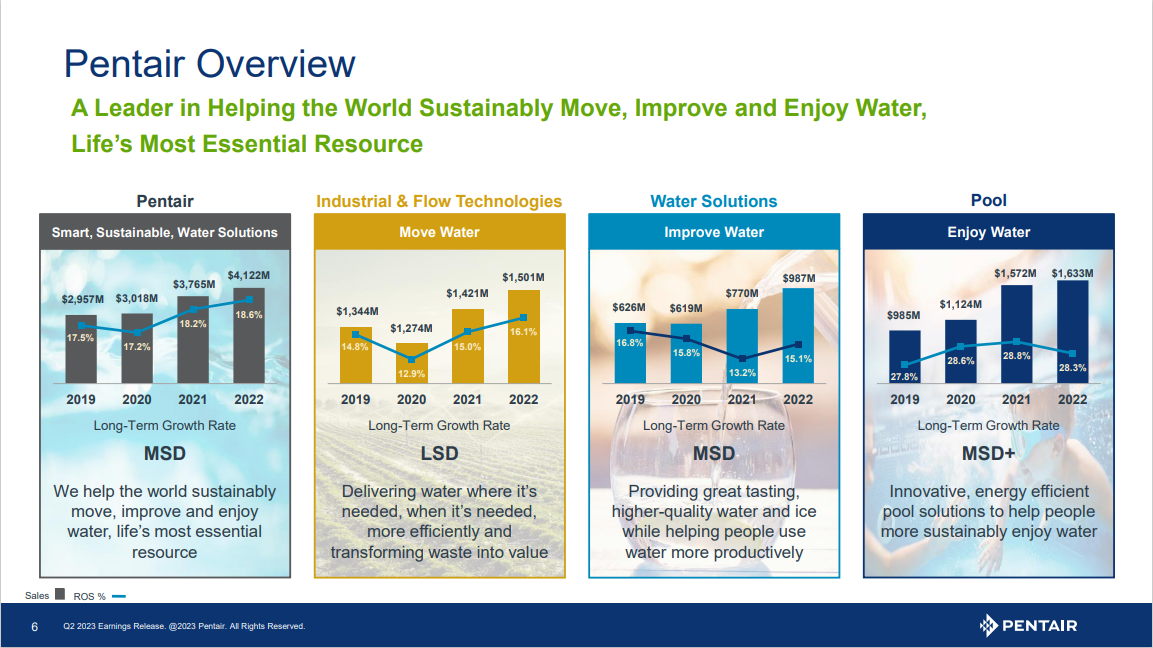

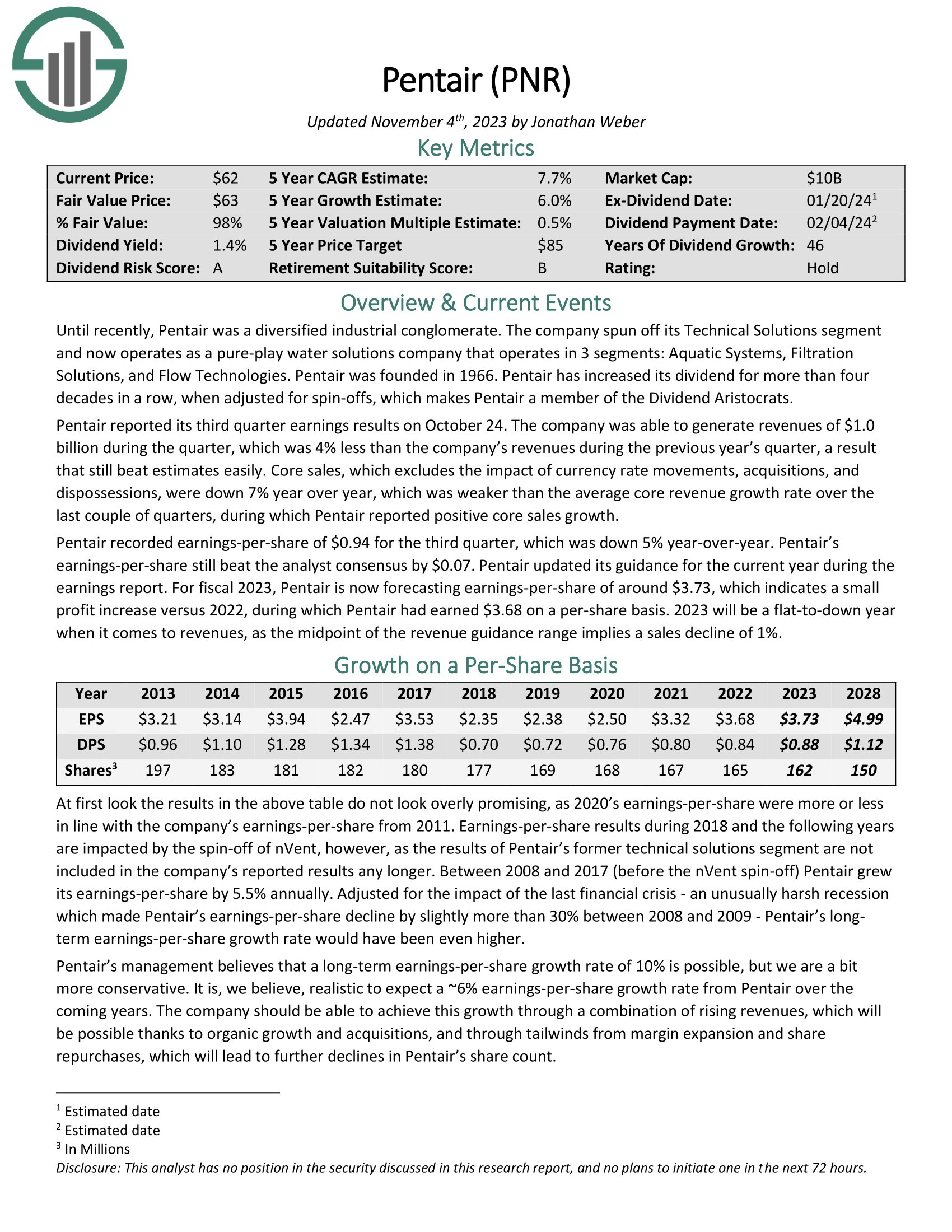

Safest Dividend Aristocrats #9: Pentair plc (PNR)

- Payout ratio: 23.6%

Pentair is a pure-play water solutions company that operates in 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies. Pentair was founded in 1966. Pentair has increased its dividend for more than four decades in a row, when adjusted for spin-offs.

Pentair is one of the top water stocks.

Source: Investor Presentation

Pentair reported its third quarter earnings results on October 24. The company was able to generate revenues of $1.0 billion during the quarter, which was 4% less than the company’s revenues during the previous year’s quarter, a result that still beat estimates easily.

Core sales, which excludes the impact of currency rate movements, acquisitions, and dispossessions, were down 7% year over year, which was weaker than the average core revenue growth rate over the last couple of quarters, during which Pentair reported positive core sales growth.

Click here to download our most recent Sure Analysis report on Pentair (preview of page 1 of 3 shown below):

Safest Dividend Aristocrats #8: Dover Corporation (DOV)

- Payout Ratio: 23.2%

Dover Corporation is a diversified global industrial manufacturer with annual revenues of nearly $9 billion. Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies. Slightly more than half of revenues come from the U.S., with the remainder coming from international markets.

On October 24th, 2023, Dover announced third quarter results the period ending September 30th, 2023. For the quarter, revenue decreased 0.2% to $2.15 billion, which was $70 million less than expected. Adjusted earnings-per-share of $2.35 compared favorably to $2.25 in the prior year and was $0.02 above estimates.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

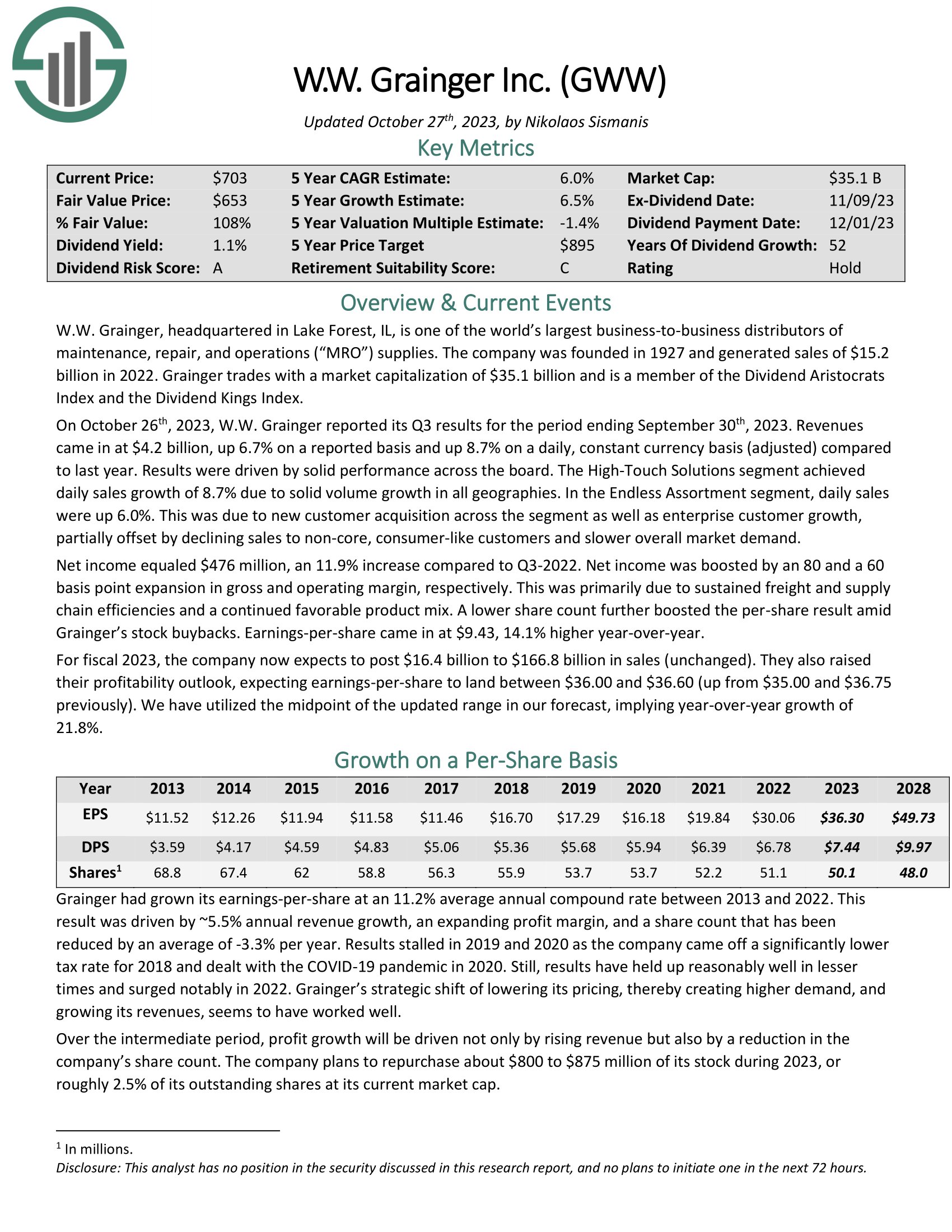

Safest Dividend Aristocrats #7: W.W. Grainger (GWW)

- Payout Ratio: 20.5%

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies.

On October 26th, 2023, W.W. Grainger reported its Q3 results for the period ending September 30th, 2023. Revenues came in at $4.2 billion, up 6.7% on a reported basis and up 8.7% on a daily, constant currency basis (adjusted) compared to last year. Results were driven by solid performance across the board. The High-Touch Solutions segment achieved daily sales growth of 8.7% due to solid volume growth in all geographies.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

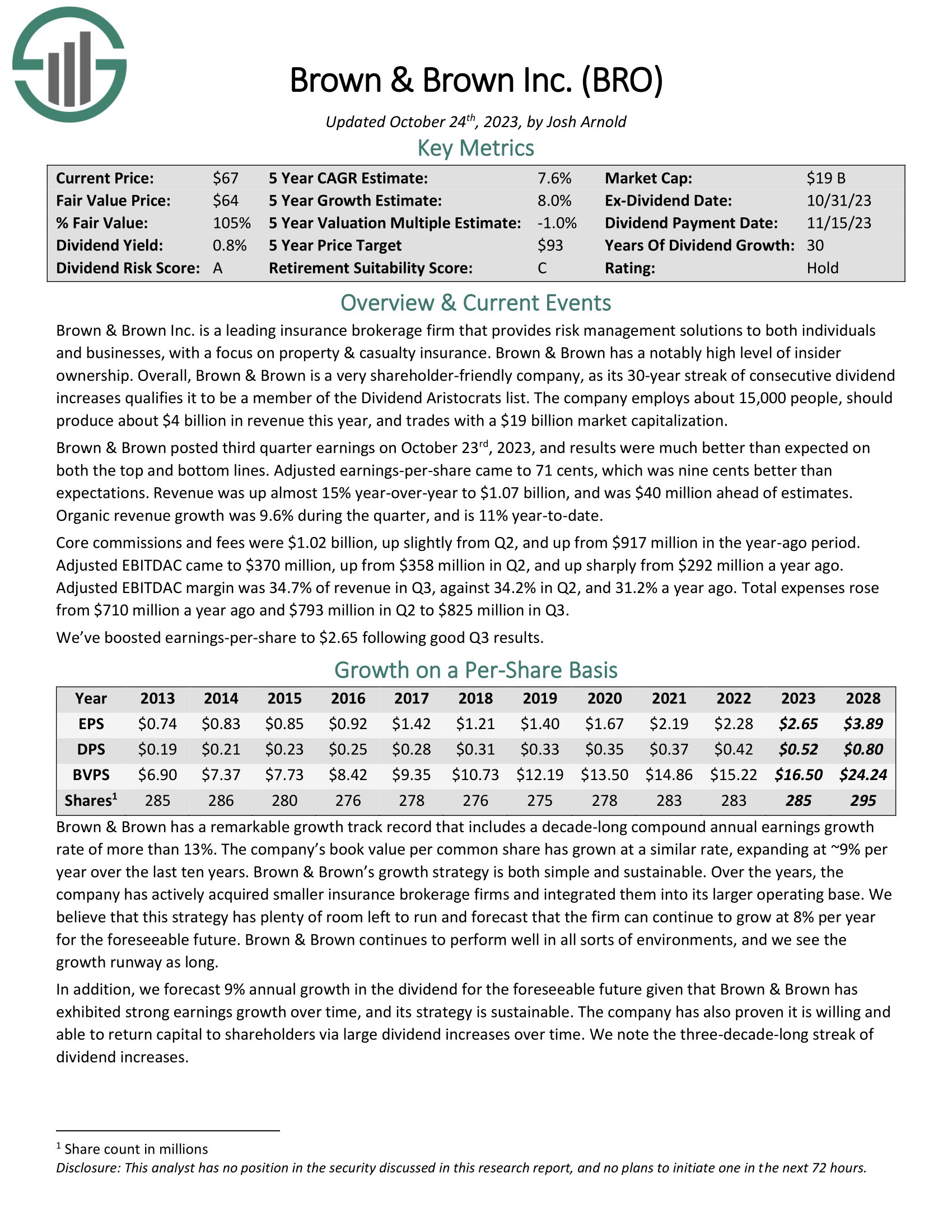

Safest Dividend Aristocrats #6: Brown & Brown (BRO)

- Payout Ratio: 19.6%

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

Brown & Brown posted third quarter earnings on October 23rd, 2023, and results were much better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 71 cents, which was nine cents better than expectations. Revenue was up almost 15% year-over-year to $1.07 billion, and was $40 million ahead of estimates. Organic revenue growth was 9.6% during the quarter, and is 11% year-to-date.

Click here to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

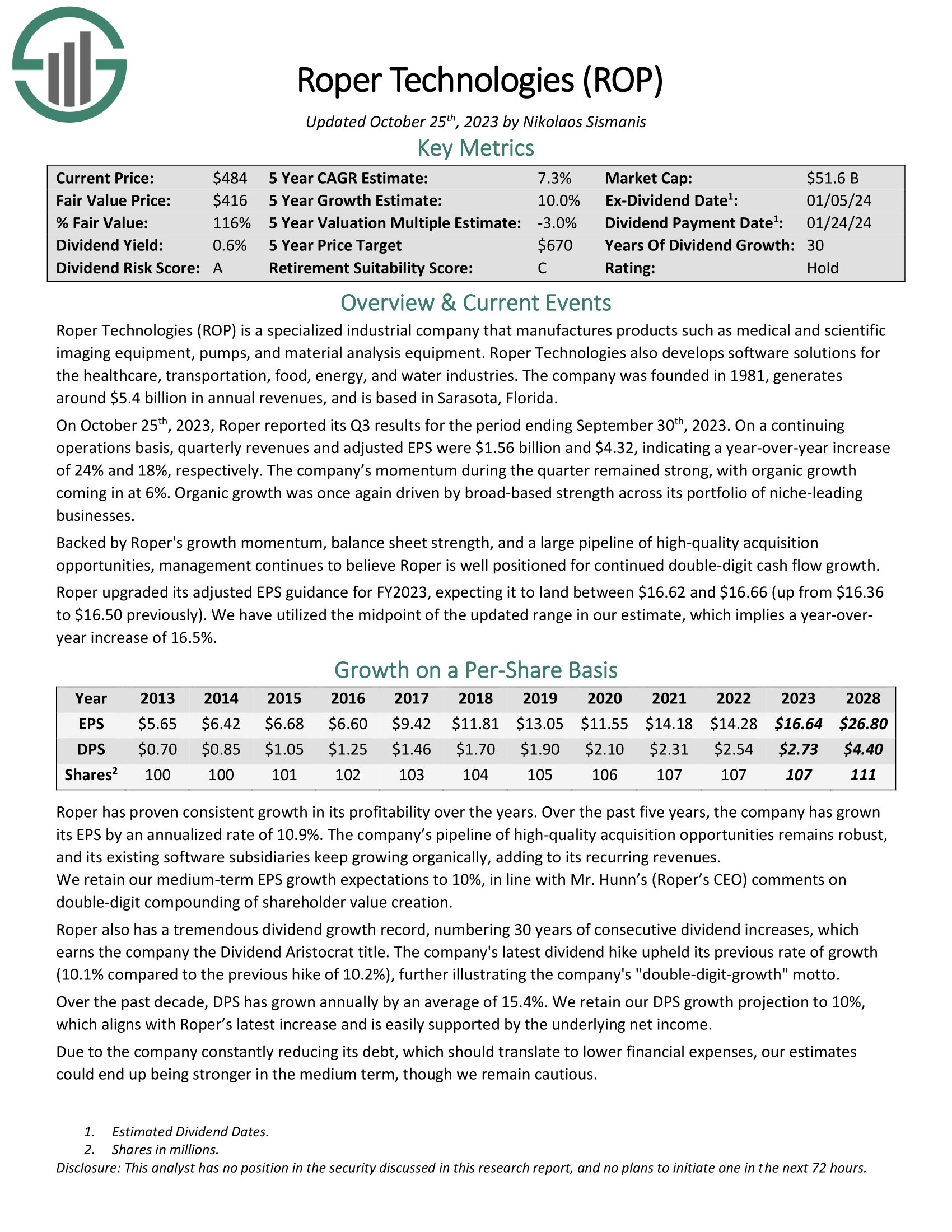

Safest Dividend Aristocrats #5: Roper Technologies (ROP)

- Payout Ratio: 18.0%

Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment. Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries. The company was founded in 1981, generates around $5.4 billion in annual revenues, and is based in Sarasota, Florida.

On October 25th, 2023, Roper reported its Q3 results for the period ending September 30th, 2023. On a continuing operations basis, quarterly revenues and adjusted EPS were $1.56 billion and $4.32, indicating a year-over-year increase of 24% and 18%, respectively.

Click here to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below):

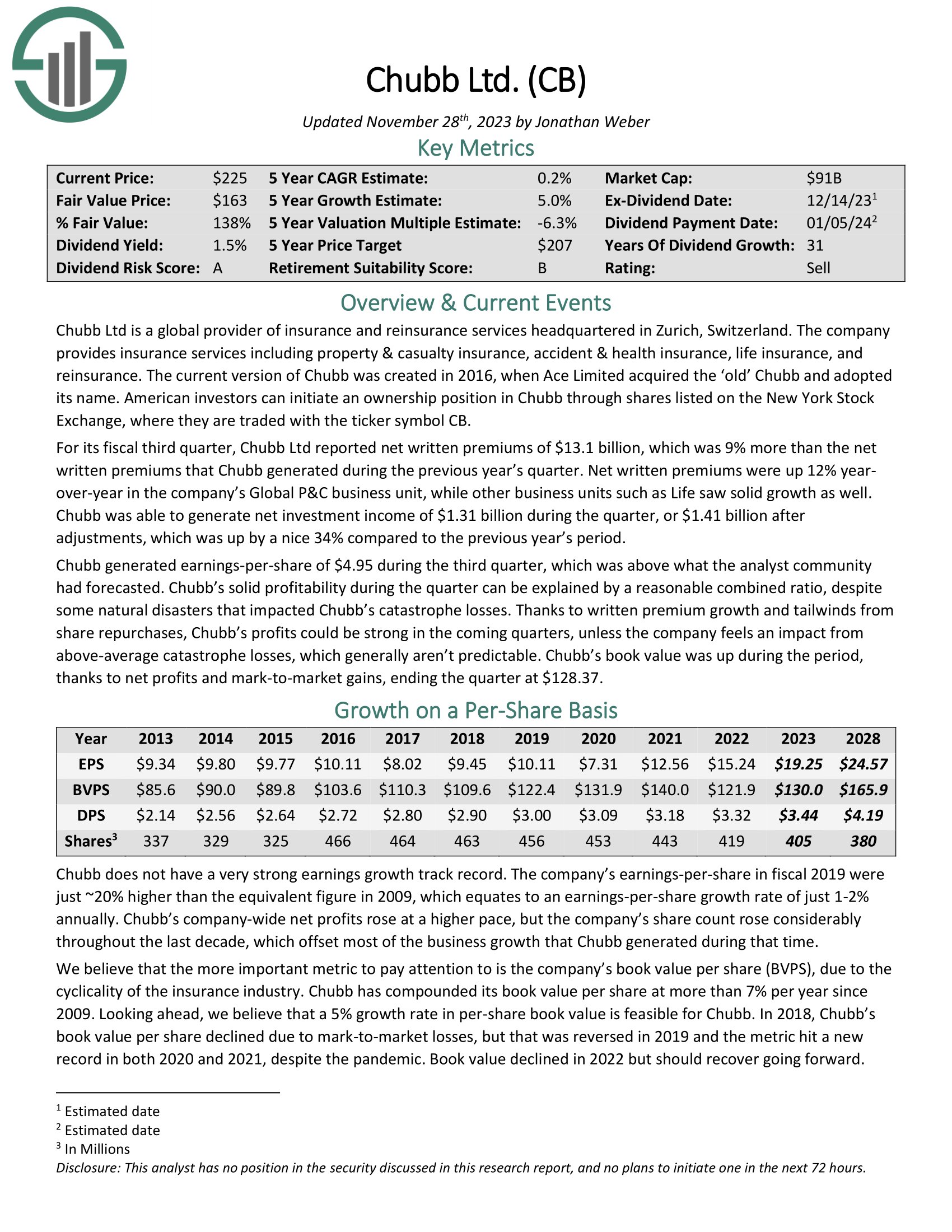

Safest Dividend Aristocrats #4: Chubb Limited (CB)

- Payout Ratio: 17.9%

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance.

For its fiscal third quarter, Chubb Ltd reported net written premiums of $13.1 billion, which was 9% more than the net written premiums that Chubb generated during the previous year’s quarter. Net written premiums were up 12% year over-year in the company’s Global P&C business unit, while other business units such as Life saw solid growth as well.

Chubb was able to generate net investment income of $1.31 billion during the quarter, or $1.41 billion after adjustments, which was up by a nice 34% compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on Chubb (preview of page 1 of 3 shown below):

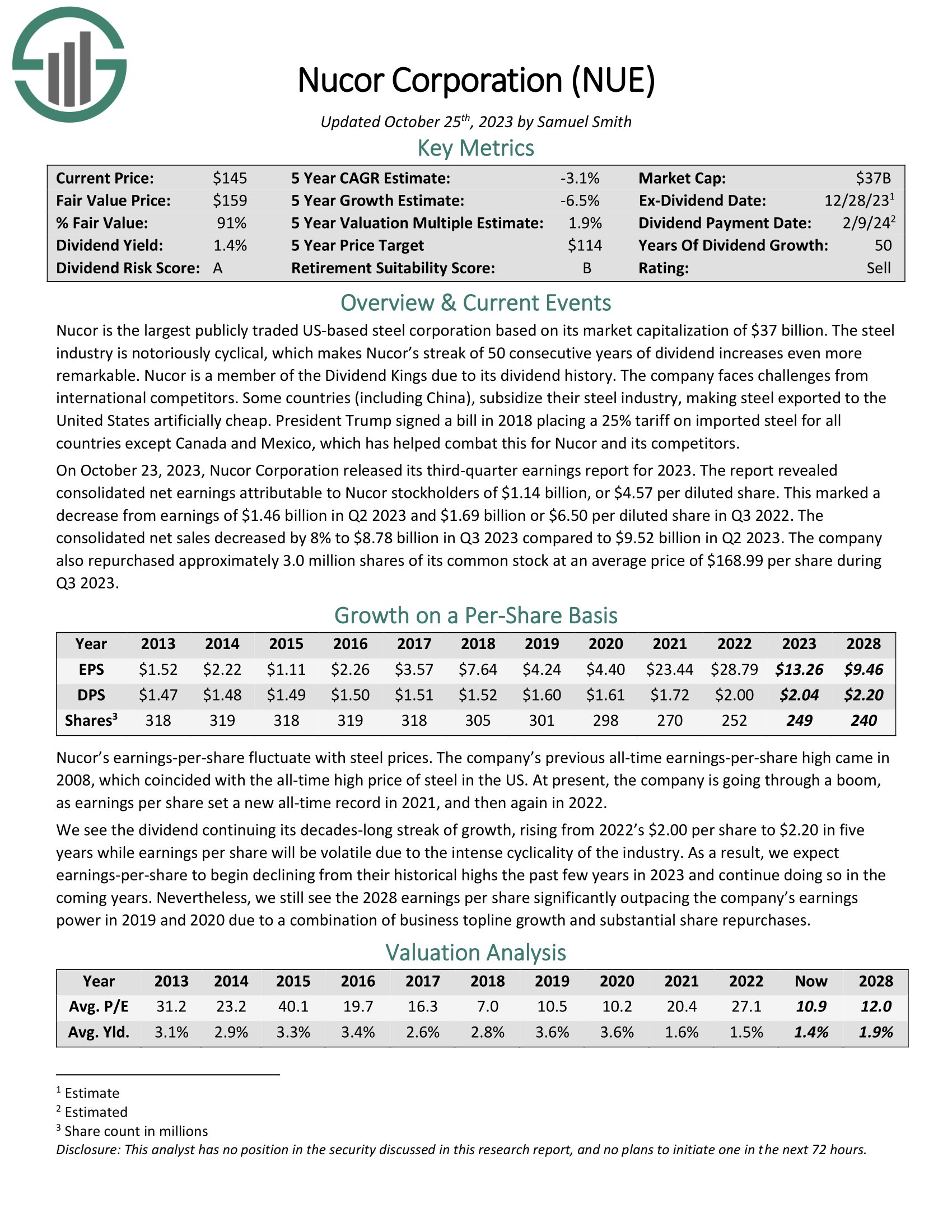

Safest Dividend Aristocrats #3: Nucor Corp. (NUE)

- Payout Ratio: 15.4%

Nucor is the largest publicly traded US-based steel corporation. The steel industry is notoriously cyclical, which makes Nucor’s streak of 50 consecutive years of dividend increases even more remarkable.

On October 23, 2023, Nucor Corporation released its third-quarter earnings report for 2023. The report revealed consolidated net earnings attributable to Nucor stockholders of $1.14 billion, or $4.57 per diluted share. This marked a decrease from earnings of $1.46 billion in Q2 2023 and $1.69 billion or $6.50 per diluted share in Q3 2022. Consolidated net sales decreased by 8% to $8.78 billion.

The company also repurchased approximately 3.0 million shares of its common stock at an average price of $168.99 per share during Q3 2023.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

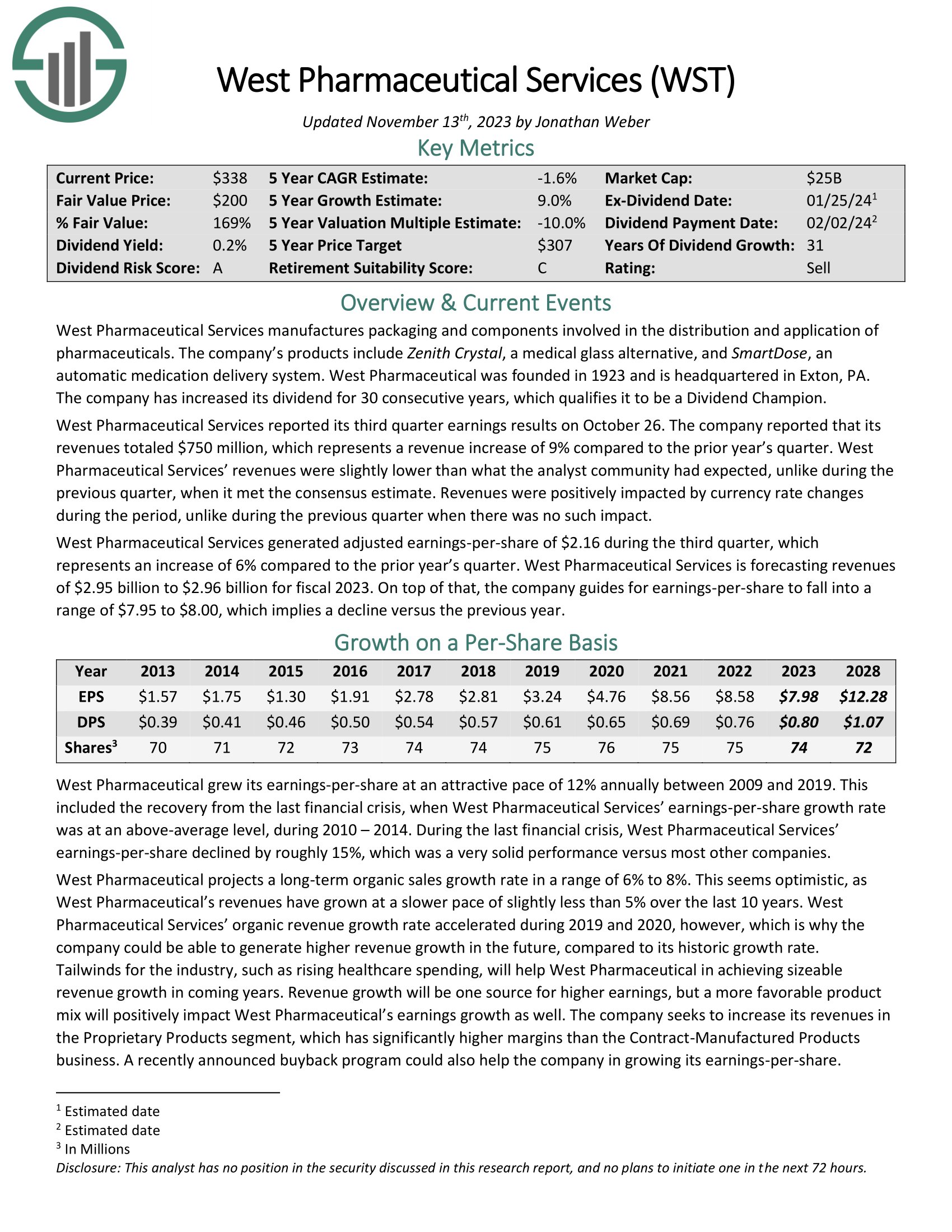

Safest Dividend Aristocrats #2: West Pharmaceutical Services (WST)

- Payout Ratio: 10.0%

West Pharmaceutical Services manufactures packaging and components involved in the distribution and application of pharmaceuticals. The company’s products include Zenith Crystal, a medical glass alternative, and SmartDose, an automatic medication delivery system.

West Pharmaceutical Services reported its third quarter earnings results on October 26. The company reported that its revenues totaled $750 million, which represents a revenue increase of 9% compared to the prior year’s quarter.

West Pharmaceutical Services’ revenues were slightly lower than what the analyst community had expected, unlike during the previous quarter, when it met the consensus estimate. Revenues were positively impacted by currency rate changes during the period, unlike during the previous quarter when there was no such impact.

Click here to download our most recent Sure Analysis report on WST (preview of page 1 of 3 shown below):

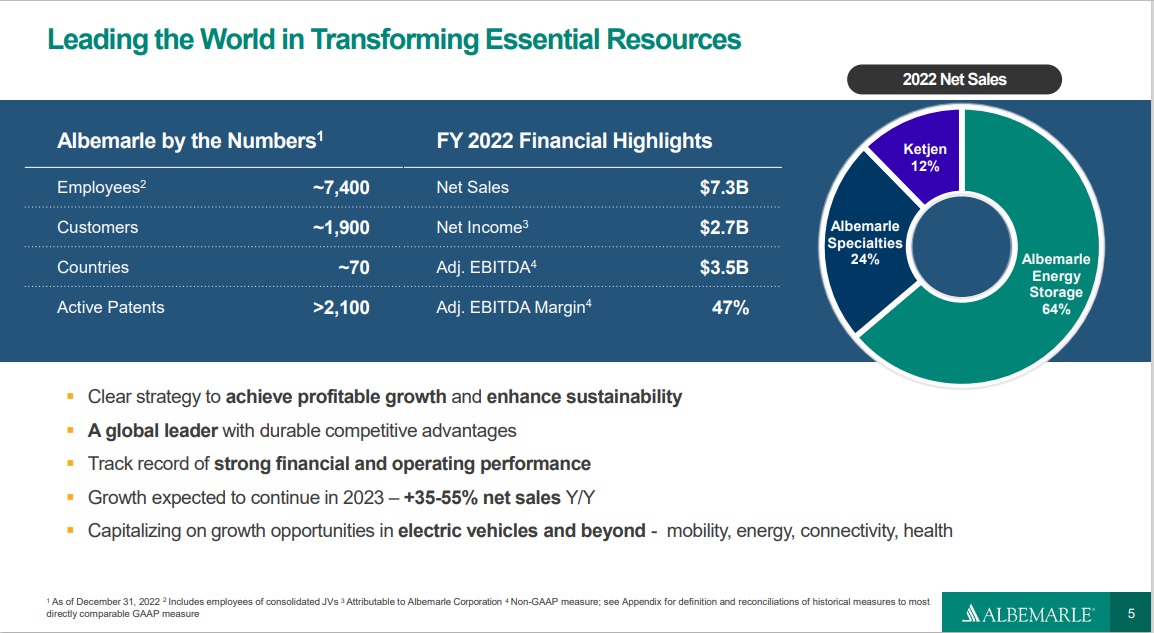

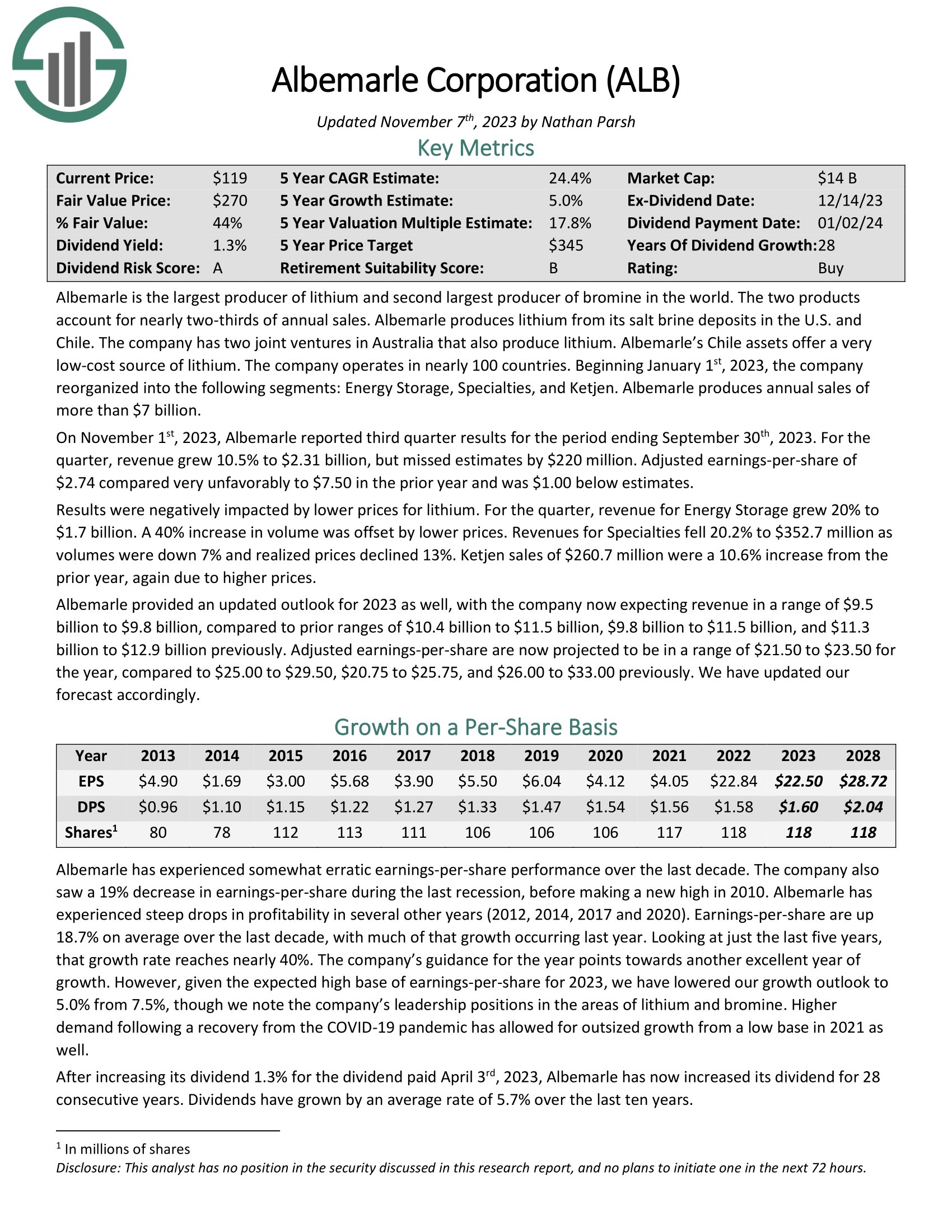

Safest Dividend Aristocrats #1: Albemarle Corp. (ALB)

- Payout Ratio: 7.1%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium.

Related: 2023 Lithium Stocks List

Source: Investor Presentation

On November 1st, 2023, Albemarle reported third quarter results for the period ending September 30th, 2023. For the quarter, revenue grew 10.5% to $2.31 billion, but missed estimates by $220 million. Adjusted earnings-per-share of $2.74 compared very unfavorably to $7.50 in the prior year and was $1.00 below estimates.

Results were negatively impacted by lower prices for lithium. For the quarter, revenue for Energy Storage grew 20% to $1.7 billion. A 40% increase in volume was offset by lower prices. Revenues for Specialties fell 20.2% to $352.7 million as volumes were down 7% and realized prices declined 13%. Ketjen sales of $260.7 million were a 10.6% increase from the prior year, again due to higher prices.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

Final Thoughts

Investors looking for quality dividend growth stocks should start their search with the Dividend Aristocrats, a select group of 67 stocks in the S&P 500 Index with at least 25 consecutive years of dividend growth.

Income investors should also consider dividend safety before investing in dividend stocks.

Fortunately, investors do not have to sacrifice quality when investing in dividend growth stocks. These 10 Dividend Aristocrats have have high-quality business models, durable competitive advantages, and safe dividend payouts that can withstand recessions.

Don’t miss the resources below for more Dividend Aristocrats investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks List: 12 dividend payments each year

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more