Updated on February 22nd, 2024

Spreadsheet data updated daily; Top 10 list is updated when the article is updated

Return on invested capital, or ROIC, is a valuable financial ratio that investors can add to their research process.

Understanding ROIC and using it to screen for high ROIC stocks is a good way to focus on the highest-quality businesses.

With this in mind, we ran a stock screen to focus on the highest ROIC stocks in the S&P 500.

You can download a free copy of the top 100 stocks with the highest ROIC (along with important financial metrics like dividend yields and price-to-earnings ratio) by clicking on the link below:

Using ROIC allows investors to filter out the highest-quality businesses that are effectively generating a return on capital.

This article will explain ROIC and its usefulness for investors. It will also list the top 10 highest ROIC stocks right now.

Table Of Contents

You can use the links below to instantly jump to an individual section of the article:

What Is ROIC?

Put simply, return on invested capital (ROIC) is a financial ratio that shows a company’s ability to allocate capital. The common formula to calculate ROIC is to divide a company’s after-tax net operating profit, by the sum of its debt and equity capital.

Once the ROIC is calculated, it is evaluated against a company’s weighted average cost of capital, commonly referred to as WACC. If a company’s WACC is not immediately available, it can be calculated by taking a weighted average of the cost of a company’s debt and equity.

Cost of debt is calculated by averaging the yield to maturity for a company’s outstanding debt. This is fairly easy to find, as a publicly-traded company must report its debt obligations.

Cost of equity is typically calculated by using the capital asset pricing model, otherwise known as CAPM.

Once the WACC is calculated, it can be compared with the ROIC. Investors want to see a company’s ROIC exceed its WACC. This indicates the underlying business is successfully investing its capital to generate a profitable return. In this way, the company is creating economic value.

Generally, stocks generating the highest ROIC are doing the best job of allocating their investors’ capital. With this in mind, the following section ranks the 10 stocks with the highest ROIC.

The Top 10 Highest ROIC Stocks

The following 10 stocks have the highest ROIC. Stocks are listed in order from lowest to highest.

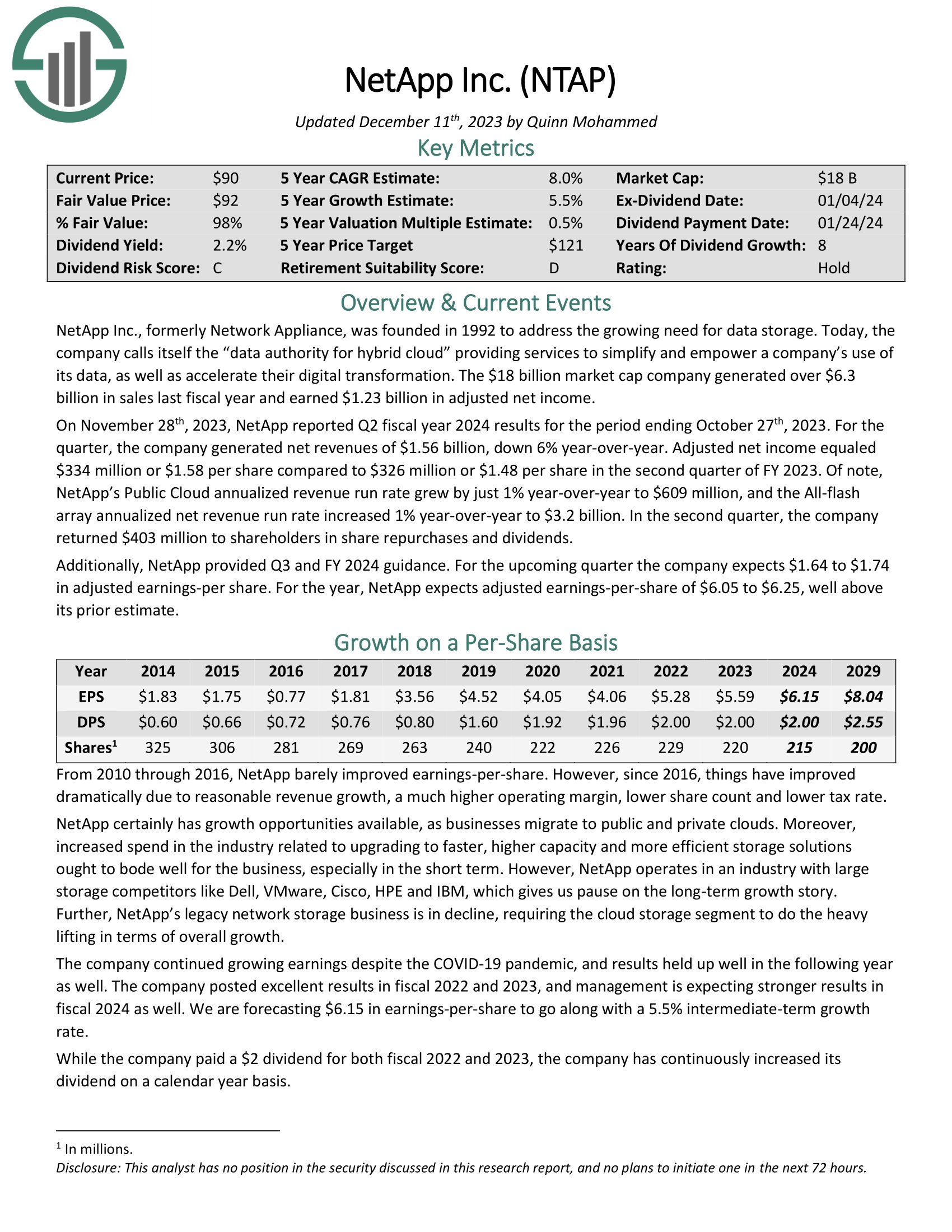

High ROIC Stock #10: NetApp (NTAP)

- Return on invested capital: 26.1%

NetApp Inc., formerly Network Appliance, was founded in 1992 to address the growing need for data storage. Today, the company calls itself the “data authority for hybrid cloud” providing services to simplify and empower a company’s use of its data, as well as accelerate their digital transformation.

On November 28th, 2023, NetApp reported Q2 fiscal year 2024 results for the period ending October 27th, 2023. For the quarter, the company generated net revenues of $1.56 billion, down 6% year-over-year. Adjusted net income equaled $334 million or $1.58 per share compared to $326 million or $1.48 per share in the second quarter of FY 2023.

Of note, NetApp’s Public Cloud annualized revenue run rate grew by just 1% year-over-year to $609 million, and the All-flash array annualized net revenue run rate increased 1% year-over-year to $3.2 billion.

Click here to download our most recent Sure Analysis report on NetApp (preview of page 1 of 3 shown below):

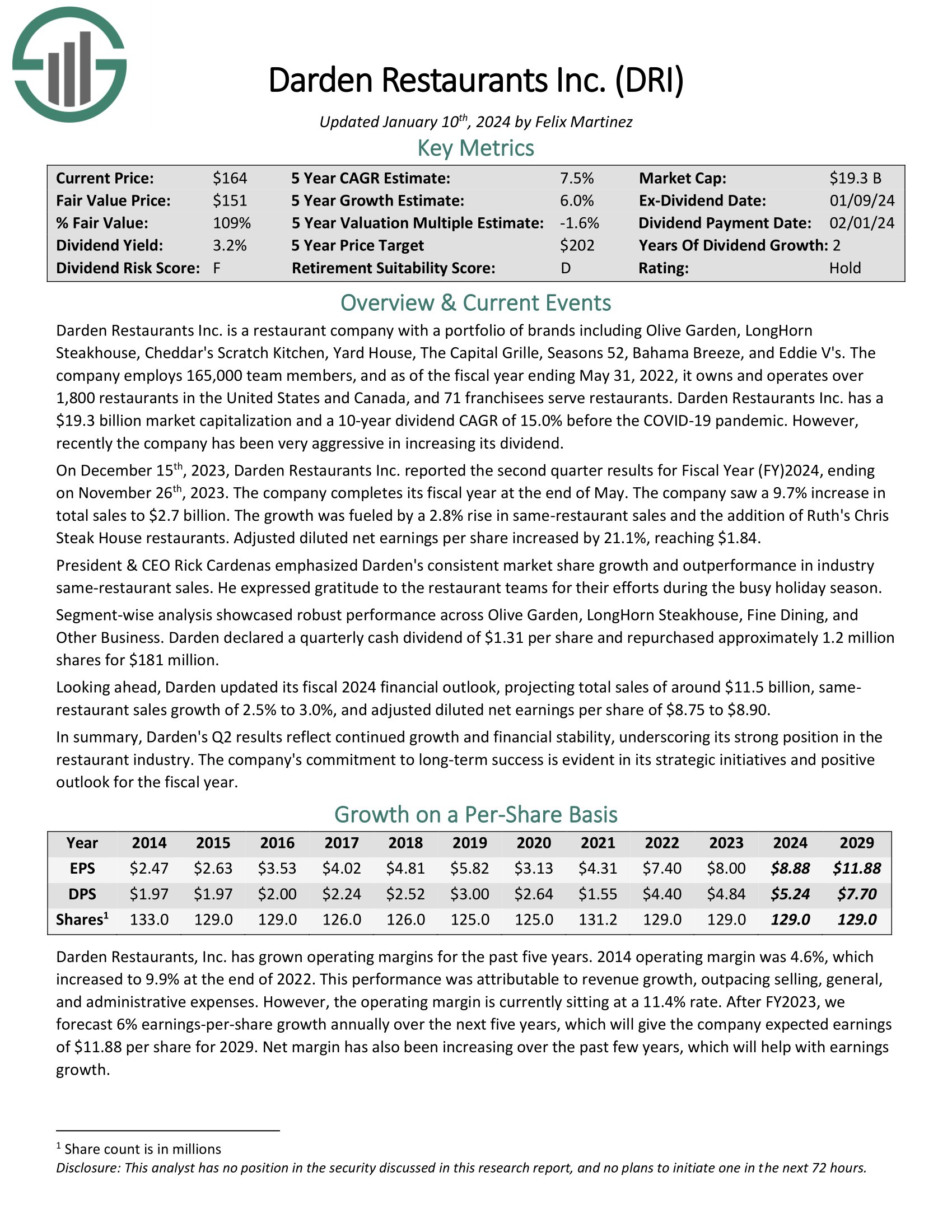

High ROIC Stock #9: Darden Restaurants Inc. (DRI)

- Return on invested capital: 30.8%

Darden Restaurants Inc. is a restaurant company with a portfolio of brands including Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, Bahama Breeze, and Eddie V’s.

On December 15th, 2023, Darden Restaurants Inc. reported the second quarter results for Fiscal Year (FY) 2024, ending on November 26th, 2023. The company completes its fiscal year at the end of May. The company saw a 9.7% increase in total sales to $2.7 billion. The growth was fueled by a 2.8% rise in same-restaurant sales and the addition of Ruth’s Chris Steak House restaurants. Adjusted diluted net earnings per share increased by 21.1%, reaching $1.84.

Click here to download our most recent Sure Analysis report on Darden Restaurants Inc. (preview of page 1 of 3 shown below):

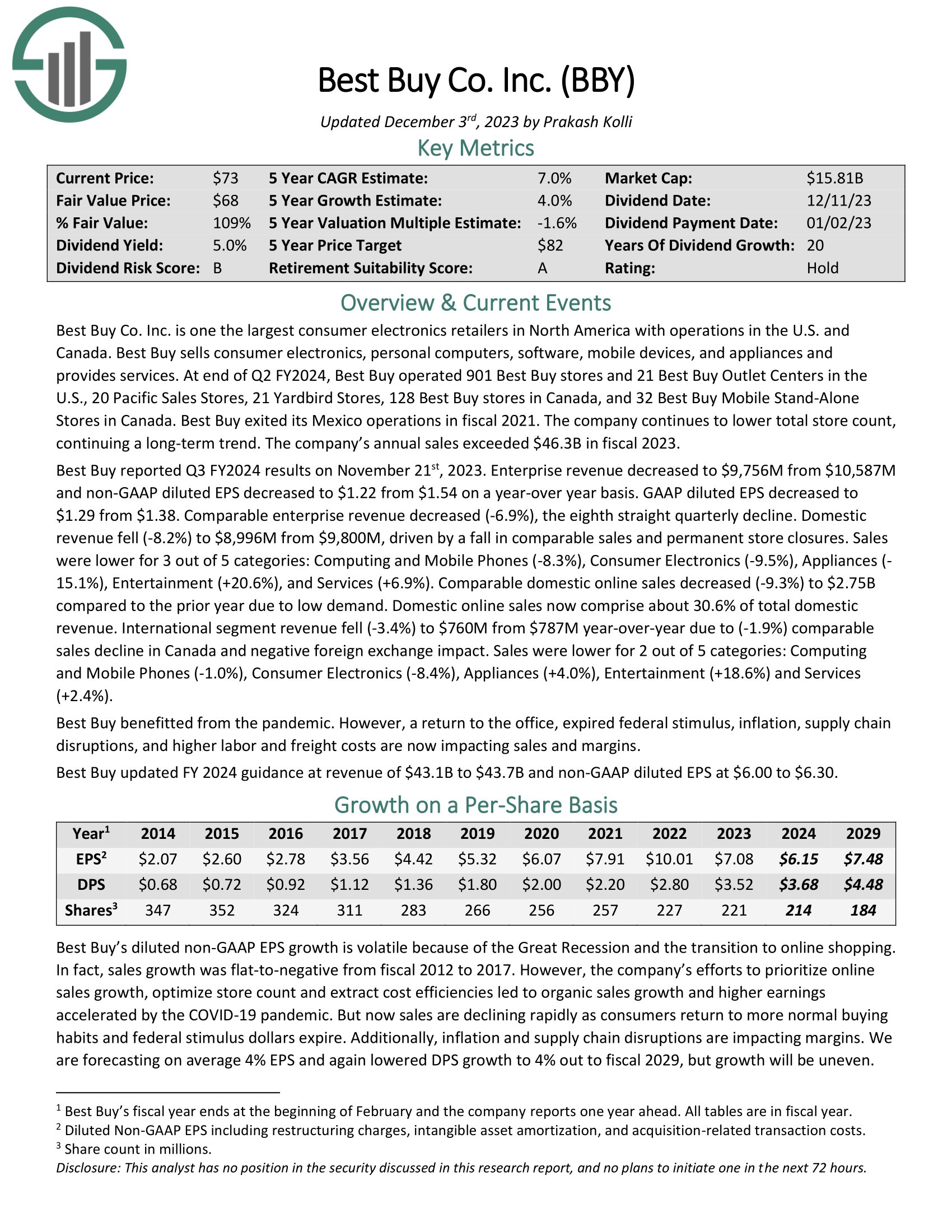

High ROIC Stock #8: Best Buy Co. Inc. (BBY)

- Return on invested capital: 35.5%

Best Buy Co. Inc. is one of North America’s largest consumer electronics retailers, with operations in the U.S. and Canada. Best Buy sells consumer electronics, personal computers, software, mobile devices, and appliances and provides services.

Best Buy reported Q3 FY2024 results on November 21st, 2023. Enterprise revenue decreased to $9,756M from $10,587M and non-GAAP diluted EPS decreased to $1.22 from $1.54 on a year-over year basis. GAAP diluted EPS decreased to $1.29 from $1.38. Comparable enterprise revenue decreased (-6.9%), the eighth straight quarterly decline.

Domestic revenue fell (-8.2%) to $8,996M from $9,800M, driven by a fall in comparable sales and permanent store closures.

Click here to download our most recent Sure Analysis report on Best Buy Co. Inc. (preview of page 1 of 3 shown below):

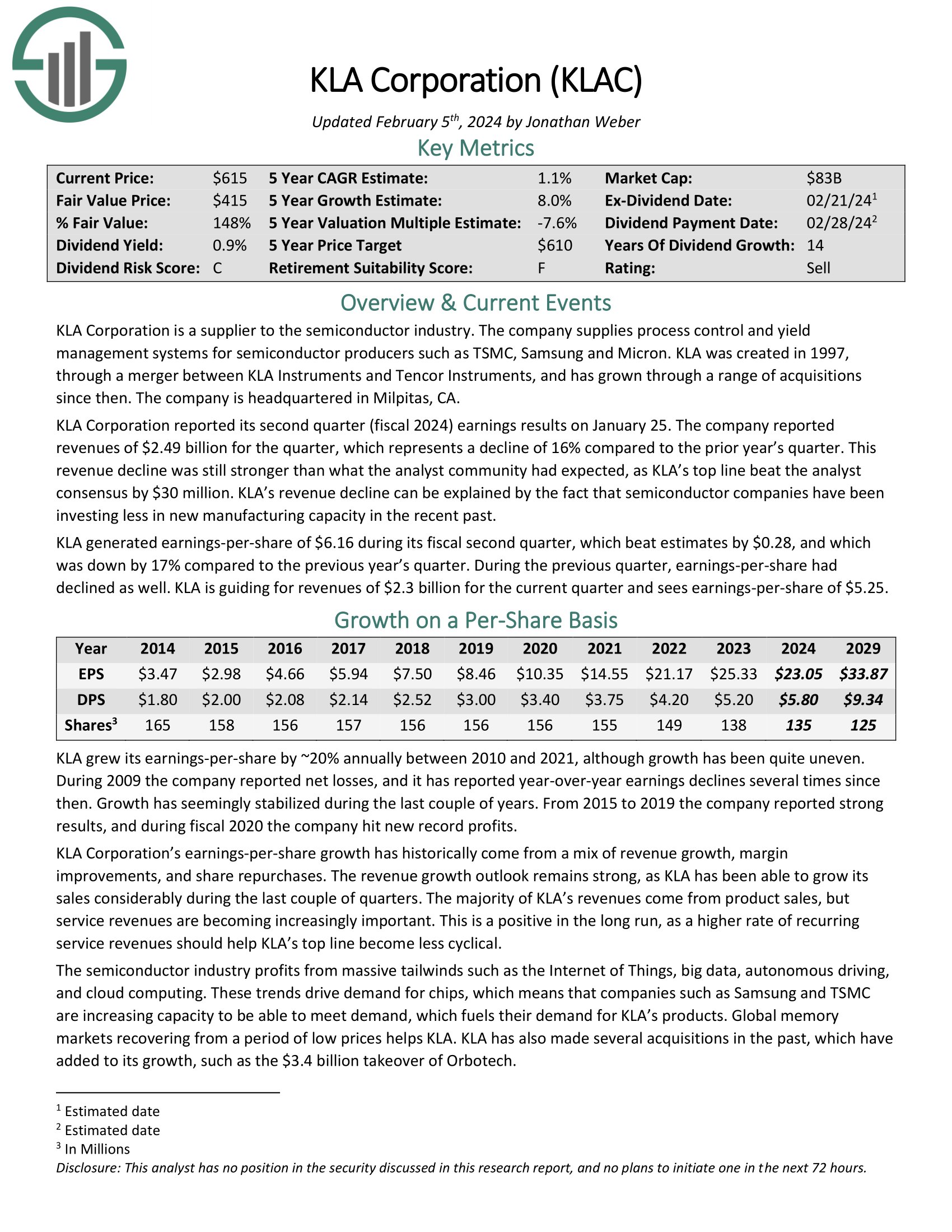

High ROIC Stock #7: KLA Corporation (KLAC)

- Return on invested capital: 39.4%

KLA Corporation is a supplier to the semiconductor industry. The company supplies process control and yield management systems for semiconductor producers such as TSMC, Samsung and Micron. KLA was created in 1997, through a merger between KLA Instruments and Tencor Instruments, and has grown through a range of acquisitions since then.

KLA Corporation reported its second quarter (fiscal 2024) earnings results on January 25. The company reported revenues of $2.49 billion for the quarter, which represents a decline of 16% compared to the prior year’s quarter. This revenue decline was still stronger than what the analyst community had expected, as KLA’s top line beat the analyst consensus by $30 million.

KLA’s revenue decline can be explained by the fact that semiconductor companies have been investing less in new manufacturing capacity in the recent past.

KLA generated earnings-per-share of $6.16 during its fiscal second quarter, which beat estimates by $0.28, and which was down by 17% compared to the previous year’s quarter.

Click here to download our most recent Sure Analysis report on KLA Corporation (preview of page 1 of 3 shown below):

High ROIC Stock #6: Ulta Beauty, Inc. (ULTA)

- Return on invested capital: 45.0%

Ulta has significantly impacted the American beauty retail industry with its strong brand power. Currently operating exclusively in the US, the company had planned a Canadian expansion, which was later cancelled before the pandemic outbreak. Ulta’s loyalty program is highly regarded and among the best in the retail sector, a common attribute of the leading retailers that I cover.

As of the latest update, the program had 39 million members, which represents a 9% YoY increase and accounts for roughly a quarter of all women in the US. This group generates 95% of sales and averages $200 of spend per year. The marketing and data advantages provided by this program are immensely valuable and offer a competitive edge for the company.

In the beauty product sales industry, top brands hold significant power and determine the locations where their products are sold. These high-end brands are highly selective, and the long-standing relationships developed over time prevent newcomers and some e-commerce companies from accessing their products.

High ROIC Stock #5: Lowe’s Companies (LOW)

- Return on invested capital: 56.8%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S.

Lowe’s reported third quarter 2023 results on November 21st, 2023. Total sales came in at $20.5 billion compared to $27.5 billion in the same quarter a year ago. Comparable sales decreased by 7.4%, while net earnings-per-share of $3.06 compared to $0.25 in third quarter 2022. Adjusted EPS in the year-ago period was $3.27. Lowe’s opened one store and three Lowe’s Outlet stores during the quarter.

The company repurchased 7.3 million shares in the third quarter for $1.6 billion. Additionally, it paid out $642 million in dividends.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

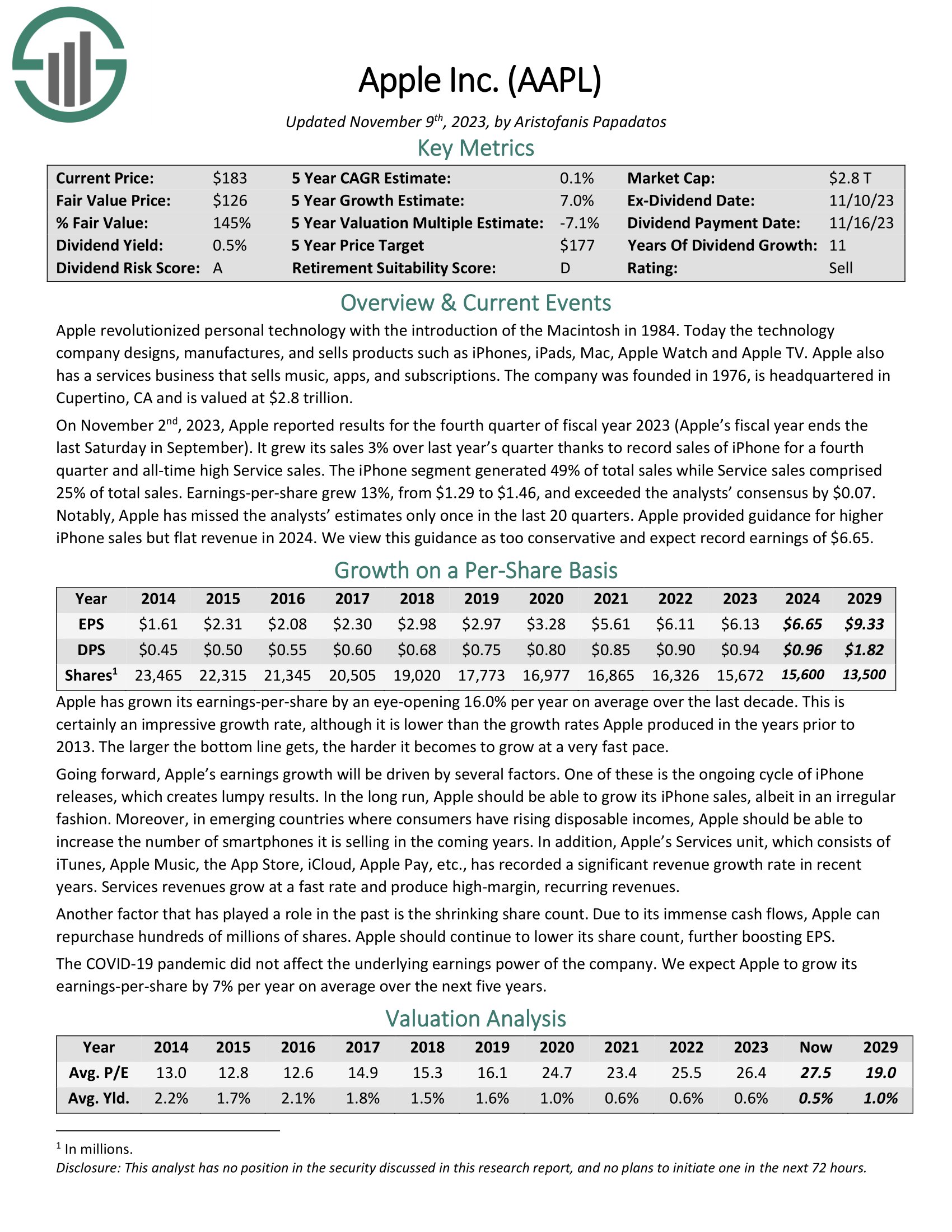

High ROIC Stock #4: Apple, Inc. (AAPL)

- Return on invested capital: 59.5%

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today the technology company designs, manufactures and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV. Apple also has a services business that sells music, apps, and subscriptions.

Apple is the #1 holding of Berkshire Hathaway (BRK.B), making the technology giant one of the top Warren Buffett stocks. Apple is also a top holding of other influential investors, such as Kevin O’Leary.

On November 2nd, 2023, Apple reported results for the fourth quarter of fiscal year 2023 (Apple’s fiscal year ends the last Saturday in September). It grew its sales 3% over last year’s quarter thanks to record sales of iPhone for a fourth quarter and all-time high Service sales. The iPhone segment generated 49% of total sales while Service sales comprised 25% of total sales.

Click here to download our most recent Sure Analysis report on AAPL (preview of page 1 of 3 shown below):

High ROIC Stock #3: Bath & Body Works (BBWI)

- Return on invested capital: 87.0%

Bath & Body Works is a specialty retailer of home fragrance, body care, and soaps and sanitizer products. Its brands include Bath & Body Works, White Barn, and more.

The company operates over 1,700 company-operated retail stores and another 300+ international partner-operated stores. The company was formerly known as L Brands, Inc. and changed its name to Bath & Body Works, Inc. in August 2021.

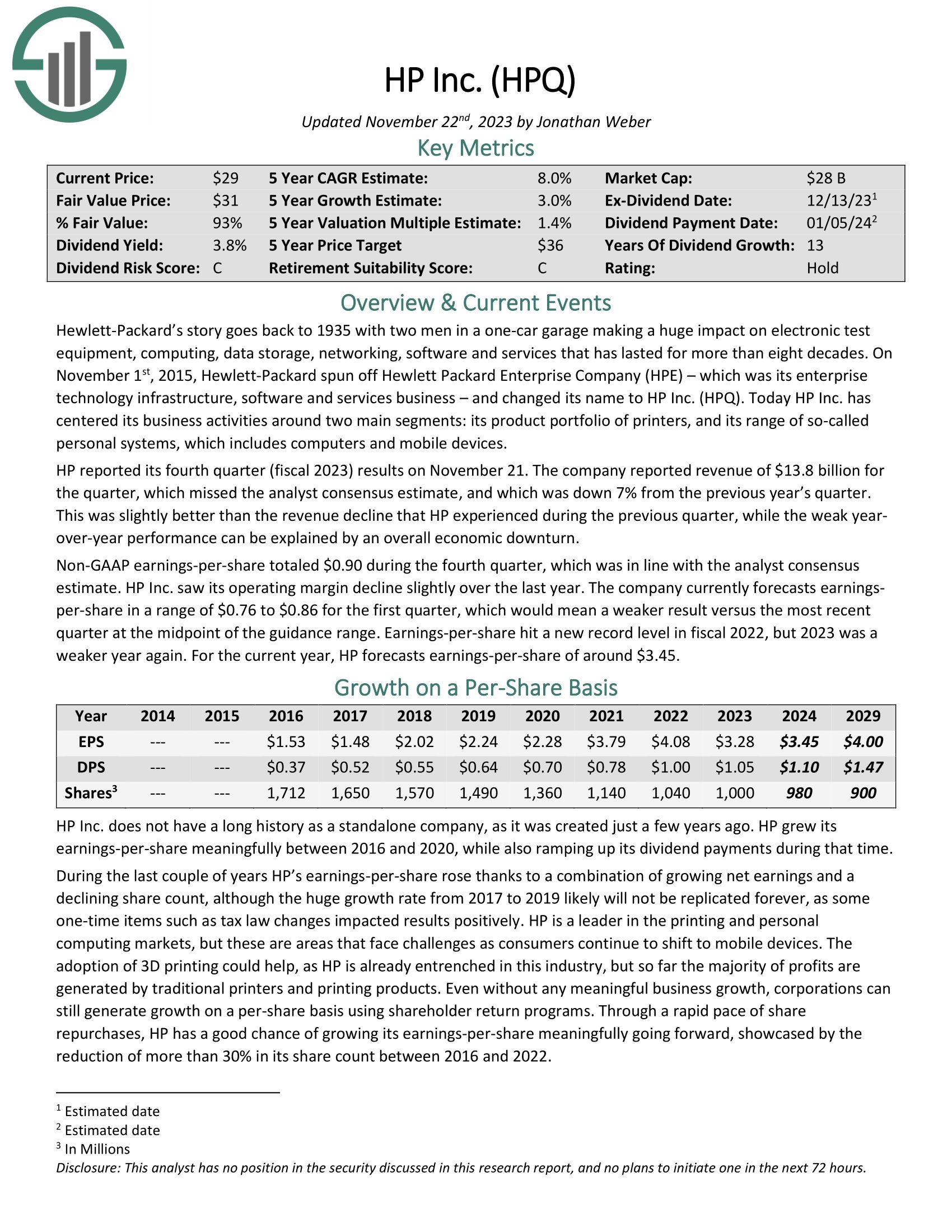

High ROIC Stock #2: HP Inc. (HPQ)

- Return on invested capital: 87.0%

Hewlett-Packard’s origins can be traced back to 1935 when two men started a business in a one-car garage. Over the past eight decades, the company has made significant contributions in electronic test equipment, computing, data storage, networking, software, and services.

HP reported its third quarter (fiscal 2023) results on August 29. The company reported revenue of $13.2 billion for the quarter, which missed the analyst consensus estimate, and which was down 10% from the previous year’s quarter. This was slightly better than the revenue decline that HP experienced during the previous quarter, while the weak year-over year performance can be explained by an overall economic downturn.

Click here to download our most recent Sure Analysis report on HP Inc. (preview of page 1 of 3 shown below):

High ROIC Stock #1: AutoZone Inc. (AZO)

- Return on invested capital: 180.5%

After opening its first store on July 4th, 1979, AutoZone has grown into the leading retailer and distributor of automotive replacement parts and accessories, with more than 6,000 stores in the U.S., Puerto Rico, Mexico, and Brazil. AutoZone carries new and re-manufactured parts, maintenance items, and accessories for cars, SUVs, vans, and light trucks.

AutoZone has proven to be recession–resistant thanks to the nature of its business. During rough economic periods, the sales of new cars fall significantly, causing the average age of cars to increase. This favors AutoZone’s business. In the Great Recession, when most companies saw their earnings plunge, AutoZone grew its EPS by 18% in 2008 and another 17% in 2009.

Final Thoughts

There are many different ways for investors to value stocks. One popular valuation method is to calculate a company’s return on invested capital. By doing so, investors can get a better gauge of companies that do the best job of investing their capital.

ROIC is by no means the only metric that investors should use to buy stocks. There are many other worthwhile valuation methods that investors should consider. That said, the top 10 ROIC stocks on this list have proven the ability to create economic value for shareholders.

Further Reading

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Aristocrats List: a group of elite S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Dividend Champions List: a broader group of stocks with 25+ years of consecutive dividend increases, without the S&P 500 Index inclusion requirement.

- The Dividend Challengers List: stocks with 5-9 years of consecutive dividend increases.

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List: considered to be the best-of-the-best among dividend growth stocks, the Dividend Kings are a group of exceptional dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.