Updated on May 29th, 2024 by Nikolaos Sismanis

The Baupost Group is a long-only hedge fund founded in 1982 by Harvard Professor William Poorvu and his partners.

Among Mr. Poorvu’s founding partners was Seth Klarman, who built his billion-dollar fortune at the helm of the fund and remains the key executive today.

The fund has around 27 billion in assets under management (AUM), $3.6 billion of which is allocated to the firm’s public equity portfolio. The Baupost Group is headquartered in Boston, Massachusetts.

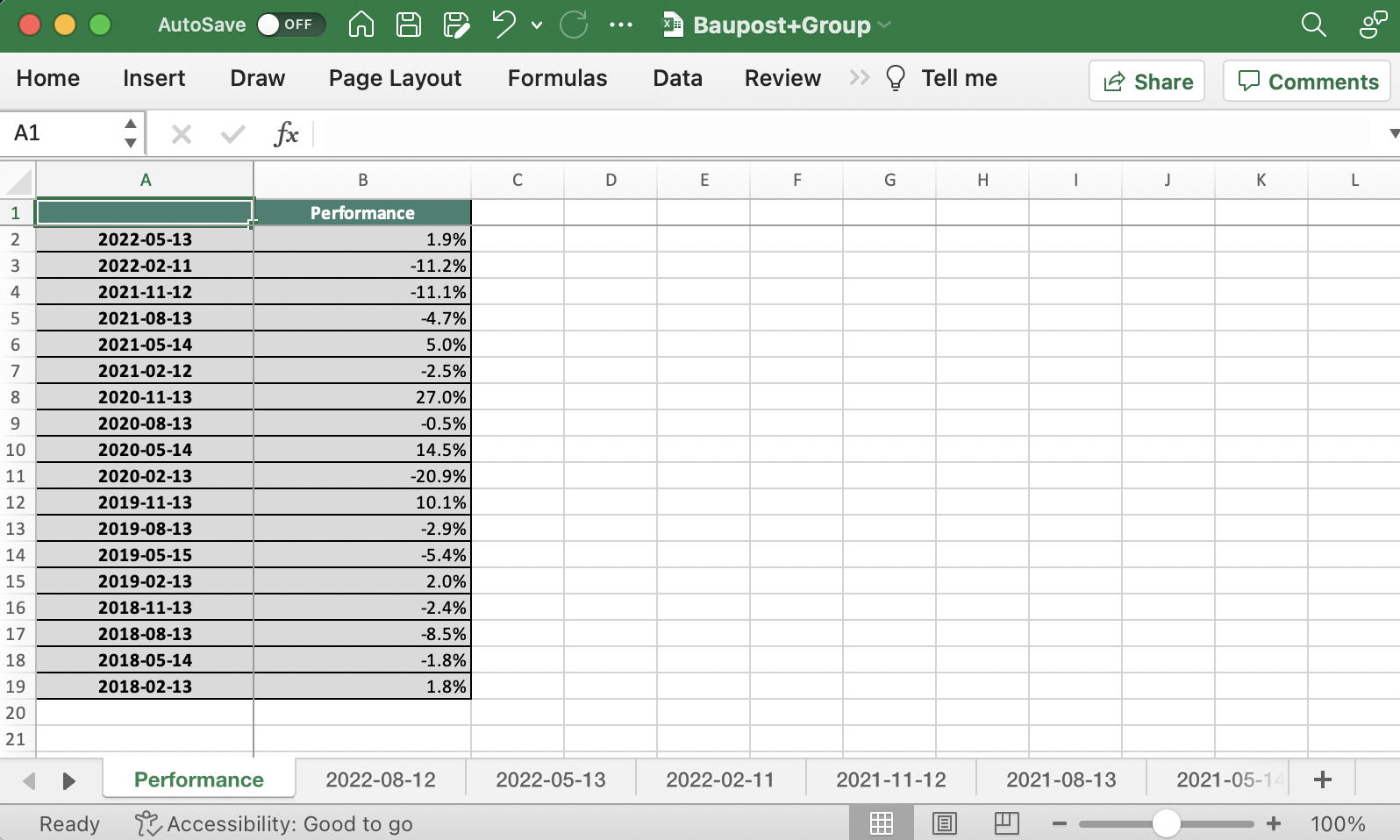

Investors following the company’s 13F filings over the last 3 years (from mid-May 2021 through mid-May 2024) would have generated annualized total returns of -2.2%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of about 9.9% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of the Baupost Group’s current 13F equity holdings below:

Keep reading this article to learn more about The Baupost Group.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Baupost Group’s Fund Manager, Seth Klarman

- Baupost Group’s Investment Philosophy & Strategy

- Baupost Group’s Noteworthy Portfolio Changes

- Baupost Group’s Portfolio & 10 Largest Public Equity Investments

- Final Thoughts

Baupost Group’s Fund Manager, Seth Klarman

Upon founding Baupost, Poorvu asked Klarman and his associates to handle funds he raised from the sale of his stake in a local TV station. The fund started with US$27 million in start-up capital. Among Baupost’s founders, Mr. Klarman was considered relatively inexperienced. Therefore, the fund was taking a big risk with his involvement.

In 2008 Klarman managed to raise $4 billion in crisis-liquidity capital from large foundations and Ivy League endowments. He would allocate $100 million of these funds in stocks and other assets per day, including distressed securities and bonds, resulting in multi-bagger returns post-2008.

Klarman wrote the book Margin Of Safety, which details his risk-averse and value-driven investment philosophy. The book is an investing classic that is out of print. Copies on eBay sell from hundreds to thousands of dollars.

Baupost Group’s Investment Philosophy & Strategy

The Baupost Group’s investment philosophy revolves heavily around Mr. Klarman’s investing principles, which can be summed into the following key points:

- Risk evaluation: While this may sound like a well-known and trivial principle, in reality, sophisticated risk-aversion is far from commonly practiced in the investing world. This is especially true in times of low volatility, such as the current incredible bull market, in which market participants tend to ignore the systemic risks that arise in the underlying economy. Therefore, Mr. Klarman and his team will make sure that their risk is well-mitigated, usually by holding put options against a market index.

- Capitalizing on “Motivated sellers”: A motivated seller is someone who, as Klarman puts it, is letting go of their shares for a non-economic reason. One such reason, for instance, can be the exclusion of stock from a major index. This can cause a stock to trade lower without anything changing in regards to its everyday operations, which can create compelling buying opportunities.

- Capitalizing on “Missing buyers”: One of Warren Buffett’s more famous quotes is that if you have been in a poker game for 30 minutes and still don’t know who the patsy is, you can be fairly certain it’s you. Mr. Klarman’s version is that he never wants to appear at an auction (i.e., stock buying) to discover that all the other bidders (Mr. Market) are more knowledgeable and have a lower entry cost than he does. Therefore, Baupost is likely to be buying unpopular assets if it sees value in them in an attempt to be ahead of the overall market, despite the “missing buyers.”

The Baupost Group’s Noteworthy Portfolio Changes

During its latest 13F filing, The Baupost Group executed the following notable portfolio adjustments:

Noteworthy new Buys:

- Eagle Materials Inc. (EXP)

- WESCO International, Inc (WCC)

- GDS Holdings Ltd ADR (GDS)

- Fortrea Holdings Inc (FTRE)

- SoundHound AI Inc (SOUN)

Noteworthy New Sells:

- Gray Television Inc (GTN)

- Tower Semiconductor Ltd (TSEM)

- SS&C Technologies Holdings Inc (SSNC)

- Garrett Motion Inc (GTX)

- Finch Therapeutics Group Inc (FNCH)

- Liberty Media Corp. (LLYVK) (LLYVA)

Baupost Group’s Portfolio & 10 Largest Public Equity Investments

Baupost’s public-equity portfolio is not heavily diversified. Instead, its holdings are concentrated, featuring high-conviction ideas. The portfolio numbers only 21 equities, the 10 most significant of which account for 62.2% of its total composition. The fund’s largest holding is Alphabet Inc. (GOOG), occupying around 17.4% of the total portfolio.

Source: 13F filing, Author

Alphabet Inc. (GOOGL) (GOOG)

Alphabet’s revenue and earnings growth flattened in 2022 due to the macroeconomic turmoil at the time, which included declining advertising spending and a strong dollar, materially impacting the company’s ability to grow. However, results rebounded notably in 2023, with the momentum persisting through 2024, evident by the company posting a fantastic first-quarter report.

Revenues grew by 15% in constant currency to $80.5 billion for the quarter, while EPS surged by 62% to $1.89.

In the meantime, the company continues to feature one of the healthiest balance sheets in the market, management returns tons of cash to shareholders through stock buybacks, and its overall performance should rebound once market conditions improve.

Alphabet is Baupost’s largest holding. The fund boosted its position in the stock by about 0.3% during the first quarter.

Fidelity National Information Services, Inc. (FIS)

Fidelity National Information Services, Inc. is a provider of financial technology services for merchants, banks, and capital markets businesses. The company was founded in 1968 and is headquartered in Jacksonville, Florida. FIS offers technology solutions for retail and institutional banking, payments, asset and wealth management, risk and compliance, payment processing, consulting, and outsourcing.

Shares of Fidelity plummeted following last year’s regional banking crisis and currently remain at rather depressed levels. Nevertheless, the company is one of the more resilient players in the space and managed to return to profitability last year.

Fidelity National Information Services is Baupost’s second-largest holding, making up about 14.6% of its portfolio. The fund trimmed its position by 12.3% during the quarter.

Willis Towers Watson (WTW)

Willis Towers Watson provides a wide range of services to clients around the world, including risk management and insurance brokerage, employee benefits consulting, and human capital and talent management solutions. The company works with businesses, institutions, and individuals to help them navigate the complexities of risk and optimize their human capital strategies.

The company has struggled to grow its revenues and net income in recent years. Still, its numbers have been robust overall, while a growing dividend and stock buybacks have provided tangible returns to investors.

Willis Towers Watson is Bauopost’s third-largest position, occupying about 13.5% of its equity holdings.

Viasat, Inc. (VSAT)

Media conglomerate Viasat is Baupost’s fourth largest holding, accounting for roughly 9.2% of its portfolio.

In our view, Baupost holds a stake in Viasat as an activist investor due to the fund holding about 12% of its total outstanding shares. This indicates the possibility that Baupost wants to have an active influence on how the company is run, with a potential aim towards modernizing.

The position could be a risky long-term bet for retail investors, though a potentially rewarding one.

CRH plc (CRH)

CRH plc is a leading global diversified building materials group based in Dublin, Ireland. Founded in 1970, CRH stands for Cement Roadstone Holdings and has grown through strategic acquisitions and organic growth to become one of the largest companies in the construction industry.

The company operates in 30 countries across North America, Europe, and Asia, supplying a wide range of products, including cement, aggregates, asphalt, and ready-mixed concrete. It also provides building products such as architectural glass, precast concrete, and construction accessories.

CRH’s net debt position currently sits at a rather hefty $10.9 billion, which, for its size, might be quite alarming in the current interest rates environment. Still, the company continues to cover its interest expenses rather comfortably.

CRH is Baupost’s fifth-largest holding, making up 7.6% of its total portfolio. The fund trimmed its position by about 19% during the previous quarter.

Clarivate Plc (CLVT)

Clarivate is a prominent global information services company renowned for its commitment to advancing innovation through insights and analytics. With a multifaceted approach, Clarivate caters to diverse industries, including life sciences, healthcare, academia, and intellectual property.

At the core of Clarivate’s offerings is the ‘Web of Science,’ a comprehensive research database providing access to an extensive collection of scholarly articles and research papers. This platform serves as a vital resource for researchers, academics, and professionals seeking the latest advancements in their respective fields.

The company’s revenues and free cash flow have been robust in recent years, though growth has been somewhat weak.

Clarivate is a relatively new holding for Baupost, with the position initiated two quarters ago. The stock makes up around 6.8% and is now the fund’s sixth-largest position.

The Liberty SiriusXM Group (LSXMA) (LSXMK)

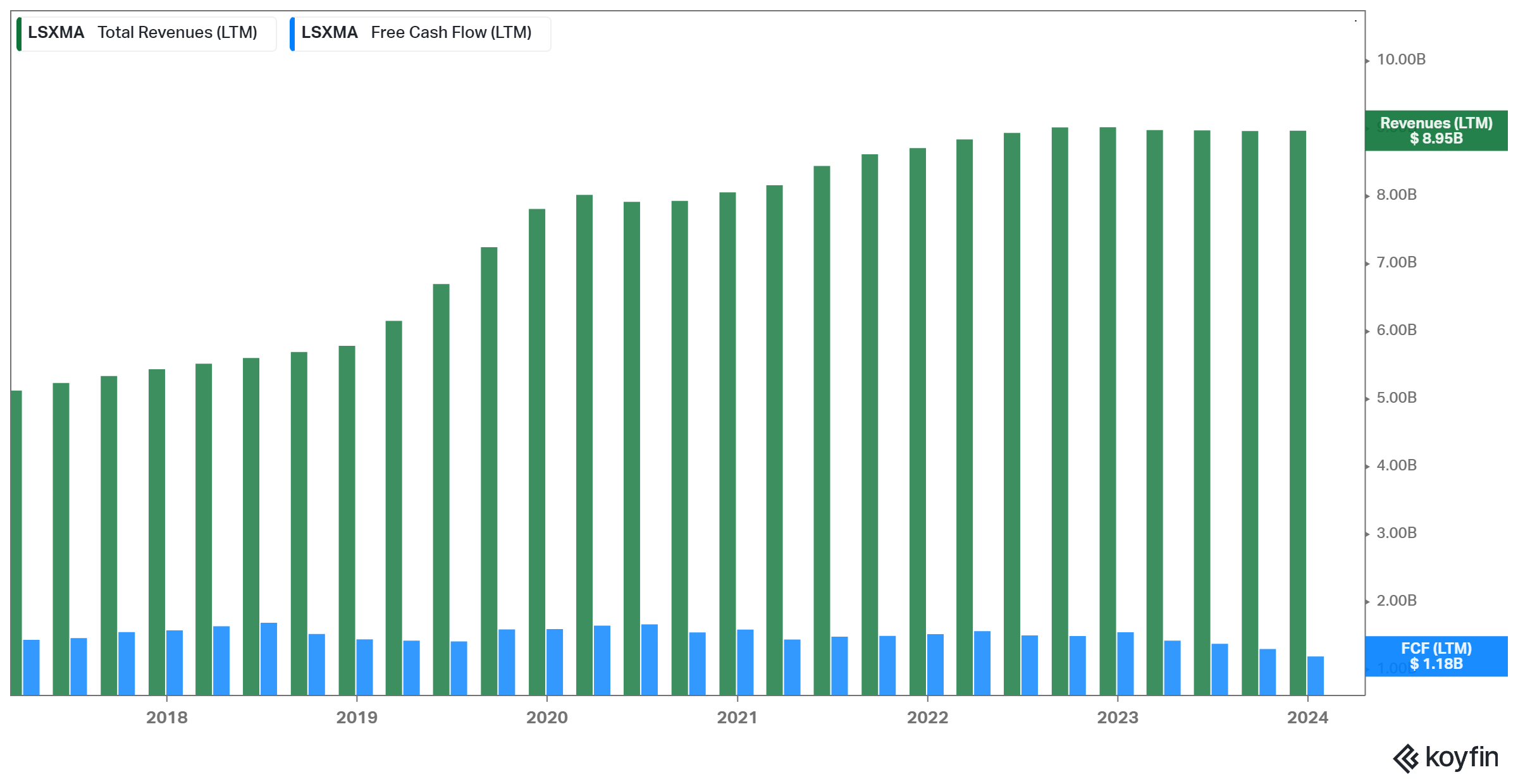

The Liberty SiriusXM Group is a prominent player in the media and entertainment industry. Headquartered in the United States, the company is a part of the Liberty Media Corporation and holds a significant stake in SiriusXM, a leading satellite radio service provider.

As a major player in the satellite radio market, the company plays a crucial role in shaping the future of audio entertainment. However, revenue growth has stalled in recent years due to severe saturation in the space.

The company does generate strong free cash flow that exceeds $1 billion per year. Still, almost all of its free cash flow is allocated towards deleveraging, as the group is heavily indebted. Specifically, the balance sheet is burdened by a net debt position of $10.8 billion.

Baupost initiated a position in The Liberty SiriusXM Group in Q1-2020 and has since steadily grown its equity stake.

Baupost’s position in Liberty SiriusXM Group remained stable during the quarter. The two classes of stock, K and A, account for 4.3% and 4.2% of the fund’s portfolio, respectively. Separately, they make up the fund’s seventh and eighth holdings. Together, they would be the fund’s fifth-largest holding.

Liberty Global Ltd. (LBTYK)(LBTYA)

Liberty Global Ltd., founded in 2005 and headquartered in London, is one of the largest international telecommunications and television companies, primarily operating in Europe. It offers broadband internet, digital TV, mobile, and telephony services through major brands like Virgin Media in the UK, Telenet in Belgium, and UPC in various European countries. Known for significant investments in advanced network technology, Liberty Global aims to deliver ultra-fast internet and innovative digital services.

The company has pursued growth through acquisitions, expanding its network infrastructure, offering bundled mobile services, investing in content partnerships, and exploring international expansion opportunities. That said, these efforts have not really been successful, with revenues and free cash flow shrinking over the years.

Baupost slashed the class A and K positions in Liberty Global by about 67% and 71% during the quarter. The two classes of stock, A and K, account for 3.8% of its portfolio each. Separately, they make up the fund’s ninth and tenth holdings. Together, they would be the fund’s sixth-largest holding.

Final Thoughts

The Baupost Group’s holdings provide several interesting positions for investors to consider. Based on our calculations, the fund’s public equity portfolio has been underperforming against the overall market. But Baupost has a long history of success with its equity selections. In any case, investors are likely to find several appealing investing ideas by analyzing the fund’s holdings.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers/gurus:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: