Updated on September 25th, 2023 by Aristofanis Papadatos

Silver stocks operate in a highly cyclical industry. Profits for mining companies are reliant on high precious metals prices. During times of rising precious metals prices, this results in a massive windfall.

But the opposite is also true–lower precious metals prices can cause mining companies to post losses. As a result, income investors looking for stable cash flow and reliable dividends need to tread carefully.

With this in mind, we created a list of silver stocks with important financial ratios such as price-to-earnings ratios and dividend payout ratios.

You can download our full list of silver stocks by clicking on the link below:

In addition to the Excel spreadsheet above, this article covers our top 5 silver stocks today. The companies analyzed primarily focus on silver, but are also engaged in mining of other metals such as gold or zinc.

We rank these 5 companies by a qualitative combination of asset quality, balance sheet strength, future growth prospects, and dividend safety.

Table of Contents

- Silver Stock #5: Hecla Mining Company (HL)

- Silver Stock #4: Pan American Silver Corporation (PAAS)

- Silver Stock #3: Wheaton Precious Metals (WPM)

- Silver Stock #2: Fresnillo Plc (FNLPF)

- Silver Stock #1: Glencore plc (GLCNF)

The price of silver plunged to a 10-year low in early 2020 due to the impact of the pandemic on the global demand for silver but it has recovered strongly since then. It is currently hovering around a 10-year high level thanks to growing demand for silver in industrial and electrical applications, such as catalysts and high-capacity batteries as well as rising demand for jewelry and silverware.

Overall, the current business environment is favorable for silver producers.

Silver Stock #5: Hecla Mining Company (HL)

Hecla Mining Company has been in business since 1891. The company, along with its subsidiaries, develops, produces, markets and explores for both precious and base metals around the world.

The company sells unrefined gold and silver to traders in the precious metal markets. Hecla also provides lead, zinc and bulk concentrates to smelters. Hecla has interests in Alaska, Colorado, Idaho, Montana, Canada, and Mexico.

According to Hecla, the company produces 45% of U.S. silver and is on track to become the largest silver producer in Canada next year.

Source: Investor Presentation

Hecla’s business performance is at the mercy of the markets for its precious and base metals. The company does have some advantages. To be sure, Hecla is the largest silver producer in the U.S., the lowest-cost silver producer thanks to high-quality assets and the third largest producer of lead and zinc.

The company also focuses on mines with a long reserve life. Its core properties have an estimated reserve life of between 11 and 15 years.

Hecla pays a quarterly dividend of $0.0063 per share, for a current yield of 0.6%.

Hecla maintains a bullish long-term view of silver, due largely to favorable supply-and-demand economic factors. The company believes that by 2030, silver demand will reach more than 1,100 million ounces if demand stays on the current trend. This compares to 2019 supply of 1,023 million ounces and demand of 1,074 million ounces.

Therefore, the supply-demand imbalance will require additional supply in order to meet projected demand. This could lead to promising long-term growth for Hecla. We expect 12% growth of earnings per share over the next five years, from $0.07 this year to $0.12 in 2028.

The stock is currently trading at a forward price-to-earnings ratio of 56.9. We assume a fair earnings multiple of 15.0 for this stock. If it trades at its fair valuation level in five years, it will incur a -23.4% annualized valuation drag, which will offset the strong earnings growth.

Given also 12.0% annual earnings growth and the 0.6% dividend, the stock could offer a -12.6% average annual total return over the next five years. It is thus evident that the market has already priced a great portion of future growth in the stock.

Silver Stock #4: Pan American Silver Corporation (PAAS)

Pan American Silver Corporation explores, acquires, develops and refines silver produced from its mines. The company has a market cap of $5.5 billion.

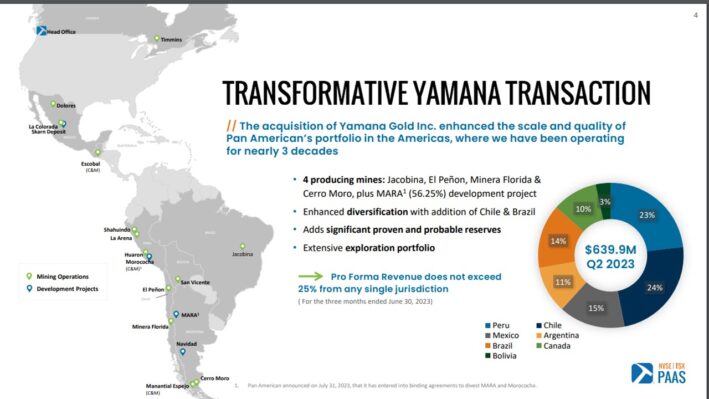

The company has operations in both North and South America. It also recently acquired Yamana Gold in a cash-and-stock deal.

Source: Investor Presentation

This acquisition has greatly enhanced the scale and quality of the asset portfolio of Pan American.

Pan American operates silver mines in the U.S., Canada, Peru, Mexico and Argentina. The company has used acquisitions to help fuel future growth, such as the acquisition of Canadian precious metal mining company Tahoe Resources in 2019 and the recent acquisition of Yamana Gold.

The company generates more than half of its revenue from gold, more than a quarter from silver, and the remainder from copper, zinc, and lead.

Pan American is a strong cash flow generator, with over $1.6 billion in free cash flow generated since 2010. With its free cash flow, the company invests in growth, pays its debt, and returns cash to shareholders. It has an investment grade rating of BBB- from S&P.

Pan American has paid a dividend every year since 2008, though the company cut its dividend in both 2015 and 2016. Over the last three years, however, Pan American’s dividend has grown at a high rate.

The company has a unique dividend policy, which is to pay a base dividend of $0.10 per common share each quarter with a variable dividend, paid quarterly, that is linked to the net cash on the balance sheet for the previous quarter. Pan American has a current yield of 2.6%.

The company is expected to earn approximately $0.45 per share this year. However, we expect it to grow its earnings per share by 15% per year on average thanks to the major acquisition of Yamana Gold and a favorable outlook for silver and gold.

The stock is currently trading at a forward price-to-earnings ratio of 33.8. We assume a fair earnings multiple of 12.0 for this stock. If it trades at its fair valuation level in five years, it will incur a -18.7% annualized valuation drag, which will offset the strong earnings growth.

Given also 15.0% annual earnings growth and the 2.6% dividend, the stock could offer a -2.8% average annual total return over the next five years. Therefore, the market seems to have already priced a significant portion of future growth in the stock.

Silver Stock #3: Wheaton Precious Metals (WPM)

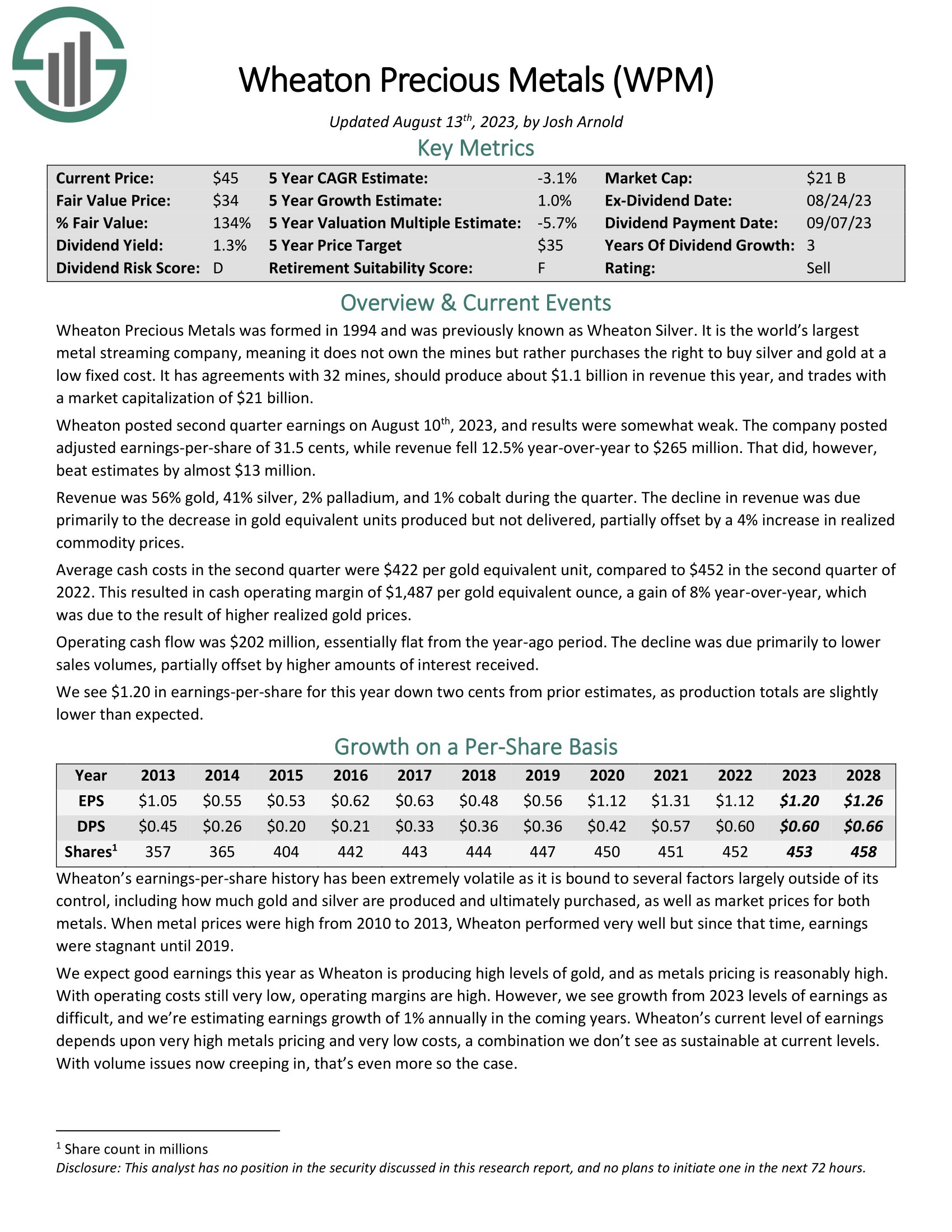

Formerly known as Wheaton Silver, Wheaton Precious Metals was started in 1994. The company has a market capitalization of $20 billion.

Wheaton is the largest metal streaming company in the world. Streaming means that the company purchases the right to buy silver and gold at a low fixed cost instead of outright mine ownership. It has 19 operating mines and another 13 development projects around the world.

Wheaton’s earnings-per-share performance has been quite volatile over the last decade. Due to its business model, Wheaton doesn’t control how much gold or silver is mined from a specific location nor does the company have control over the market prices for the precious metals.

Wheaton reported second quarter earnings on August 10th, 2023, and results were somewhat weak. The company posted adjusted earnings-per-share of $0.31, which decreased 6% over the prior year’s quarter, though they exceeded the analysts’ consensus by $0.04. Revenue fell 12.5% year-over-year, to $265 million, but it exceeded the analysts’ estimates by almost $13 million. The decline in revenue resulted primarily from a decrease in the average price of gold.

Average cash costs in the second quarter were $422 per gold equivalent unit, compared to $452 in the second quarter of 2022. This resulted in cash operating margin of $1,487 per gold equivalent ounce, a gain of 8% year-over-year.

Based on the annualized dividend of $0.60, the stock yields 1.4%. We expect 5% growth of earnings per share over the next five years, from $1.20 this year to $1.26 in 2028.

The stock is currently trading at a forward price-to-earnings ratio of 36.1. We assume a fair earnings multiple of 28.0 for this stock. If it trades at its fair valuation level in five years, it will incur a -4.9% annualized valuation drag. Given also 1.0% annual earnings growth and the 1.4% dividend, the stock could offer a -2.3% average annual total return over the next five years. It thus appears unattractive around its current price.

Click here to download our most recent Sure Analysis report on WPM (preview of page 1 of 3 shown below):

Silver Stock #2: Fresnillo Plc (FNLPF)

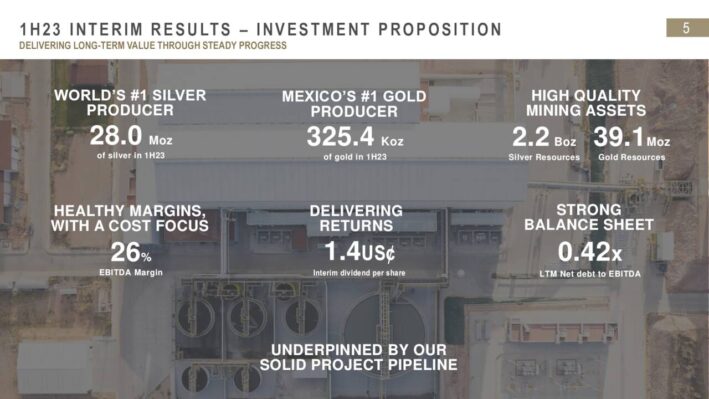

Fresnillo is the world’s leading producer of silver and the largest producer of gold in Mexico. The company’s shares are listed on the London stock exchange. Besides silver and gold, Fresnillo explores for lead and zinc concentrates.

The company also leases mining equipment, supplies semi-pure alloys of gold and silver and provides administrative services. Fresnillo has a market capitalization of $5.2 billion.

Fresnillo is a diversified company, with high-quality assets, healthy operating margins and a rock-solid balance sheet.

Source: Investor Presentation

Like many companies on this list, Fresnillo has experienced wide variance in earnings results. The company has incurred losses several times over the last decade.

Fresnillo’s policy is to pay out 33% to 50% of profit after tax in the form of dividends. The company pays out one-third of the dividend in September while the remaining two-thirds of the dividend is paid in June.

Because profit changes from year-to-year and currency exchange impacts what amount U.S. investors are paid, the dividend has varied over the years. Investors should note that the company has paid a dividend for at least 10 consecutive years, the longest streak of any company on this list.

Based on the trailing two semi-annual payments, the stock yields 2.1%. We expect 15% growth of earnings per share over the next five years, from $0.30 this year to $0.60 in 2028.

The stock is currently trading at a forward price-to-earnings ratio of 23.1. We assume a fair earnings multiple of 15.0 for this stock. If it trades at its fair valuation level in five years, it will incur an -8.3% annualized valuation drag, which will partly offset the strong earnings growth. Given also 15.0% annual earnings growth and the 2.1% dividend, the stock could offer an 8.1% average annual total return over the next five years.

Silver Stock #1: Glencore plc (GLCNF)

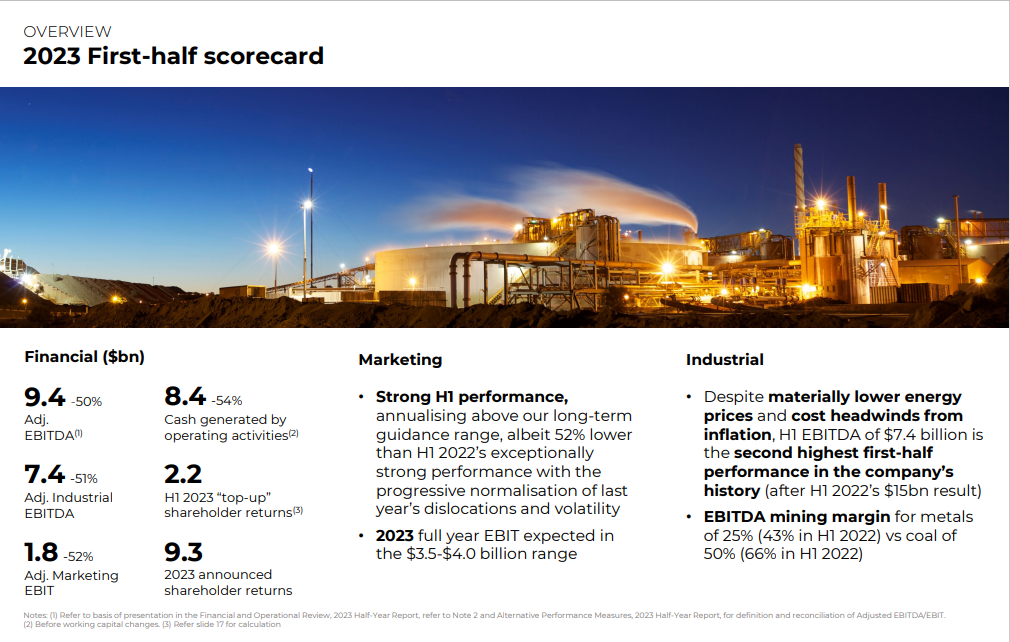

Glencore was founded in 1974 and is one of the leading companies in the mining sector. Glencore plc was the result of merging Glencore with Xstrata in 2013. The company smelts, refines, mines, processes and stores silver, copper, zinc, aluminum, nickel, cobalt, iron ore and other metals.

Glencore, which is the largest company in Switzerland, also has an energy and agricultural products segment. This makes the company the most diversified on this list. Diversification is especially valuable when considering silver stocks, considering the volatility of precious metals prices.

You can see an overview of Glencore’s 2023 first-half performance in the image below:

Source: Investor Presentation

Earnings decreased 50% over the prior year’s period due to exceptionally high commodity prices in the prior year’s period amid a strong recovery from the pandemic and supply chain disruptions. Nevertheless, earnings remained above average.

While silver is the company’s largest metal produced, Glencore is also a leader in several other areas. Glencore is a global leader in the production of copper, cobalt, zinc, nickel and seaborne energy coal.

Glencore is the largest name in its sector, which should fuel continued growth in the years ahead. We also find the diversified business model away from precious metals to be attractive as well. Nevertheless, given the cyclicality of commodity prices, we expect 4% average annual growth of earnings per share over the next five years.

Glencore pays a separate dividend every semester, depending on its earnings. Thanks to favorable commodity prices, the stock is currently offering an annual dividend of $1.04, which corresponds to a 9.4% yield. This renders Glencore a high dividend stock.

We expect Glencore to post earnings per share of $0.92 this year. The stock is trading at a price-to-earnings ratio of 12.1, which is only marginally higher than our assumed fair earnings multiple of 12.0 for this stock. If Glencore trades at its fair valuation level in five years, it will incur a marginal -0.1% annualized valuation drag.

Given also 4.0% annual earnings growth and the 9.4% dividend, the stock could offer a 10.5% average annual total return over the next five years. It thus appears attractive around its current price.

Final Thoughts

Investing in silver stocks is best left to those with higher risk tolerances. The companies on this list have each struggled during various portions of the past decade. Some companies have rarely recorded a profit from year to year.

Moreover, many silver stocks do not pay dividends, and even those that do cannot be counted on to maintain their dividends during a recession, or during periods of declining silver prices.

That said, if investors are interested in silver stocks, we believe that Glencore and Fresnillo are the best options.

Further Reading

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Aristocrats List:a group of elite S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Highest Yielding Dividend Aristocrats: the 20 Dividend Aristocrats with the highest dividend yields right now.

- The Dividend Champions List: a broader group of stocks with 25+ years of consecutive dividend increases, without the S&P 500 Index inclusion requirement.

- The Dividend Challengers List: stocks with 5-9 years of consecutive dividend increases.

- The Dividend Achievers List:a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List:considered to be the best-of-the-best among dividend growth stocks, the Dividend Kings are a group of exceptional dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List:contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2023 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- Augusta Precious Metals review by SavingAdvice.com.