Updated on May 29th, 2024 by Nikolaos Sismanis

Founded in 2003, Scion Asset Management, LLC is a private investment firm led by investing guru Dr. Michael J. Burry.

Scion Asset Management has become increasingly popular due to Dr. Burry’s ability to identify undervalued investment opportunities around the world. The fund only has four clients. It charges an asset-based management fee that can be as high as 2% per year, while it may also take up to 20% of the value of the appreciation from each client’s account.

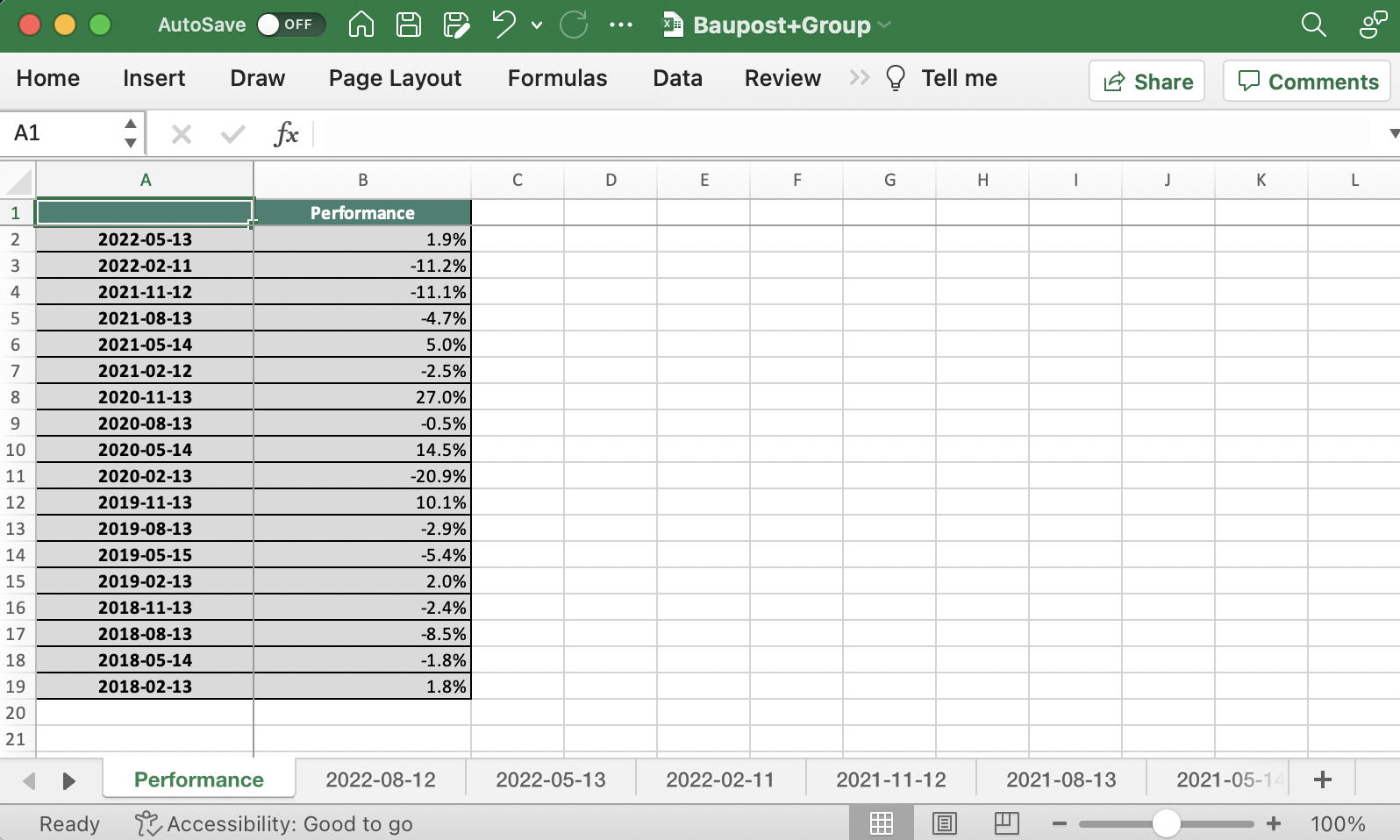

Investors following the company’s 13F filings over the last 3 years (from mid-May 2021 through mid-May 2024) would have generated annualized total returns of 20.0%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 9.9% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Scion Asset Management’s current 13F equity holdings below:

Keep reading this article to learn more about Scion Asset Management.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Scion Asset Management’s Fund Manager, Michael Burry

- Scion Asset Management’s Investment Philosophy & Strategy

- Scion Asset Management’s Noteworthy Portfolio Changes

- Scion Asset Management’s Portfolio – All 15 Public Equity Investments

- Final Thoughts

Scion Asset Management’s Fund Manager, Michael Burry

Michael J. Burry is known by most as the “Big Short” investor due to the eponymous movie revolving around himself and his story during the days of the Great Financial Crisis, a role played by Christian Bale. However, Dr. Burry has a much broader track record in the investing world.

After attending medical school, Dr. Burry left to start his own hedge fund in 2000. He had already built a reputation as an investor at the time by exhibiting success in value investing. Specifically, his picks were published on message boards on the stock discussion site Silicon Investor back in 1996, with their returns being outstanding! In fact, Dr. Burry had showcased such great stock-picking skills that he drew the interest of companies such as Vanguard, White Mountains Insurance Group, and renowned investors such as Joel Greenblatt.

Nevertheless, it is Dr. Burry’s legendary plays prior to the Great Financial Crisis, and the massive returns that followed that pushed his name into the international spotlight. Particularly, in 2005, Dr. Burry started to concentrate on the subprime market. Based on his analysis of mortgage lending practices utilized in 2003 and 2004, he accurately forecasted that the real estate bubble would come tumbling by 2007.

His analysis resulted in him shorting the market by convincing Goldman Sachs and other investment firms to sell him credit default swaps against subprime deals he saw as weak. Interestingly enough, when Dr. Burry had to pay for the credit default swaps, he experienced an investor revolt, as some investors in his fund feared his prophecy was inaccurate, requesting to withdraw their funds. Ultimately, Burry’s analysis proved right. Not only did he make a personal profit of $100 million, but his remaining investors earned more than $700 million.

To illustrate how successful Dr. Burry’s picks were from the origins of Scion Asset Management to the Great Financial Crisis, the hedge fund recorded returns of 489.34% (net of fees and expenses) between its inception in November 2000 and June 2008. In comparison, the S&P 500 returned just under 3%, including dividends, over the same period.

Michael Burry’s Investment Philosophy & Strategy

The concept of “Value Investing can sum up Michael Burry’s whole investment philosophy”. He has stated more than once that his investment style is based on Benjamin Graham and David Dodd’s 1934 book Security Analysis. In his words: “All my stock picking is 100% based on the concept of a margin of safety.”

Dr. Burry does not differentiate between small-caps, mid-caps, tech stocks, or non-tech stocks. He only looks for their undervalued elements, regardless of their sector and class. Precisely because he doesn’t focus on a specific industry and because the essence of financial metrics shifts by industry and each company’s place in the economic cycle, Dr. Burry utilizes the ratio of enterprise value (EV) to EBITDA when researching investment ideas.

Accordingly, he disregards price-to-earnings ratios to dodge being deceived by a company’s stated metrics. Company metrics from any one time period can be misleading based on the underlying state of the economy and macros that may benefit or harm the company at a given point in time. Rather, he pays attention to off-balance sheet metrics and, naturally, free cash flow.

Scion Asset Management’s Noteworthy Portfolio Changes

During its latest 13F filing, Scion Asset Management executed the following notable portfolio adjustments:

Noteworthy new Buys:

- Sprott Physical Gold Trust (PHYS)

- BP Plc ADR (British Petroleum) (BP)

- First Solar Inc (FSLR)

- Baidu Inc ADR (BIDU)

Noteworthy new Sells:

- GEN Restaurant Group Inc (GENK)

- Toast Inc (TOST)

- Mettler-Toledo International, Inc. (MTD)

- Bruker Corp (BRKR)

- Nexstar Media Group Inc (NXST)

- Booking Holdings Inc. (Priceline) (BKNG)

- Alphabet Inc. Class A (GOOGL)

- Warner Bros.Discovery Inc (WBD)

- Amazon.com Inc. (AMZN)

- Qurate Retail Group Inc Series A (Formerly Liberty Interactive) (QRTEA)

- Big Lots Inc (BIG)

- MGM Resorts International, Inc. (MGM)

- CVS Health Corp. (CVS)

Scion Asset Management’s Portfolio – All 15 Public Equity Investments

Excluding Michael Burry’s long and short option plays, the core equity portfolio numbers only 15 names, with JD.com, Inc. (JD) accounting for 12.2% of its holdings.

The fund’s top five holdings, which we analyze below, account for 46% of its total public equity exposure.

Source: 13F filing, Author

JD.com, Inc. (JD)

JD.com is a leading Chinese e-commerce company headquartered in Beijing. Founded by Richard Liu Qiangdong in 1998 as an offline electronics store, JD.com transitioned to an online platform in 2004. It is one of the largest e-commerce companies in China, competing primarily with Alibaba’s Tmall.

JD.com rose to success through its advanced logistics infrastructure, which includes numerous warehouses and a large delivery fleet, enabling fast and reliable deliveries. The company’s strict quality control by managing its supply chain reduces the risk of counterfeit products, enhancing customer trust. By investing heavily in technology, such as AI and robotics, the company consistently boosts operational efficiency and customer experience.

Additionally, JD Finance offers a range of financial services that diversify its revenue streams. JD.com also integrates online and offline channels, providing a seamless shopping experience through its physical stores and local retail delivery service, JD Daojia.

As you can see in the chart below, JD’s growth has stagnated in recent years, with the Chinese economy slowing down. Nevertheless, the company has taken this opportunity to focus on improving its profitability during this period, with free cash flow starting to grow notably.

JD is now Scion’s largest position, accounting for 12.2% of its public-equity portfolio.

Alibaba Group Holding

Alibaba Group, founded in 1999 by Jack Ma and headquartered in Hangzhou, China, is a global technology and e-commerce giant. Known for its e-commerce platforms like Alibaba.com and Tmall, the company also engages in cloud computing through Alibaba Cloud.

Additionally, Alibaba has a presence in digital entertainment with platforms like Youku and Alibaba Pictures, and it plays a key role in financial technology through Ant Group’s Alipay.

The company features a noteworthy track record of revenue and earnings growth, capitalizing on China’s massive economies of scale and ever-expanding digitization trend. That said, shares of Alibaba have failed to show any gains from the stock’s IPO levels due to investors’ lack of interest in trust toward Chinese equities.

To address the undervaluation issue, management has focused on boosting stock buybacks. The company repurchased $12.3 billion worth of stock last year, which translates to a buyback yield of about 6.2%.

Alibaba also declared its first-ever dividend, amounting to $1.00 and translating to a dividend yield of about 1.2% at the current levels, as an additional potential catalyst that could help to attract investor interest in the stock.

Alibaba is Scion’s second-largest holding, accounting for 10.2% of its equity holdings.

HCA Healthcare Inc.

HCA Healthcare was founded in 1968 and has since grown to become a leading player in the healthcare industry. The organization is known for its commitment to providing high-quality patient care and medical services. HCA Healthcare’s facilities offer a wide range of healthcare services, including emergency care, surgery, maternity care, cardiology, and various specialized medical treatments.

The company is also involved in medical education and research, contributing to advancements in healthcare practices. HCA Healthcare aims to enhance the overall well-being of communities by delivering compassionate and innovative healthcare solutions.

HCA features a tremendous long-term track record of revenue and net income growth.

The company also features a fantastic track record of capital returns to shareholders, having repurchased and retired about 45% of its shares over the past 10 years alone.

HCA Healthcare is Scion’s third-largest holding, accounting for 8.2% of its equity holdings.

Citigroup

Citigroup, established in 1812 and headquartered in New York City, stands as a global financial giant. Offering a spectrum of services, from everyday banking to high-stakes investment banking, it caters to millions of customers globally.

Beyond the numbers, Citigroup is known for its adaptability and innovation in the dynamic world of finance.

The company has been successful in growing its book value per share ever since the catastrophic events of the Great Financial Crisis. That said, as we note in our most recent quarterly research report, its profitability has been somewhat underwhelming lately.

Earnings, in fact, declined for the second consecutive year in fiscal 2023. This is despite the banking industry posting growing earnings these days as a result of rising interest rates.

Citigroup is Scion’s fourth-largest holding, accounting for 8.1% of its equity holdings.

The Cigna Group (CI)

The Cigna Group (CI) is a global health services organization based in Bloomfield, Connecticut. Formed in 1982 through the merger of Connecticut General Life Insurance Company and the Insurance Company of North America, Cigna provides a wide range of health insurance products and services.

Cigna rose to success with its comprehensive health services, catering to individuals, employers, and government entities. The company’s focus on innovation, such as integrated health solutions and personalized care programs, enhances customer satisfaction. Strategic acquisitions, like Express Scripts in 2018, expanded its capabilities in pharmacy benefits management. This explains the jump in revenues at the time as illustrated in the graph below.

Cigna’s growth continues due to its investment in technology and data analytics, improving care coordination and patient engagement. Its global presence and diverse product range allow it to serve a broad customer base. Emphasis on preventive care and wellness programs aligns with the trend towards value-based care, driving sustainable growth in the healthcare industry.

Cigna is now Sciont’s fifth-largest holding, accounting for about 6.9% of its public-equity holdings.

Final Thoughts

Following the massive triumph he experienced by successfully predicting the subprime mortgage crisis of 2007-2008, Dr. Michael Burry has grown into a living legend in the world of finance. His solemn investing philosophy has resulted in outsized market returns over the past few years, beating the S&P 500 by a wide margin.

While Scion Asset Management’s portfolio lacks diversification, its holdings come with characteristics that reflect Dr. Burry’s principles. Nevertheless, most fund stocks seem to bear their fair share of risks. Thus, be mindful and conduct your own research before allocating your hard-earned money to any of these names.

Additional Resources

See the articles below for analysis on other major investment firms/asset managers/gurus:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: