Updated on July 8th, 2025 by Nathan Parsh

The Dividend Kings comprise companies that have increased their dividends for at least 50 consecutive years. Over the decades, many of these companies have become huge multinational corporations, but not all.

You can see the full list of all 55 Dividend Kings here.

We compiled a comprehensive list of all Dividend Kings, including key financial metrics such as price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Kings list by clicking on the link below:

Dover Corporation (DOV) has raised its dividend for 69 consecutive years, one of the longest dividend growth streaks in the stock market.

The company has achieved an exceptional record of dividend growth, thanks to its strong business model, decent resilience to recessions, and conservative payout ratio, which provides a wide margin of safety during recessions.

Dover is a time-tested dividend growth company. This article will examine its future prospects in greater detail.

Business Overview

Dover is a diversified global industrial manufacturer that offers its customers a range of products, including equipment and components, consumable supplies, aftermarket parts, software, and digital solutions.

It has annual revenues of just under $8 billion, with approximately half of its revenues generated in the U.S. The company operates in five segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

The past few years have been challenging for Dover, as the coronavirus pandemic led to prolonged business deterioration. As its customers are primarily industrial manufacturers, they were significantly impacted by the global recession caused by the pandemic.

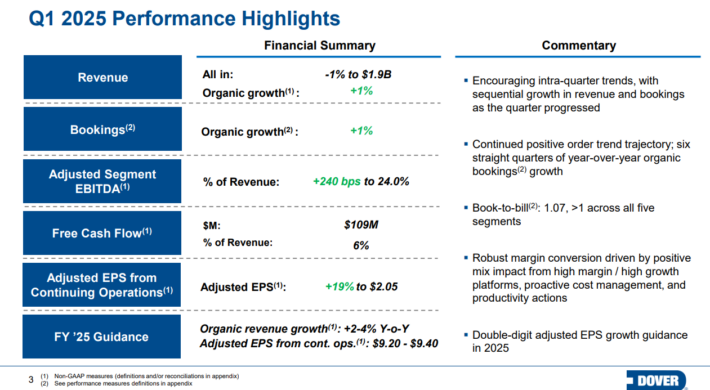

Dover and its customers have rebounded mainly from the pandemic, with the company showing growth more often than not. However, the most recent quarter showed some areas of weakness.

Source: Investor Presentation

Growth Prospects

Dover has pursued growth by expanding its customer base and through bolt-on acquisitions. It routinely executes a series of bolt-on acquisitions, along with occasional divestments, to reshape its portfolio and maximize long-term growth.

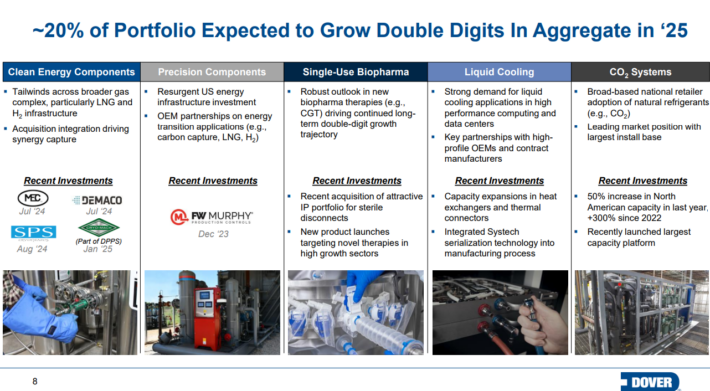

Additionally, the company’s current businesses are expected to contribute to double-digit growth this year. Much of this growth will stem from a high percentage of Dover’s businesses achieving 20% or more growth on a year-over-year basis.

Source: Investor Presentation

The management team is consistently focused on delivering maximum value to shareholders through portfolio transformation, and it has generally been successful. Today, Dover is a highly diversified industrial company with an attractive growth profile.

In addition, Dover is also likely to enhance its earnings per share via opportunistic share repurchases. We expect Dover to generate annual earnings-per-share growth of 8% over the next five years. Growth should be driven primarily by revenue increases, with an additional boost from margin expansion and share repurchases.

Competitive Advantages & Recession Performance

Dover is a manufacturer of industrial equipment, and some investors may think that the company has no moat in its business due to little room for differentiation. However, the company offers highly engineered products, which are critical to its customers. It is also uneconomical for its customers to switch to another supplier, as the risk of lower performance is substantial.

Therefore, Dover essentially operates in niche markets, which offer the company a significant competitive advantage. This competitive advantage helps explain Dover’s consistent long-term growth trajectory.

On the other hand, Dover is vulnerable to recessions due to its reliance on industrial customers. In the Great Recession, its earnings per share were as follows:

- 2007 earnings-per-share of $3.22

- 2008 earnings-per-share of $3.67 (14% increase)

- 2009 earnings-per-share of $2.00 (45% decline)

- 2010 earnings-per-share of $3.48 (74% increase)

Dover survived the Great Recession with just one year of decline in earnings per share, and the company almost fully recovered from the recession in 2010. That performance was certainly impressive. The oil industry’s downturn also impacts Dover during periods of weak oil prices.

To mitigate its exposure to oil prices, Dover spun off its energy division, Apergy, in 2018. This company now trades as ChampionX Corporation (CHX).

Given the impact of recessions and falling oil prices, it is highly impressive that Dover has increased its dividend each year for almost seven decades. One reason for this is the company’s policy of maintaining a payout ratio of around 30%. This policy provides a wide margin of safety during periods of economic uncertainty. The payout ratio is expected to be approximately 22% of earnings per share for 2025, indicating that the dividend is highly secure.

Thanks to its low payout ratio, resilience to recessions, and healthy balance sheet, Dover is likely to continue raising its dividend for many years.

Valuation & Expected Returns

Dover is expected to generate earnings per share of $9.30 for 2025. That means the stock trades for a price-to-earnings ratio of 18.4 times this year’s expected EPS, which is just above the fair value estimate of 18. That implies a -0.4% annual headwind to total returns from valuation compression.

Adding 8% expected annual earnings-per-share growth and the 1.2% dividend yield, total returns are expected to reach 8.5%. This puts Dover stock in the hold rating territory.

Final Thoughts

Dover has a long history of dividend growth, with 69 consecutive years of dividend increases. This is an impressive achievement, particularly given the company’s dependence on industrial customers, who tend to struggle during recessions.

Dover has consistently grown its earnings per share over the years, primarily thanks to a series of bolt-on acquisitions and improvements among its existing business segments. Due to the company’s revenue and earnings growth, the stock has generated strong total returns to shareholders.

That said, Dover stock currently has a hold rating, with projected total returns of 8% or more.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks