Updated on July 15th, 2025 by Nathan Parsh

The Dividend Kings are widely known as a group of dividend growth stocks to buy and hold for the long term.

These companies have consistently generated substantial profits year after year, even during recessions, and have demonstrated their ability to grow earnings steadily over many years. The Dividend Kings are a group of companies that have achieved 50 or more consecutive years of dividend increases.

You can see all 55 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus metrics that matter, such as price-to-earnings ratios and dividend yields) by clicking the link below:

Up next in our annual Dividend Kings In Focus series is consumer products behemoth Procter & Gamble (PG), which has paid dividends for 134 years and grown its dividend for 69 consecutive years.

Procter & Gamble is one of the best-known dividend stocks, largely due to its extensive dividend history and widely recognized brands.

Years ago, P&G undertook a major overhaul of its product portfolio, including a significant divestment of brands deemed no longer necessary.

This article will discuss P&G’s portfolio transformation, future growth prospects, and stock valuation.

Business Overview

Procter & Gamble is a consumer products giant that sells its products in more than 180 countries, generating roughly $84 billion in annual sales. Its core brands include Gillette, Tide, Charmin, Crest, Pampers, Febreze, Head & Shoulders, Bounty, Oral-B, and many more.

During P&G’s massive portfolio restructuring over the past few years, the company sold off dozens of its consumer brands.

Asset sales in recent years include battery brand Duracell to Berkshire Hathaway (BRK-A) (BRK-B) for $4.7 billion and a collection of 43 beauty brands to Coty (COTY) for $12.5 billion.

Today, P&G has slimmed down to just 65 brands, from 170 previously. And these brands have been gaining global market share at a healthy rate over the past few years.

Source: Investor Presentation

The company operates in five reporting segments based on the following product categories:

- Fabric & Home Care

- Baby, Feminine, & Family Care

- Beauty

- Health Care

- Grooming

Growth Prospects

Following P&G’s restructuring, the company is now a more agile and flexible organization with improved growth prospects. While P&G divested low-margin businesses with limited growth potential, it retained its core consumer brands, including Tide, Charmin, Pampers, Gillette, and Crest, which have strong growth potential.

In addition, P&G received billions of dollars from its numerous asset sales and spent a portion of the proceeds on share repurchases. These share repurchases have contributed to the growth of earnings per share over time.

Margin expansion is a significant component of P&G’s earnings growth strategy. P&G’s cost-cutting efforts have enhanced its operating margins and after-tax profit margins. Thanks to its strong brands, P&G can raise prices even in an inflationary environment. It has thus implemented multiple price hikes over the last two years, offsetting the adverse effect of cost inflation on its margins.

As part of the restructuring, P&G launched a massive cost-cutting effort. Through headcount reduction and lower SG&A expenses, it cut costs by $10 billion throughout the reorganization.

At the same time, the focus on premier brands with pricing power has resulted in consistent sales growth:

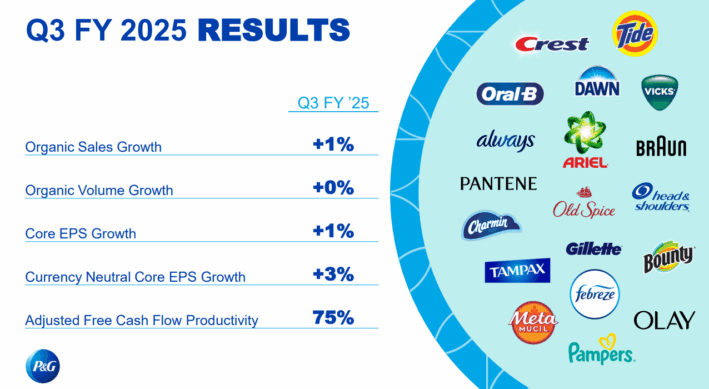

Source: Investor Presentation

The company reported its fiscal year 2025 third-quarter results on April 24th, 2025, showing net sales of $19.8 billion, a 2.1% decline from the previous year. However, organic sales, which exclude the impact of foreign exchange and acquisitions, increased by 1%, driven by higher prices. Core earnings-per-share (EPS) improved 1% to $1.54, operating cash flow stood at $3.7 billion, and the company returned $3.8 billion to shareholders through dividends and share repurchases.

We are forecasting 5% annual earnings-per-share growth over the next five years.

Competitive Advantages & Recession Performance

P&G has several competitive advantages. The first is its strong brand portfolio, which includes several brands with annual sales exceeding $1 billion.

These and other core brands also hold leadership positions in their respective categories. These products are associated with high quality, and hence, consumers are willing to pay a premium for them.

The company invests heavily in advertising to retain its competitive position, which it can do thanks to its financial strength. It also invests heavily in research and development. This investment is a competitive advantage for P&G; R&D fuels product innovation, while advertising helps market new products and gain share.

P&G’s competitive advantages allow the company to remain profitable even during periods of recession. Earnings held up remarkably well during the Great Recession:

- 2007 earnings-per-share of $3.04

- 2008 earnings-per-share of $3.64 (19.7% increase)

- 2009 earnings-per-share of $3.58 (-1.6% decline)

- 2010 earnings-per-share of $3.53 (-1.4% decline)

As is evident from the above, P&G had a robust year in 2008, with nearly 20% earnings growth. Earnings dipped only mildly in the following two years. This was a strong performance during one of the worst economic downturns in recent decades.

P&G also performed very well in 2020, as consumers continued to need personal care and household products during the coronavirus pandemic. The consumer products giant grew its earnings per share by 13% in 2020 to a new all-time high, and it has continued to increase since then.

Overall, P&G’s business model is resilient to economic downturns. Everyone needs paper towels, toothpaste, razors, and other P&G products, regardless of the economic climate.

Valuation & Expected Returns

Based on our expectation of earnings per share of $6.77 for fiscal 2025, P&G is currently trading at a forward price-to-earnings ratio of 22.7.

Our fair value estimate for P&G is a price-to-earnings ratio of 20. As such, shares appear overvalued. If the price-to-earnings ratio of P&G reverts to 20.0 over the next five years, the stock will incur a -2.5% annualized valuation headwind.

Earnings growth and dividends will help offset the impact of a contracting price-to-earnings multiple. For example, we expect P&G to generate 5.0% annual earnings growth each year, and the stock currently offers a dividend yield of 2.7%. Given all these figures, the stock has a total return potential of 5.0% per year over the next five years.

That said, P&G remains an attractive option for dividend growth investors. The current dividend payout is well-covered by earnings, as evidenced by a healthy payout ratio of 62%. Consequently, the dividend has ample room to continue growing.

Investors should expect P&G to continue raising its dividend yearly for many years. It possesses the brand strength, competitive advantages, and profitability necessary to sustain steady annual dividend increases over the long term.

Final Thoughts

P&G has many strong qualities that make it a time-tested dividend growth company. Thanks to a significant reshuffling of its brand portfolio years ago, P&G positioned itself to capitalize on global growth opportunities.

P&G has a long history of rewarding shareholders with dividends. Because of its long history of annual dividend hikes, P&G has earned a place on our list of “blue chip” stocks (you can see the complete list of blue chip stocks here).

However, the current valuation leaves something to be desired from a value perspective. While we remain enthused about the ongoing growth of the business, we do not find shares to be attractive enough to buy at this time.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks