Spreadsheet data updated daily

Constituents updated annually

For income-oriented investors, creating a passive income stream that varies little from month-to-month can be very difficult.

That’s where Sure Dividend comes in. We maintain databases of dividend stocks categorized by the calendar month of their dividend payment dates.

You can download a comprehensive list of stocks that pay dividends in May at the link below:

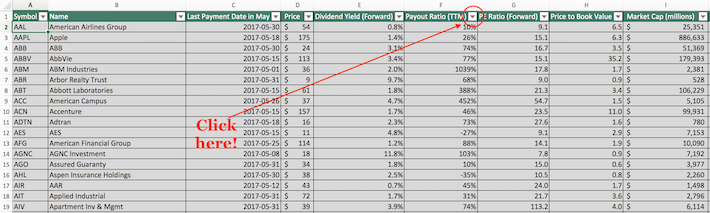

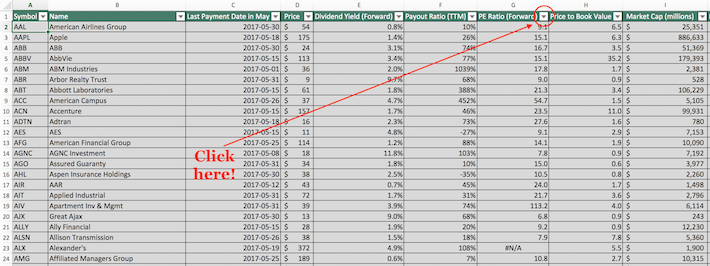

The database of stocks that pay dividends in May available for download at the link above contains the following metrics for each security in the spreadsheet:

- Last dividend payment date in May

- Dividend Yield

- Dividend Payout Ratio

- Price-to-Earnings Ratio

- Price-to-Book Ratio

- Market Capitalization

- Return on Equity

- Beta

Keep reading this article to learn more about how to use the list of stocks that pay dividends in May to find investment ideas.

Note: Constituents for the spreadsheet and table above are from the Wilshire 5000 index, with data provided by Ycharts and updated annually. Securities outside the Wilshire 5000 index are not included in the spreadsheet and table.

How to Use The List of Stocks That Pay Dividends in May to Find Investment Ideas

Having a quantitative document that contains the names, tickers, and financial metrics for every stock that pays dividends in May can be very powerful.

This resource becomes even more useful when combined with knowledge of how to use Microsoft Excel to implement actionable investing screens.

With that in mind, this tutorial will demonstrate how to apply two useful investing screens to the list of stocks that pay dividends in May available for download in this article.

The first screen we’ll implement is for stocks with dividend payout ratios below 100% and dividend yields above 3%.

Screen 1: Dividend Payout Ratio Below 100%, Dividend Yield Above 3%

Step 1: Download your list of stocks that pay dividends in May by clicking here.

Step 2: Click the filter icon at the top of the payout ratio column, as shown below.

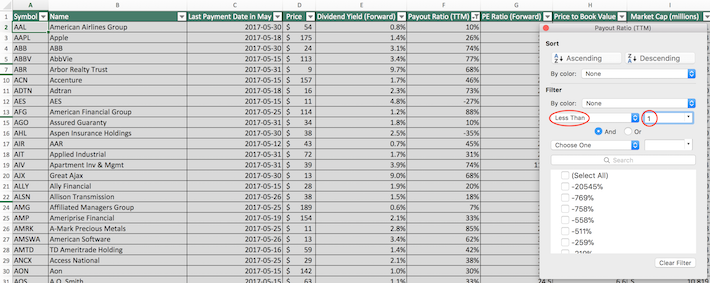

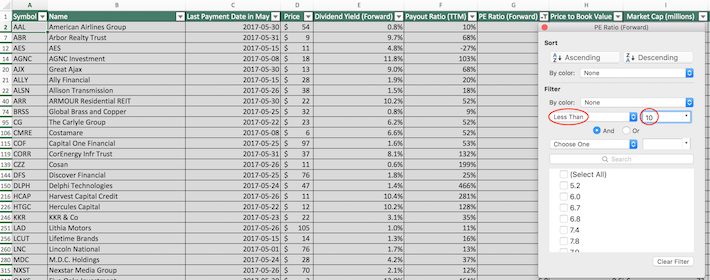

Step 3: Change the filter setting to “Less Than” and input 1 into the field beside it. Note that since payout ratio is measured in percentage points, this is equivalent to filtering for stocks with payout ratios below 100%.

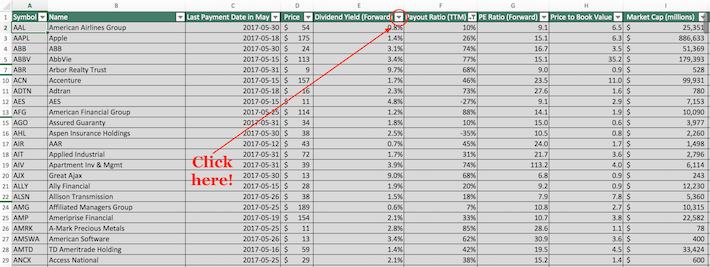

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click the filter icon at the top of the dividend yield column, as shown below.

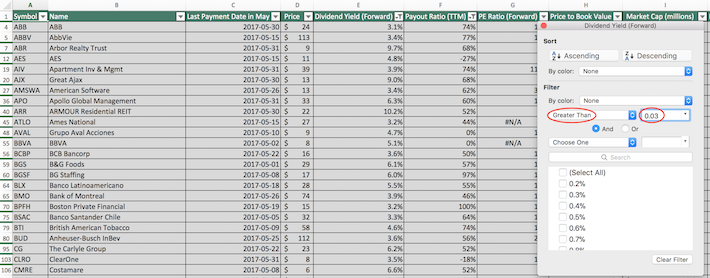

Step 5: Change the filter setting to “Greater Than” and input 0.03 into the field beside it. Note that since dividend yield is measured in percentage points, this is equivalent to filtering for stocks that pay dividends in May with dividend yields above 3%.

The remaining stocks in this spreadsheet are stocks that pay dividends in May with dividend payout ratios below 100% and dividend yields above 3%.

The next screen that we’ll demonstrate how to implement will be appealing to value investors. More specifically, we’ll demonstrate how to apply a screen for stocks with price-to-earnings ratios below 10 and price-to-book ratios below 1.

Screen 2: Price-to-Earnings Ratios Below 10, Price-to-Book Ratios Below 1

Step 1: Download your list of stocks that pay dividends in May by clicking here.

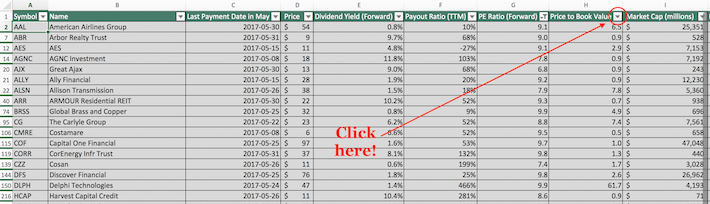

Step 2: Click on the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 3: Change the filter setting to “Less Than” and input 10 into the field beside it, as shown below. This will filter for stocks that pay dividends in May with price-to-earnings ratios below 10.

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Next, click on the filter icon at the top of the price-to-book column, as shown below.

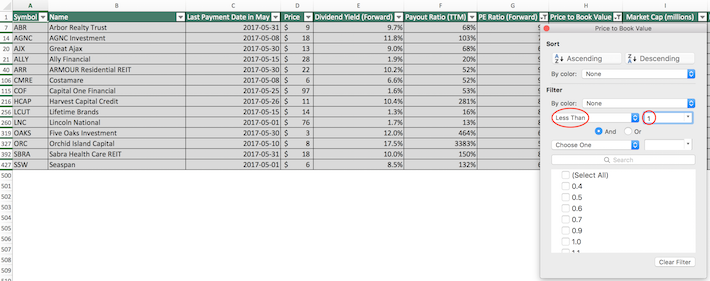

Step 5: Change the filter setting to “Less Than” and input 1 into the field beside it. This will filter for stocks that pay dividends in May with price-to-book ratios below 1.

The remaining stocks in this spreadsheet are stocks that pay dividends in May with price-to-earnings ratios below 10 and price-to-book ratios below 1.

You now have a solid, fundamental understanding of how to use our list of stocks that pay dividends in May to find investment ideas.

To conclude this article, we’d like to refer you to numerous other investing databases that may prove useful on your journey as an investor.

Final Thoughts: Other Useful Investing Databases

We recognize that having databases of stocks categorized by which month they pay dividends can be a very useful resource for income-oriented investors. We maintain databases for every other calendar month, available for access below:

- The Complete List of Stocks That Pay Dividends in January

- The Complete List of Stocks That Pay Dividends in February

- The Complete List of Stocks That Pay Dividends in March

- The Complete List of Stocks That Pay Dividends in April

- The Complete List of Stocks That Pay Dividends in June

- The Complete List of Stocks That Pay Dividends in July

- The Complete List of Stocks That Pay Dividends in August

- The Complete List of Stocks That Pay Dividends in September

- The Complete List of Stocks That Pay Dividends in October

- The Complete List of Stocks That Pay Dividends in November

- The Complete List of Stocks That Pay Dividends in December

Payment date aside, we believe that the best investments are companies that have a tendency to increase their dividend each year. Sure Dividend maintains multiple stock market databases based on this belief. You can access our databases of dividend growth stocks below.

- The Dividend Aristocrats: the Dividend Aristocrats are our flagship database of dividend growth stocks, and are comprised of S&P 500 stocks with 25+ years of consecutive dividend increases. There are currently 68 Dividend Aristocrats.

- The Dividend Champions: the Dividend Champions are a separate group of stocks that have raised their dividends for 25 consecutive years, just without the S&P’s other criteria such as market cap and trading volume requirements.

- The Dividend Achievers: a more broad group of dividend growth stocks, the Dividend Achievers are a group of dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: the Dividend Kings are our most exclusive database of dividend growth stocks. In order to be a Dividend King, a company must have 50+ years of consecutive dividend increases.

You can tell that dividend growth stocks are among our favorite investment opportunities. If you are a retiree or other income-oriented investor, you may also be searching for dividend stocks with particular financial characteristics. If that is the case, you may find the following databases interesting:

- The Complete List of Monthly Dividend Stocks: our database of monthly dividend stocks includes stocks that make 12 dividend payments per year.

- The Best High Dividend Stocks With 5%+ Dividend Yields: our database of high dividend stocks that are especially attractive for investors seeking higher dividend income.

Having sector diversification is an important component of a successful investment strategy. With that in mind, Sure Dividend provides databases for every major sector of the stock market. You can access these databases below.

- The Complete List of Communication Services Stocks

- The Complete List of Technology Stocks

- The Complete List of Utilities Stocks

- The Complete List of Materials Stocks

- The Complete List of Industrial Stocks

- The Complete List of Consumer Discretionary Stocks

- The Complete List of Consumer Staples Stocks

- The Complete List of Healthcare Stocks

- The Complete List of Energy Stocks

- The Complete List of Financial Stocks