Updated on October 22nd, 2024 by Felix Martinez

ABM Industries (ABM) has an amazing track record of paying dividends to shareholders. The company is part of the Dividend Kings, a group of stocks that have raised their payouts for at least 50 consecutive years. You can see all 53 Dividend Kings here.

We created a full list of all 53 Dividend Kings and important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios. You can download the full list by clicking on the link below:

Dividend Kings are the best when it comes to rewarding shareholders with cash returns. This article will discuss ABM’s dividend safety, valuation, and outlook.

Business Overview

ABM was founded in 1909 and has grown into an industry powerhouse. ABM Industries is a leading provider of facility solutions, including janitorial, electrical and lighting, energy solutions, facilities engineering, HVAC and mechanical, landscape and turf, and parking. The company produces $8.1 billion in annual revenue and has a market cap of $3.4 billion.

ABM has a long and impressive client list that includes hospitals, universities, public schools, data centers, manufacturing plants, and airports. The company’s expertise and many decades of experience in facility management have earned it a terrific reputation, making it a true industry leader.

ABM’s strategy is to compete in industries where it can win rather than competing everywhere. Over the decades, ABM has learned where it can compete successfully and where it cannot and has focused its efforts accordingly.

In 2007, ABM’s annual revenue was about $3 billion, but it has nearly tripled since then, currently standing at nearly $8.1 billion. ABM has grown organically in part, but the vast majority of its growth has been acquisition. Given ABM’s strategic direction in terms of future cash usage, we can expect more acquisitions as the years go on.

ABM also has an exceptional dividend growth record. The company has paid more than 223 quarterly dividends and increased its dividend for 55 consecutive years.

Source: Investor Presentation

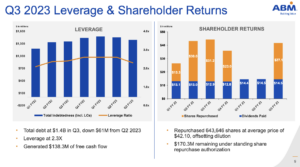

Given the remarkably low payout ratio of ~25% projected for 2023, its long-term growth prospects, and its resilience to recessions, ABM is likely to keep raising its dividend for many years to come. In addition, the company has bought back nearly six hundred thousand shares in recent quarters, helping to drive higher earnings-per-share. This is a change from prior behavior, where capital returns were almost exclusively through cash dividends.

One source of potential earnings growth going forward is international expansion, as ABM entered the U.K. market with the GBM and Westway acquisitions in the past few years. Going forward, continue looking for lots of transactions from ABM in terms of acquisitions and divestitures as it shifts its mix around further.

ABM is split into six segments that provide its customers a wide array of facility solutions: Business & Industry, Education, Aviation, Technology & Manufacturing, Healthcare, and Technical Solutions. The company’s revenue streams are highly diversified, with janitorial services comprising ABM’s biggest single piece of the pie.

Growth Prospects

As we saw above, ABM’s stated strategy is to grow by acquisition. However, that’s not to say that it is ignoring its ability to grow organically. When it has free cash flow to spend, it looks first at organic growth. The company has deep expertise and a great reputation here in the US for facilities management and looks to exploit that where possible. That means going after national accounts first, where it can gain a significant amount of business all at once as well as centralizing support services to improve margins.

ABM also specifically calls out acquisitions in its strategy, although it is behind organic investments and the dividends. Still, ABM’s recent history suggests that acquisitions are a very important part of its overall strategy and thus, we can expect ABM will continue to grow via acquisitions as well as organically.

ABM is still extremely focused on the US market, which presents potential opportunities for further international expansion. ABM could use its significant expertise in facilities management to gain access to global clients worldwide. The moves into the U.K. in recent years prove ABM is willing to take a chance; this may be the most significant growth avenue ABM has going forward.

Source: Investor presentation

The company released its third-quarter earnings on September 6, reporting revenues of $2.1 billion, a 3% increase compared to the same period last year, surpassing estimates. This marks an improvement from the previous quarter, where revenue was flat year-over-year. The company maintained its strong margins, with EBITDA rising 2%, nearly matching the revenue growth.

Earnings per share (EPS) for the quarter came in at $0.94, beating analyst expectations by $0.09 and reflecting a 19% increase from last year’s adjusted EPS. ABM also raised its full-year 2024 guidance, now expecting adjusted EPS between $3.48 and $3.55, a slight 0.5% increase from fiscal 2023. However, earnings are projected to stay below the record levels of 2022.

Overall, ABM’s growth is likely to be moderate as the economy normalizes. We expect 5% annual earnings-per-share growth over the next five years.

Competitive Advantages & Recession Performance

ABM’s competitive advantage is its size and the resultant economies of scale it enjoys. It has a 100+ year history of providing facility solutions for a wide array of customers, and that expertise is what sets ABM apart. It is a true industry leader in the facilities management space, and that affords it not only the ability to more easily attract new clients, but also to expand relationships with the ones it already has.

In addition, since ABM operates in low-margin businesses, smaller competitors are at a disadvantage in terms of leveraging down back office and support costs. ABM may be in some competitive lines of work, but it is certainly better positioned than its competitors to overcome some of those obstacles.

ABM Industries is one of the biggest companies in its industry, and its history of making acquisitions has enhanced its scale advantages further. ABM Industries will likely continue to make acquisitions to increase its size further.

Recessions are painful for ABM just like any other company, but its performance during the Great Recession was remarkable. ABM’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.99

- 2008 earnings-per-share of $1.10 (11% increase)

- 2009 earnings-per-share of $1.33 (21% increase)

- 2010 earnings-per-share of $1.34 (0.7% increase)

Impressively, ABM grew earnings-per-share each year during the Great Recession. Very few companies were able to accomplish this. Moreover, ABM has once again proved its resilience in the coronavirus pandemic.

Thanks to an increase in high-margin work orders from resilient customers, ABM has easily offset the effect of the pandemic on its customers in the aviation industry and education. As a result, it is poised to grow its earnings per share to an all-time high level this year.

Overall, ABM enjoys thin operating margins and lackluster growth rates during normal economic times but is exceptionally resilient during rough economic periods.

This resilience is very important, as it supports the stock’s long-term returns and makes it easier for the shareholders to retain the stock during broad market sell-offs.

Valuation & Expected Returns

ABM is expected to generate earnings-per-share of $3.52 in its fiscal 2024. As a result, the stock is currently trading at a price-to-earnings ratio of just 15.2. This is significantly lower than the average price-to-earnings ratio of ~17.5 for the stock in the past 10 years. We consider 15 times earnings to be a reasonable estimate of fair value for this stock.

The stock is as cheap as it has been at any point in the past decade. If the stock trades at our assumed fair valuation level in five years, thanks to the expansion of its earnings multiple, it will generate 1.2% annualized returns.

Moreover, the stock offers a 1.7% dividend yield. This yield is somewhat higher than the S&P 500’s, but it is still relatively low.

In addition, recent dividend raises have been very small, with typical increases in the 2% or 3% range. While ABM has an impressive history of paying dividends, it lacks a high current yield and dividend growth rate.

Lastly, we expect annual EPS growth of 5.0% over the next five years. Combined with a 1.7% dividend and a 1.2% annualized expansion of the price-to-earnings ratio, total annual returns could approach 7.9% per year.

Final Thoughts

ABM is certainly not a high-yield income or a high dividend growth stock. But what it lacks in excitement, it makes up for with consistency. ABM’s long and impressive history of paying a dividend should be respected, as the Dividend Kings are rare in comparison to the thousands of publicly traded stocks in the market.

ABM’s organic growth is intact, and acquisitions add to growth. Growth from here depends upon potential international expansion as well as continued margin gains. In addition, the company has a relatively new tailwind of share repurchases.

With a very cheap valuation and reasonable growth ahead, total annual returns could be strong at 7.9% annually through the next five years. ABM is o hold due to its low expected return and long history of dividend increases.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks