Updated on April 30th, 2024 by Bob Ciura

The Dividend Aristocrats are among the highest-quality dividend growth stocks an investor can buy. The Dividend Aristocrats have increased their dividends for 25+ consecutive years.

Becoming a Dividend Aristocrat is no small feat. Beyond certain market capitalization and trading volume requirements, Dividend Aristocrats must have raised their dividends each year for at least 25 years, and be included in the S&P 500 Index.

This presents a high hurdle that relatively few companies can clear. For example, there are currently 68 Dividend Aristocrats out of the 500 companies that comprise the S&P 500 Index.

We created a complete list of all 68 Dividend Aristocrats, along with important financial metrics like dividend yields and price-to-earnings ratios. You can download an Excel spreadsheet of all 68 Dividend Aristocrats by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

An even smaller group of stocks have raised their dividends for 50+ years in a row. These are known as the Dividend Kings.

Genuine Parts (GPC) has increased its dividend for 68 consecutive years, giving it one of the longest dividend growth streaks in the market. You can see all 54 Dividend Kings here.

There is nothing overly exciting about Genuine Parts’ business model, but its steady annual dividend increases prove that a “boring” business can be just what income investors need for long-term dividend growth.

Business Overview

Genuine Parts traces its roots back to 1928 when Carlyle Fraser purchased Motor Parts Depot for $40,000. He renamed it, Genuine Parts Company. The original Genuine Parts store had annual sales of just $75,000 and only 6 employees.

it has grown into a sprawling conglomerate that sells automotive and industrial parts, electrical materials, and general business products. Its global span reaches throughout North America, Australia, New Zealand, and Europe and is comprised of more than 3,000 locations.

Source: Investor Presentation

The industrial parts group sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers. Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care.

Genuine Parts posted fourth quarter and full-year earnings on February 15th, 2024, and results were mixed. Adjusted earnings-per-share came to $2.26, which was six cents ahead of estimates.

Revenue was up very slightly year-over-year to $5.6 billion, which missed estimates by $60 million. Sales were driven by a 2% benefit from acquisitions, a 0.3% favorable impact of foreign exchange translation, and a -1.2% impact from comparable sales.

The company guided for $9.79 to $9.90 per share in adjusted earnings, and we’ve set our initial estimate at the low end at $9.80. Genuine Parts expects to see 3% to 5% sales growth, in line with analyst estimates.

Growth Prospects

Genuine Parts should benefit from structural trends, as the environment for auto replacement parts is highly positive. Consumers are holding onto their cars longer and are increasingly making minor repairs to keep cars on the road for longer, rather than buying new cars.

As average costs of vehicle repair increase as the car ages, this directly benefits Genuine Parts.

According to Genuine Parts, vehicles aged six years or older now represent over ~70% of cars on the road. This bodes very well for Genuine Parts.

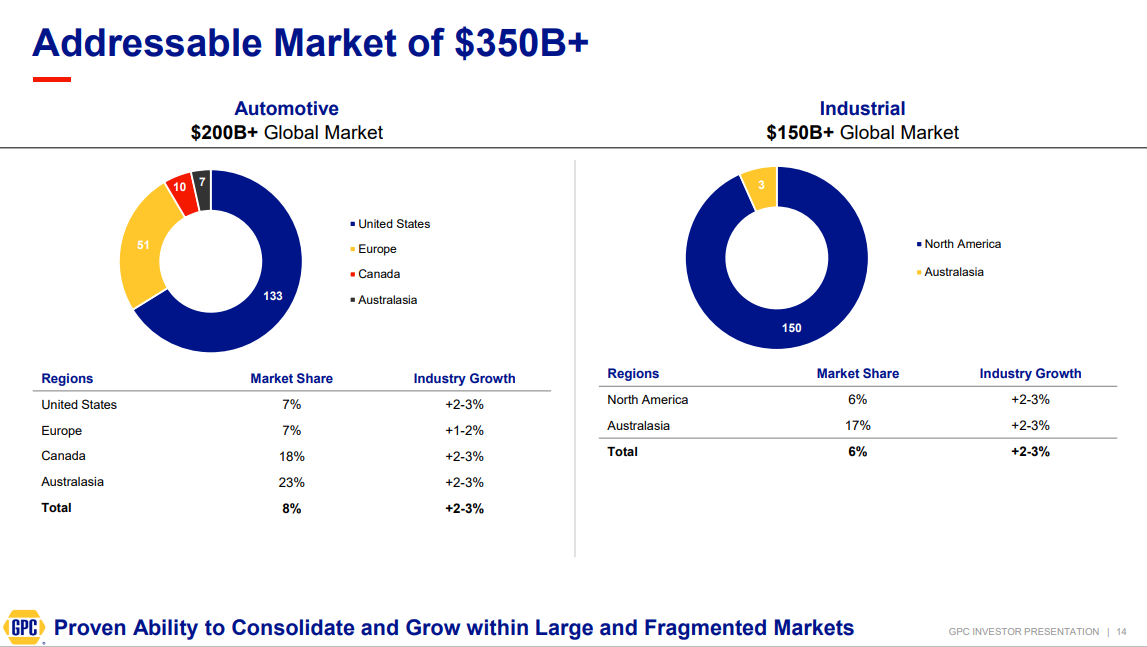

In addition, the market for automotive aftermarket products and services is significant. Genuine Parts has a sizable portion of the $200 billion (and growing) automotive aftermarket business.

Source: Investor Presentation

One way the company has captured market share in this space has historically been acquisitions. It has made several acquisitions over the course of its history.

For example, Genuine Parts acquired Alliance Automotive Group for $2 billion. Alliance is a European distributor of vehicle parts, tools, and workshop equipment. More recently, Genuine Parts completed its $1.3 billion all-cash purchase of Kaman Distribution Group, which is a leading power transmission, automation, and fluid power company, in 2022.

Finally, earnings growth will be aided by expense reductions. The company noted it is undergoing a corporate restructuring to lower headcount and improve efficiency. With these changes should come better operating margins over time.

GPC expects to see costs in the range of $100 million to $200 million due to the restructuring. However, that should offer $40 million in savings in 2024, as well as $45 million to $90 million on an annualized basis thereafter.

We expect 6% annual EPS growth over the next five years for Genuine Parts.

Competitive Advantages & Recession Performance

The biggest challenge facing the retail industry right now, is the threat of e-commerce competition. But automotive parts retailers such as NAPA are not exposed to this risk.

Automotive repairs are often complex, challenging tasks. NAPA is a leading brand, thanks in part to its reputation for quality products and service. It is valuable for customers to be able to ask questions to qualified staff, which gives Genuine Parts a competitive advantage.

Genuine Parts has a leadership position across its businesses. All four of its operating segments represent the #1 or #2 brand in its respective category. This leads to a strong brand, and steady demand from customers.

Genuine Parts’ earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $2.98

- 2008 earnings-per-share of $2.92 (2.0% decline)

- 2009 earnings-per-share of $2.50 (14% decline)

- 2010 earnings-per-share of $3.00 (20% increase)

Earnings-per-share declined significantly in 2009, which should come as no surprise. Consumers tend to tighten their belts when the economy enters a downturn.

That said, Genuine Parts remained highly profitable throughout the recession, and returned to growth in 2010 and beyond. The company remained highly profitable in 2020, despite the economic damage caused by the coronavirus pandemic.

There will always be a certain level of demand for automotive parts, which gives Genuine Parts’ earnings a high floor.

Valuation & Expected Returns

Based on the most recent closing price of ~$157 and expected 2024 earnings-per-share of $9.80, Genuine Parts has a price-to-earnings ratio of 16.0. Our fair value estimate for Genuine Parts is a price-to-earnings ratio of 17.

As a result, Genuine Parts is slightly undervalued at the present time. Multiple expansion could increase annual returns by 1.2% per year over the next five years.

Genuine Parts’ future earnings growth and dividends will add to future returns. We expect Genuine Parts to grow its earnings-per-share by 6% annually over the next five years.

The stock also has a 2.5% current dividend yield. Genuine Parts has a highly sustainable dividend. The company has paid a dividend every year since it went public in 1948.

Adding it all up, Genuine Parts’ total annual returns could consist of the following:

- 6% earnings growth

- 2.5% dividend yield

- 1.2% valuation multiple expansion

In total, Genuine Parts is expected to generate total annual returns of 9.7% over the next five years. This is a strong rate of return which makes the stock a buy.

Final Thoughts

Genuine Parts does not get much coverage in the financial media. It is far from the high-flying tech startups that typically receive more attention. However, Genuine Parts is a very appealing stock for investors looking for stable profitability and reliable dividend growth.

The company has a long runway of growth ahead, due to favorable industry dynamics. It should continue to raise its dividend each year, as it has for the past 68 years.

Given its history of dividend growth, Genuine Parts is suitable for investors desiring income, as well as steady dividend increases each year. With a nearly 10% expected rate of return, GPC stock is a buy.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: