Updated on July 7th, 2025 by Felix Martinez

We believe that long-term investors should focus on the highest-quality dividend-growth stocks. These are companies with long histories of raising their dividends, and durable competitive advantages to fuel continued dividend growth.

Therefore, we tend to steer investors toward the Dividend Kings, a group of just 55 stocks that have maintained at least 50 years of consecutive dividend increases.

You can also download an Excel spreadsheet with the full list of all 55 Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

We review each of the Dividend Kings every year. The following stock to be reviewed in this year’s edition is AbbVie (ABBV).

There are questions regarding AbbVie’s future growth, as its flagship drug, Humira, is facing patent expiration. However, the company has a plan to continue growing in the years ahead.

Business Overview

AbbVie is a global pharmaceutical giant. It began trading as an independent company in 2013, having been spun off from Abbott Laboratories (ABT). Since the spin-off, AbbVie has generated strong growth. According to AbbVie, revenue and adjusted EPS growth increased by 9% and 12.1%, respectively, each year from 2013 to 2024.

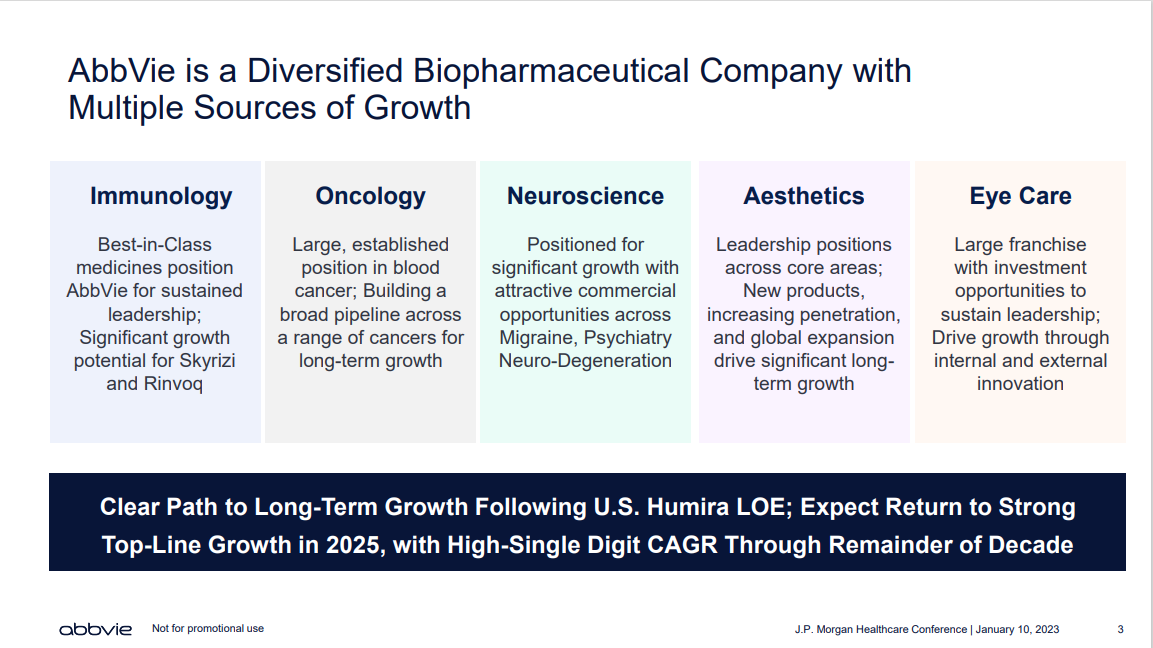

Today, AbbVie focuses on a single main business segment: pharmaceuticals. It focuses on several key treatment areas, including immunology, hematologic oncology, neuroscience, and others.

Source: Investor Presentation

Since the spin-off from Abbott, AbbVie has experienced excellent growth, primarily driven by Humira, a multi-purpose drug. The challenge for AbbVie is that Humira is now facing biosimilar competition after it has lost patent exclusivity.

Even so, AbbVie remains a giant in the healthcare sector, with an extensive and diversified product portfolio.

Growth Prospects

The significant risk for global pharmaceutical manufacturers is the loss of patent protection. When a particular drug loses patent, the market is typically flooded with competition, especially for the world’s top-selling products.

AbbVie’s biggest risk is the impending competition to its flagship drug, Humira. This multi-purpose drug is used to treat a variety of conditions, including rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, and more.

Humira once generated over half of AbbVie’s annual sales. Loss of patent exclusivity is a significant overhang; as a result, AbbVie’s total sales declined in 2023. At the same time, AbbVie also expects to return to sales growth in 2025, with high single-digit annual growth through the end of the decade.

Fortunately, the company prepared for the loss of patent exclusivity on Humira by investing heavily in new products and acquisitions to boost its growth. For example, Rinvoq and Skyrizi are two key products that represent long-term growth catalysts.

Source: Investor Presentation

AbbVie also completed the $63 billion acquisition of Allergan. Allergan’s flagship product is Botox, which diversifies AbbVie’s portfolio by exposing it to the global aesthetics market.

We expect AbbVie to achieve 5% EPS growth over the next five years. We believe the growth outlook will improve once the Humira overhang is resolved, but there is uncertainty surrounding AbbVie’s ability to offset this with new products.

Competitive Advantages & Recession Performance

The most critical competitive advantage for AbbVie and any pharmaceutical company is its patent portfolio. Pharmaceutical giants must invest heavily in developing new drugs and therapies when one of their blockbusters loses patent protection.

AbbVie has over 60 clinical programs. It has multiple growth opportunities to replace Humira, particularly in the therapeutic areas of immunology, hematology, and neuroscience. The result of its significant investment in R&D is a well-stocked pipeline.

AbbVie was not a standalone company during the last financial crisis, so it does not have a recession track record. However, since sick people require treatment regardless of the economy’s strength, it is highly likely that AbbVie would continue to perform well during a recession.

AbbVie’s earnings are likely to decline somewhat during a recession, but the dividend is expected to remain secure. AbbVie has a projected dividend payout ratio of ~54% for 2025.

Valuation & Expected Returns

AbbVie is expected to generate adjusted EPS of $12.19 for 2025 at the midpoint of guidance. At this EPS level, the stock currently has a price-to-earnings ratio of 15.4.

Our fair value estimate for AbbVie is a price-to-earnings ratio of 13, indicating that the stock is currently overvalued. A declining P/E multiple could reduce shareholder returns by approximately 3.2% per year over the next 5 years.

Additionally, we anticipate annual earnings growth of 5% through 2029.

Lastly, the stock has a current dividend yield of 3.5%. Given these inputs, we expect annual returns of 5.2% per year over the next five years, making AbbVie stock a hold.

Final Thoughts

AbbVie is a high-quality business, boasting a strong pharmaceutical pipeline and significant growth potential. It is also a shareholder-friendly company that returns excess cash flow to investors through stock buybacks and dividends.

AbbVie faces a significant challenge in replacing lost Humira sales, as it competes with other companies in the U.S. and Europe. This is why we have fairly low assumptions for the company’s future EPS growth and fair value P/E multiple.

Still, the company has built an extensive portfolio of new products that should help maintain its growth. AbbVie will also be able to generate additional growth from the acquisition of Allergan.

However, the expected returns make the stock a hold.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks