Updated on September 8th, 2023 by Aristofanis Papadatos

In 2023, National Fuel Gas (NFG) raised its dividend for the 53rd consecutive year. That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 50 Dividend Kings here.

We have created a full list of all 50 Dividend Kings, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can access the spreadsheet by clicking on the link below:

National Fuel Gas has remained a relatively small company, trading at a market capitalization of $4.8 billion. However, a small market cap is not a negative feature when investing; quite the contrary.

Despite its small size, National Fuel Gas has promising long-term growth prospects and an attractive valuation. In addition, its nearly 10-year high dividend yield of 3.9% is much higher than the broader market yield of 1.5%, and there is room for more dividend raises down the road.

Business Overview

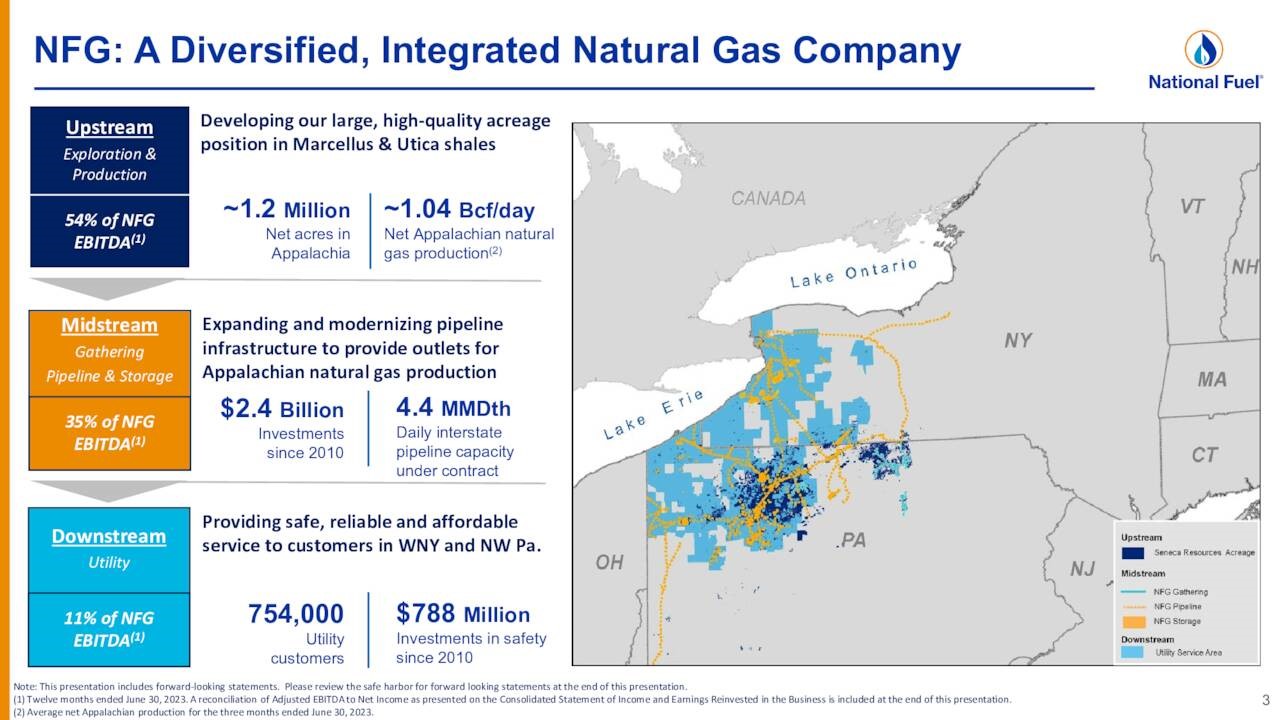

National Fuel Gas is a diversified and vertically integrated company that operates in four segments: Exploration & Production, Pipeline & Storage, Gathering, and Utility. The upstream segment (exploration & production) is by far the most important one, as it generates 54% of the EBITDA of the company.

The midstream division (pipeline & storage and gathering) generates 35% of EBITDA, while the downstream segment (utility) generates the remaining 11% of EBITDA.

While National Fuel Gas seems to be a pure commodity stock on the surface, with all the disadvantages related to the boom-and-bust cycles of commodity producers, the company has a superior business model compared to commodity producers. Thanks to its vertically integrated business model, it enjoys significant synergies.

Source: Investor Presentation

Its midstream and downstream businesses provide a strong buffer when natural gas prices decrease. Moreover, the company enjoys higher returns on its investments, as both its upstream and midstream divisions benefit from its investments in production growth projects.

On August 2nd, 2023, National Fuel Gas reported financial results for the third quarter of fiscal 2023. The company grew its production 7% over the prior year’s quarter thanks to the development of some of its core acreage positions in Appalachia.

However, the price of natural gas decreased while the company also incurred increased operating costs. As a result, adjusted earnings-per-share declined 34%, from $1.54 to $1.01, though they exceeded the analysts’ consensus by $0.09. The company has beaten the analysts’ estimates in 15 of the last 17 quarters.

The price of natural gas has bounced lately but it is still near its 2-year lows, primarily due to an abnormally warm winter weather, which has resulted in high inventories. In addition, the global gas market has somewhat absorbed the impact of the sanctions of western countries on Russia for its invasion in Ukraine.

According to the latest report of the Energy Information Administration (EIA), the U.S. natural gas inventories are currently standing 12% above their 5-year average and 22% above their level a year ago, mostly due to excessive output from producers and poor demand due to an abnormally warm winter in both the U.S. and Europe.

Growth Prospects

National Fuel Gas pursues growth by increasing its natural gas production and expanding its pipeline network. The company has grown its earnings-per-share at an average annual rate of 7.2% since 2013. This is fairly improved over returns from years earlier thanks to the multi-year high price of natural gas and the company’s record production in 2022.

And the company has promising growth prospects ahead.

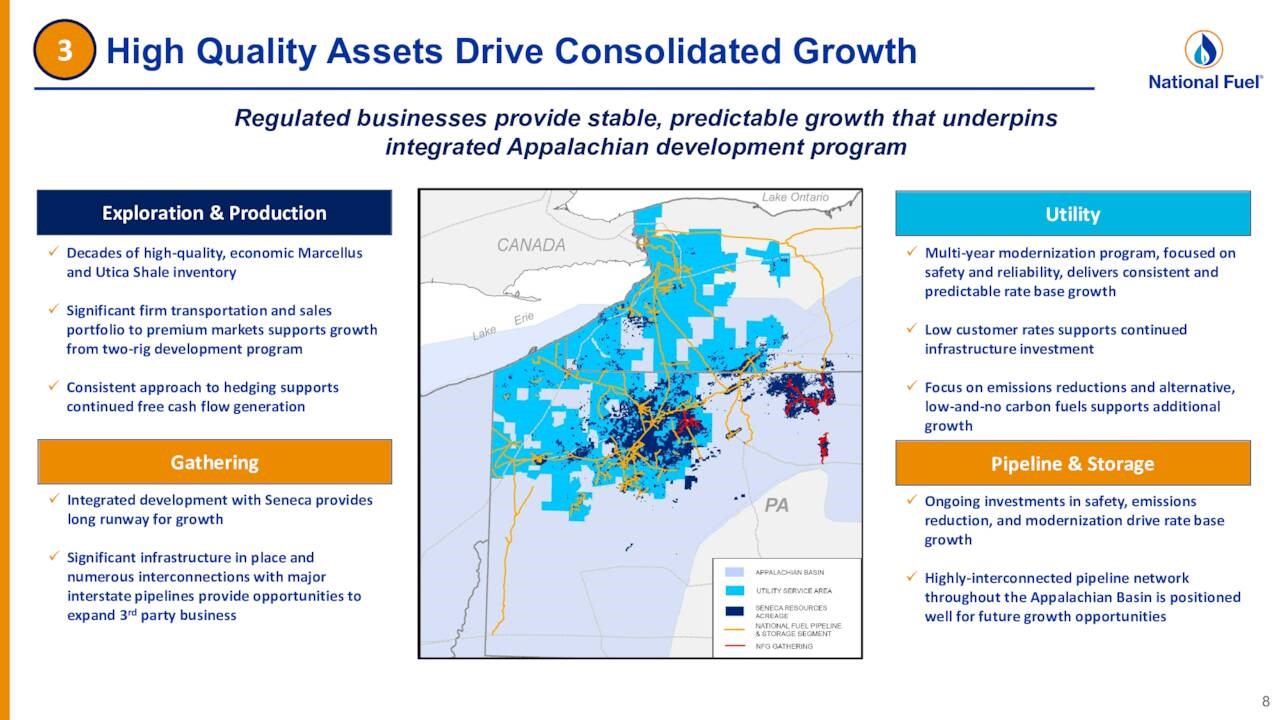

Source: Investor Presentation

Given the lackluster short-term outlook for natural gas prices, National Fuel Gas slightly lowered its guidance for its earnings-per-share in fiscal 2023 for a third consecutive quarter, from $5.10-$5.40 to $5.15-$5.25.

However, the company still has promising growth prospects in the long run, especially given that natural gas is considered a much cleaner fuel than oil products and hence it is much more resilient to the ongoing boom of renewable energy projects than oil products.

Overall, we expect National Fuel Gas to grow its earnings per share by about 2.0% per year on average over the next five years, given the sustained production growth of the company but also the high cyclicality of the price of natural gas.

Competitive Advantages & Recession Performance

As mentioned above, the upstream segment generates over 50% of its total EBITDA, with natural gas comprising roughly 90% of the total output. It is evident that the company is highly sensitive to the price of natural gas. This sensitivity was apparent in 2015 and 2016 when the price of natural gas collapsed, and the company posted hefty losses.

It has also been apparent in the trailing twelve months, as NFG has underperformed the broader market by a wide margin (-27% vs. +14% of the S&P 500), primarily due to lower natural gas prices.

On the other hand, thanks to its vertically integrated business model, National Fuel Gas is more resilient to downturns than most oil and gas producers, as its midstream and utility businesses provide a strong buffer during downturns.

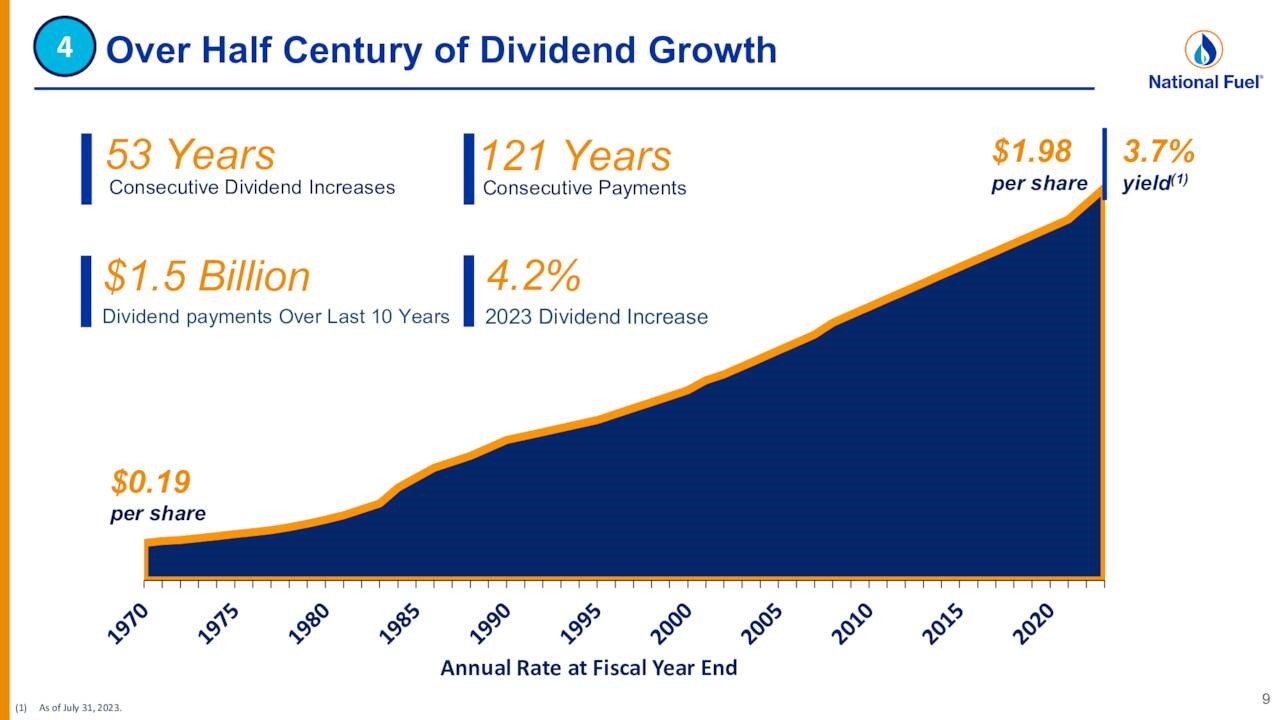

The superior business model of National Fuel Gas helps explain its admirable dividend growth record. The company has paid uninterrupted dividends for 121 consecutive years and has raised its dividend for 53 consecutive years. This is an impressive achievement for a commodity producer, as commodities are infamous for their high cyclicality, which results in dramatic boom-and-bust cycles.

Source: Investor Presentation

Given the healthy payout ratio of 38% (based on expected 2023 adjusted EPS) and the decent balance sheet of the company, the dividend can be considered safe for the foreseeable future. We expect National Fuel Gas to continue raising its dividend for many more years.

Valuation & Expected Returns

National Fuel Gas is currently trading at 9.9 times its expected earnings of $5.20 per share this year. This earnings multiple is much lower than the average price-to-earnings ratio of 13.1 over the last five years. Our fair value estimate for NFG stock is a P/E of 13.1. If the P/E multiple expands from 9.9 to 13.1 by 2028, it will lift annual returns by 5.8% per year over the next five years.

Given the 2% estimated annual growth of earnings-per-share, the 3.9% dividend, and a 5.8% annualized expansion of the price-to-earnings ratio, we expect National Fuel Gas to offer a 10.8% average annual return over the next five years. This makes the stock a marginal buy in our view.

Final Thoughts

National Fuel Gas is highly sensitive to the gyrations of the price of natural gas. On the other hand, its midstream and utility segments provide a strong support to its financial results during downturns.

Overall, the midstream and utility segments provide reliable cash flows, while the upstream segment offers long-term growth potential thanks to strong production growth.

In addition, National Fuel Gas stock is undervalued right now. Given an expected 2% growth of earnings over the intermediate term, its 3.9% dividend, and its cheap valuation, we view the stock as a marginal buy here.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks