Updated on May 11th, 2023 by Aristofanis Papadatos

Uranium plays a pivotal role in producing nuclear power. As a result, investors looking to capitalize on the long-term growth potential of nuclear energy might be interested in learning more about uranium stocks.

Uranium stocks are highly risky–most have low market caps, below $1 billion, and only a few pay dividends to shareholders.

However, like many commodities sectors, uranium stocks could provide attractive long-term growth, as demand for nuclear power rises around the world.

With this in mind, we created a list of 40 uranium stocks. You can download a copy of the uranium stocks list (along with important financial metrics such as dividend yields and P/E ratios) by clicking on the link below:

This article will give an overview of the uranium industry, and the top 7 uranium stocks now.

Table of Contents

You can instantly jump to a specific section of the article by clicking on the links below:

- Industry Overview

- Uranium Stock #7: Uranium Royalty (UROY)

- Uranium Stock #6: Ur-Energy (URG)

- Uranium Stock #5: Energy Fuels (UUUU)

- Uranium Stock #4: Uranium Energy (UEC)

- Uranium Stock #3: NexGen Energy (NXE)

- Uranium Stock #2: Cameco Corp. (CCJ)

- Uranium Stock #1: BHP Group (BHP)

- Final Thoughts

Industry Overview

Uranium was discovered in 1789. It is a metallic chemical element, primarily found naturally in soil, rock and water. In the mid-20th century, uranium was found to have potential use as an energy source.

Today, uranium’s primary industrial application is to power commercial nuclear reactors that produce electricity. Uranium is also used to produce isotopes for medical, industrial, and defense.

Until a few years ago, most countries were trying to shift from nuclear energy to other clean energy sources, such as wind and solar energy, in order to eliminate the risk of a nuclear accident. There were good reasons behind the extremely negative sentiment that was prevailing about uranium. The nuclear accidents at Chernobyl (Russia) in 1986 and Fukushima (Japan) in 2011 caused millions of deaths and devastating pollution to the environment (soil) in these areas.

However, due to the Ukrainian crisis, the prices of oil and natural gas skyrocketed to 13-year highs last year. Consequently, millions of households around the world struggled to pay for their energy bills and thus a severe global energy crisis showed up. In response to that crisis, most countries are now doing their best to shift away from fossil fuels. Most of them are investing heavily in solar and wind power but the energy crisis has improved the sentiment about uranium as well.

In 2021, the total global production volume of uranium from mines was 48,332 metric tons. This compares with global production of 54,742 metric tons in 2019.

Kazakhstan is the largest uranium producer in the world, with a production volume of 21,819 metric tons in 2021. This output was down from approximately 22,808 metric tons in 2019.

By contrast, the U.S. produces very little uranium. According to Statista, U.S. uranium production totaled just eight metric tons in 2021. In 2012, production was 1,596 metric tons of uranium in the U.S.

However, the U.S. is the largest consumer of uranium, as nuclear energy use is widespread. In 2020, the U.S. consumed about 18,300 metric tons of uranium, nearly twice as much as the next-highest consumer. After the U.S., the largest consumers of uranium are China and France, with annual consumption of 10,800 and 8,700 metric tons, respectively.

Uranium does not trade on an open market like other commodities. Instead, buyers and sellers negotiate contracts privately. Prices are published by independent market consultants. Recent publications show the price of uranium around $53/pound.

The price of uranium has more than doubled over the past five years, from about $21 per pound to $53.4 per pound, partly due to geopolitical issues at Kazakhstan, which is the top global producer, and Russia. The rally of the price of uranium signifies the potential investment case for buying uranium stocks.

It is also important to note that the price of uranium is still well below its peak of about $70 per pound, which was recorded just before the accident in Japan, in 2011. Since then, the price of uranium has not approached that level but the positive fundamentals of supply and demand signal that there may be significant upside potential in the upcoming years.

Indeed, the growth potential of uranium stocks is clear. First, roughly one-third of the global population lives in “energy poverty”, meaning lack of access to reliable electricity. Next, the world faces the challenge of climate change, making thermal replacement a strategic priority for many developed nations. Electrification of multiple industries that previously relied on coal for energy is a major task.

Not surprisingly, global demand for electricity is expected to rise by 75% from 2020 to 2050, according to the 2021 IEA World Energy Outlook.

This is where uranium stocks come in. The following section will discuss the top 7 uranium stocks today.

Uranium Stock #7: Uranium Royalty (UROY)

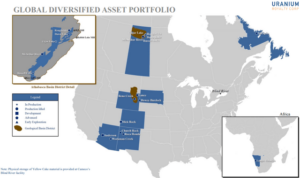

Uranium Royalty was incorporated in 2017 and is headquartered in Vancouver, Canada. It operates as a pure-play uranium royalty company. It acquires, accumulates, and manages a portfolio of geographically diversified uranium interests.

Uranium Royalty has royalty interests in Canada, Arizona, Wyoming, New Mexico, South Dakota and Colorado as well as a project in Namibia.

Source: Investor Presentation

The geographical diversification of Uranium Royalty may lead some investors to think that the company is somewhat resilient to the cycles of its business. However, this is far from true. The company has posted operating losses every year since its formation. It also has a small market capitalization, which currently stands at $204 million and increases the risk of the stock even further.

Due to the losses and the high risk of Uranium Royalty, its stock price is markedly volatile. Even worse, while uranium prices have gained 4% over the last 12 months, the stock has slumped 30% during this period.

On the bright side, Uranium Royalty has a pristine, debt-free balance sheet. It can thus endure periods of adverse business conditions and wait patiently for a rally of uranium prices. Nevertheless, the stock is highly speculative and suitable only for the investors who have great conviction in higher uranium prices in the near future.

Uranium Stock #6: Ur-Energy (URG)

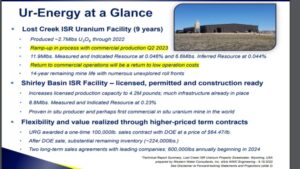

Ur-Energy engages in the acquisition, exploration, development, and operation of uranium mineral properties. The company holds interests in 12 projects located in the U.S. Its flagship property is the Lost Creek project, which comprises a total of approximately 1,800 unpatented mining claims and three Wyoming mineral leases that cover an area of approximately 48,000 acres located in the Great Divide Basin, Wyoming. Ur-Energy, which has a market capitalization of only $260 million, was founded in 2004 and is headquartered in Littleton, Colorado.

The Lost Creek project, which is the flagship project of the company, has been in operation for the past 10 years and has produced approximately 2.7 million tons of uranium throughout this period. Unfortunately, its production slumped close to zero in recent years due to low uranium prices.

Source: Investor Presentation

However, thanks to a rally of uranium prices, Ur-Energy has begun to ramp up its production. Moreover, the company estimates a 14-year remaining mine life, without taking into account the numerous unexplored roll fronts.

On the other hand, investors should be aware of the high risk of this small-cap stock. About three months ago, the company announced a secondary offering, which triggered a plunge of the stock to a nearly 2-year low level.

It is also worth noting that the stock has underperformed the S&P 500 by a wide margin over the last decade, as it has gained only 9%, whereas the index has rallied 146%. Overall, Ur-Energy is extremely sensitive to the price of uranium. It is thus a high-risk (at low uranium prices), high-reward (at high uranium prices) bet on uranium prices.

Uranium Stock #5: Energy Fuels (UUUU)

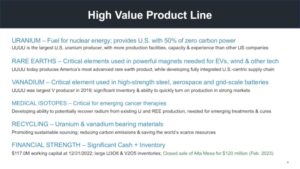

Energy Fuels engages in the extraction, recovery, exploration, and sale of conventional and in situ uranium recovery in the U.S. The company owns and operates the Nichols Ranch project, the Jane Dough property, and the Hank project located in Wyoming; and the Alta Mesa project located in Texas, as well as White Mesa Mill in Utah. It also holds interests in uranium and uranium/vanadium properties and projects in various stages of exploration, permitting, and evaluation. The company was formerly known as Volcanic Metals Exploration and changed its name to Energy Fuels in 2006.

Energy Fuels has a high-value product line, which includes uranium, rare earths, vanadium and other products.

Source: Investor Presentation

These products are used in numerous applications and enjoy secular growth of demand. Nevertheless, the core product of Energy Fuels is uranium. This helps explain the ticker of the stock.

Just like most uranium companies, Energy Fuels has incurred operating losses in every single year over the last decade, primarily due to low uranium prices. However, thanks to the rally of uranium prices, the company is expected to narrow its losses per share from -$0.38 to -$0.16 this year and become profitable next year.

Moreover, Energy Fuels has an exceptionally strong balance sheet, without any debt and a net cash position of $90 million. As this amount of cash is 9% of the market capitalization of the stock, it is evident that the company has a rock-solid balance sheet. On the other hand, income-oriented investors should be aware that Energy Fuels is far from initiating a dividend, primarily due to the volatile nature of its business.

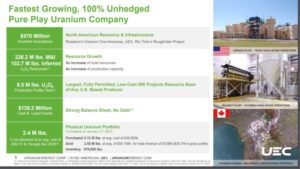

Uranium Stock #4: Uranium Energy (UEC)

Uranium Energy engages in the exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates in the U.S., Canada, and Paraguay. The company was formerly known as Carlin Gold and changed its name to Uranium Energy in early 2005. Uranium Energy was incorporated in 2003 and is based in Corpus Christi, Texas.

Uranium Energy has focused its property acquisition program primarily in the southwestern U.S. states of Texas, Wyoming, New Mexico, Arizona and Colorado. This region has historically been the most concentrated area for uranium mining in the U.S. With the use of historical exploration databases, Uranium Energy has been able to target properties for acquisition that have already been the subject of significant exploration and development by senior energy companies in the past.

Uranium Energy does not hedge its production and hence it can reap the full benefit from the rally of uranium prices.

Source: Investor Presentation

In addition, thanks to its promising growth projects and its rock-solid balance sheet, it has significant upside potential while it can endure patiently the downturns of its business.

Uranium Stock #3: NexGen Energy (NXE)

NexGen Energy is an exploration and development stage company engaged in the acquisition, exploration and evaluation and development of uranium properties in Canada. The company was incorporated in 2011 and currently has a market capitalization of $2.0 billion.

NexGen, like most uranium stocks, is highly speculative. As an exploration and development stage company, the company does not have revenues and has reported operating losses for at least 10 consecutive years. As a result, as of the end of the first quarter of 2023, NexGen had equity of only $330 million.

Therefore, investing in NexGen is essentially a bet on the company’s assets. To be sure, the company does possess quality uranium assets. A notable example is the company’s Rook I Project, the largest low-cost uranium mine in the world.

Source: Investor Presentation

This project is unhedged and hence it has 100% exposure to future uranium prices. It will thus prove highly profitable if uranium prices remain on an uptrend.

Moreover, NexGen has a rock-solid balance sheet, with cash of $106 million and total liabilities of only $68 million, as of the end of the 2023 first quarter. This means that the company is debt-free, with a net cash position of $38 million.

On the other hand, investors interested in safety or stability should not buy the stock. Only the most risk-tolerant investors looking for exposure to uranium stocks should consider NexGen.

That said, the stock could provide attractive returns, in the form of capital gains, if it is able to execute on its growth initiatives.

Uranium Stock #2: Cameco Corp. (CCJ)

Cameco is one of the largest uranium producers in the world. It has the licensed capacity to produce more than 53 million pounds (100% basis) of uranium concentrates annually, backed by more than 464 million pounds of proven and probable mineral reserves.

It is also a supplier of uranium refining, conversion and fuel manufacturing services. Its land holdings, including exploration, span about 2 million acres of land.

Cameco has a dominant position in the largest uranium mine in the world, McArthur River, and is ideally positioned to take advantage of the growing demand for uranium amid limited supply.

Source: Investor Presentation

In 2022, the company greatly benefited from favorable uranium prices and grew its revenues 27% over the prior year. It also enhanced its adjusted earnings per share from $0.06 in 2021 to $0.09 in 2022.

Business momentum has accelerated this year. Thanks to favorable uranium prices and strong production, Cameco expects to grow its revenues to $2.22-$2.37 billion in 2023, much higher than the consensus of $1.75 billion. At the mid-point, this guidance implies 64% growth over the prior year. Moreover, the company is expected to nearly triple its earnings per share this year, from $0.25 to $0.72, with more growth expected in the next few years.

Cameco stock pays a dividend. However, this dividend is negligible for the shareholders, as the current yield is standing at 0.3%. Therefore, Cameco stock is more of a potential growth stock than a dividend stock.

Uranium Stock #1: BHP Group (BHP)

Uranium stocks are highly risky and can be volatile. As a result, the top spot goes to BHP Group. While BHP is not the largest uranium producer in the world, it offers investors the biggest scale and relative stability. BHP is a global giant with a market cap of $153 billion.

BHP is headquartered in Melbourne, Australia. The company has a diversified production portfolio. It explores, produces, and processes iron ore, metallurgical coal, copper, and more. Almost two-thirds of the company’s annual EBITDA is derived from Iron Ore production, but BHP is also involved in uranium.

BHP produced approximately 2.4 million metric tons of uranium in the most recent fiscal year, which ended on June 30, 2022. This marked a decrease from 3.3 million metric tons of uranium in 2021, but still makes BHP a major uranium producer.

In late February, BHP reported financial results for the first half of fiscal 2023. Its revenue and its earnings decreased 16% and 32%, respectively, over the prior year’s period due to a 25% decline in iron ore prices and a 19% decline in copper prices.

Iron ore is the most important product for BHP, as it generates about 50% of its earnings. It comprised 70% of earnings in 2021 but its share in earnings fell in 2022 due to a rally in coal and copper prices. On the bright side, iron ore prices have rallied to an 8-month high lately thanks to the ongoing economic recovery of China from the pandemic. Thanks to this tailwind, we expect BHP to grow its earnings per share by about 8% in this fiscal year, from $4.71 to $5.10.

In addition to its size and competitive advantages, BHP is the top pick because it has the highest dividend yield of all uranium stocks.

With a dividend yield of 6.0%, BHP is a high dividend stock.

Click here to download our most recent Sure Analysis report on BHP Group (preview of page 1 of 3 shown below):

Final Thoughts

Uranium stocks are risky, and investors should carefully weigh the various risk factors before buying uranium stocks. Many uranium stocks are small companies with uncertain futures. Extremely few uranium stocks pay dividends to shareholders.

However, for investors willing to take the risk, the long-term potential could be rewarding. Uranium stocks are set to benefit from continued long-term growth of nuclear energy around the world. Therefore, the top uranium stocks could generate attractive returns over the long run.

You may also be looking to invest in dividend growth stocks with high probabilities of continuing to raise their dividends each year into the future.

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The 20 Highest Yielding Dividend Aristocrats

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 48 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: