Updated on April 29th, 2024 by Bob Ciura

When it comes to dividend growth stocks, the Dividend Aristocrats are the “cream of the crop.” These are stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases. Additionally, the Dividend Aristocrats must meet certain market cap and liquidity requirements.

It is relatively difficult to become a Dividend Aristocrat, which is why only 68 of them exist. With that in mind, we created a full list of all 68 Dividend Aristocrats.

You can download your copy of the Dividend Aristocrats list, along with important metrics like price-to-earnings ratios and dividend yields, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

At the same time, Real Estate Investment Trusts (REITs) seem like natural fits for the Dividend Aristocrats Index. REITs are required to distribute at least 90% of their earnings to shareholders. And yet, there are only 3 REITs on the list of Dividend Aristocrats, including Federal Realty Investment Trust (FRT).

The reason for the relative lack of REITs in the Dividend Aristocrats Index is primarily due to the high payout requirement of REITs. It’s challenging to grow dividends every year when the bulk of income is already being distributed, as this leaves little margin for error.

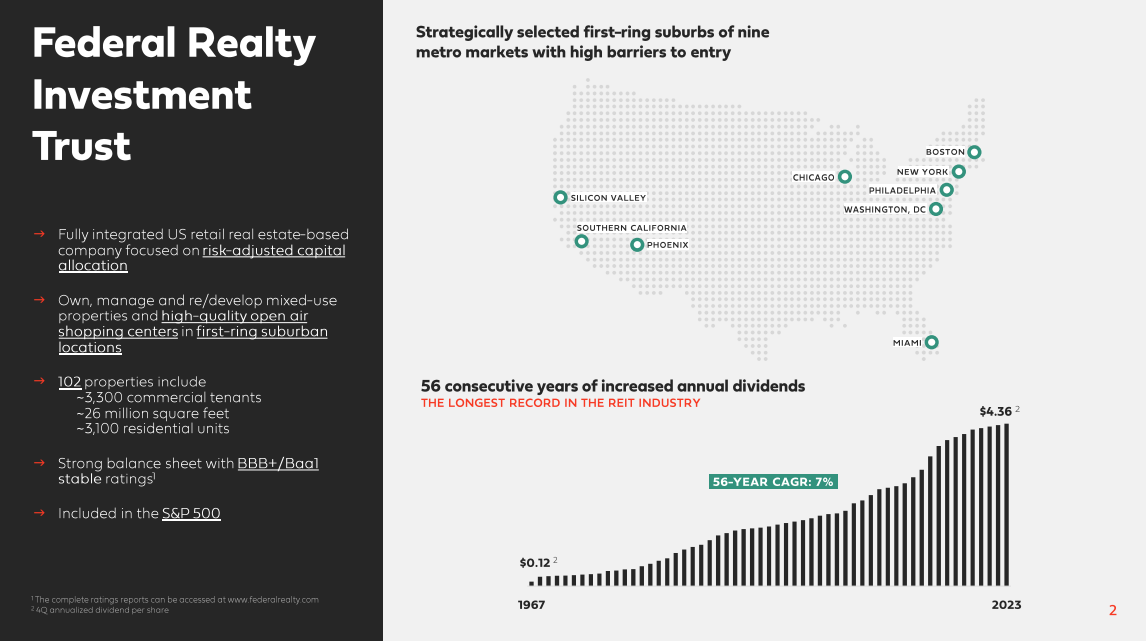

Federal Realty has a very impressive dividend history, particularly for a REIT. Federal Realty has increased its dividend for 56 years in a row, which also makes it a Dividend King.

This article will discuss the only REIT on the list of Dividend Aristocrats and Dividend Kings.

Business Overview

Federal Realty was founded in 1962. Federal Realty’s business model is to own and rent out real estate properties as a Real Estate Investment Trust. It uses a significant portion of its rental income and external financing to acquire new properties.

This helps create a “snowball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in the redevelopment of multi-purpose properties, including retail, apartments, and condominiums.

Source: Investor Presentation

The portfolio is highly diversified in terms of the tenant base. Federal Realty has a high-quality tenant portfolio.

The trust’s investment strategy is to pursue densely populated, affluent communities with high commercial and residential real estate demand. This strategy has fueled strong growth over the past several years.

Growth Prospects

Federal Realty Investment Trust released its fourth-quarter earnings report for 2023 on February 12th. In the fourth quarter, Federal Realty Investment Trust reported Funds from Operations (FFO) of $1.64, meeting expectations.

The company achieved a robust 4.3% growth in comparable property operating income (POI) for the full year of 2023 and 4.4% for the fourth quarter, excluding lease termination fees and prior period rents collected. Notably, Federal Realty continued its strong leasing performance, signing 100 comparable retail leases in the fourth quarter alone, representing over 2 million square feet of comparable space.

The company’s portfolio maintained strong occupancy and leasing metrics, with a 92.2% occupancy rate and 94.2% leased rate at the end of the quarter. Additionally, Federal Realty announced the second phase of residential redevelopment at Bala Cynwyd in Bala Cynwyd, PA, projected to cost between $90 million to $95 million with an anticipated return on investment (ROI) of 7%.

Furthermore, the company successfully raised $685.0 million in capital through two separate financings and repaid $600.0 million in senior unsecured notes at maturity. Looking ahead, Federal Realty introduced its 2024 earnings per diluted share guidance of $2.72 to $2.94 and 2024 FFO per diluted share guidance of $6.65 to $6.87.

Competitive Advantages & Recession Performance

One way in which REITs establish a competitive advantage is through investing in the highest-quality portfolios. Federal Realty has done this by focusing on affluent areas of the country where demand exceeds supply.

This is also how it can continue to boost its cash basis rollover growth over time; it owns properties in the most desirable areas, and tenants are willing to pay more to gain access to the best consumers.

Federal Realty benefits from a favorable economic backdrop, with high occupancy rates and the ability to raise rents over time.

Another competitive advantage for Federal Realty is a strong balance sheet. The trust’s senior unsecured debt holds a credit rating of A- from Standard & Poor’s, which is solidly investment-grade and is a high rating for a REIT.

A strong balance sheet helps keep borrowing costs low, which is critical for the REIT business model.

These competitive strengths allowed Federal Realty to perform well during the last recession. Federal Realty’s FFO during the Great Recession is shown below:

- 2007 FFO-per-share of $3.63

- 2008 FFO-per-share of $3.87 (6.6% increase)

- 2009 FFO-per-share of $3.87 (flat)

- 2010 FFO-per-share of $3.88 (0.3% increase)

- 2011 FFO-per-share of $4.00 (3% increase)

FFO either held steady or increased during each year of the recession. This was a remarkable achievement that speaks to the strength of the business.

We expect Federal Realty to hold up well during the next downturn, but we also note that growth will certainly slow during such a period.

Valuation & Expected Returns

Based on 2024 expected FFO-per-share of $6.79, Federal Realty stock trades for a price-to-FFO ratio of 15.2. Investors can think of this as similar to a price-to-earnings ratio.

On a valuation basis, Federal Realty appears overvalued. Our fair value estimate is a P/FFO ratio of 12, implying downside potential due to the high valuation multiple.

Therefore, future returns could be reduced by -4.6% per year over the next five years if the P/FFO ratio declines from 15.2 to 12.

FFO-per-share growth, expected to reach 4.3% per year, plus the 4.3% current dividend yield, results in total expected returns of 4.0% per year.

Federal Realty helps make up for this with strong dividend growth and its impeccable track record. It has increased its dividend for 56 years in a row.

Final Thoughts

Investors flock to REITs for dividends, and with high yields across the asset class, it is easy to see why they are so popular for income investors.

Federal Realty does not have a tremendous dividend yield, particularly for a REIT. This is because the stock consistently trades for a relatively high valuation. However, high-quality businesses tend to sport above-average valuations.

That said, Federal Realty is a strong choice for dividend investors, and we rate the stock a hold due to its impressive dividend history.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The 20 Highest Yielding Dividend Aristocrats

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: